Some homeowners are taking advantage of a little-known loophole in the bankruptcy law to get rid of their second mortgage and also avoid the pain of foreclosure, reports the San Jose Mercury News. Here’s how it works: [More]

mortgages

Banks Back In Business Of Lending Money, People Back To Borrowing

The New York Federal Reserve just issued its latest quarterly Household Debt & Credit report — which looks at the state of mortgages, home equity borrowing, auto loans and credit cars — and, for the first time in a few years, there are a number of not-so-bad things to say about things. [More]

Smooth The Buying Process By Getting Pre-Approved For A Loan

Make enough major purchases and you’ll eventually learn that it’s always wise to enter a transaction with your own financing in place. [More]

Why A 15-Year Mortgage Might Not Be Your Best Bet

If your main goal is to kill off your mortgage quickly while paying as little interest as possible, a 15-year mortgage is tempting. Larger payments knock down your principal at a quicker rate than a traditional 30-year plan, but signing up for such a mortgage might not be the wisest course of action. [More]

Mortgage Rates Hit 4-Month Low

For those potential home-buyers with enough money for a down payment, it looks like you may want to start scanning the real estate listings. According to Freddie Mac, the average rate on 30-year fixed-rate mortgages has hit a four-month low. [More]

When Should You Strategically Default?

Homeowners who owe more on their house than it’s worth face a dilemma. Should I stay or should I go now? Suze Orman tells CBS Sacramento’s Call Kurtis that those folks need to take a hard look at the value of their homes and make a tough decision. “If you own a home that is 50% underwater, 70% underwater, it will never ever, ever come back to where you purchased it.” she said. [More]

County Pulls Surprise Eviction On Georgia Man

A Georgia man who says he was up to date on his mortgage came home to find his belongings strewn across his front yard, neighbors picking through the property and, presumably, an eviction notice from the county. [More]

Should You Walk Away From Your Mortgage?

It’s considered a given of home ownership that allowing your home to go into foreclosure is a last resort, something that you only do after you’ve exhausted all other options. However, according to new information from credit-scoring firm Fair Isaac Corp. (FICO), more homeowners are intentionally choosing foreclosure — or “strategic default” — and that those borrowers tend to be pretty savvy consumers. [More]

Bank Meltdown Forces Eviction Of Blameless Homeowner

The grease fire that is the home mortgage business is reportedly set to claim a Wisconsin homeowner who paid his mortgage on time. [More]

Regulators Hatch Plan To Pay Back Victims Of Bad And Illegal Foreclosures

It’s no secret that foreclosures in America have been a royal mess. Missing paperwork, faked documents, turbo-charged courts that just rubberstamp foreclosure orders, robosigners, the list goes on. Along the way, a number of homeowners have gotten foreclosed on improperly and, in some cases, even illegally. So regulators are putting together a plan for grand-scale recompense. They’ve laid down decrees that servicers have to start following the law, for really reals this time, banks need to hire outside firms to review their foreclosure actions between 2009 and 2010, and then pay back their victims. [More]

Fifth Third Is Jealous You're In A Committed Mortgage Relationship With Another Bank

It’s not all that interesting that Fifth Third Bank sent Jeff and his wife a letter encouraging them to refinance their mortgage: after all, they’re Fifth Third customers, but their mortgage is with another bank. What is interesting is that they just took out the mortgage a few months ago, and they went with another bank because Fifth Third turned them down. [More]

Bank Of America Posts 36% Drop In Profits

Perhaps hoping to garner sympathy votes in our Worst Company in America contest, Bank of America today reported a 36% drop in profits for the first quarter. One of the big drags on business continues to be the toxic landfill of mortgages the bank gobbled up when it bought Countrywide Home Loans. Never trust a man who is completely orange, I always say. [More]

Being 30 Days Late On House Payment Can Knock 100 Points Off Credit Score

Usually very closed-mouth about how it calculates scores, FICO released a whole bunch of data about how being late on your mortgage payments affects your credit score. For instance, being 30 days later on a mortgage payment can chop your 780 credit score down to 670. And a short sale or deed-in-lieu of foreclosure will hurt your score just as bad as a foreclosure if the service reports it as having a deficiency amount or an unpaid balance. Yikes! Here’s some sexy tables with more details: [More]

Middlemen Blocking Mortgage Mods

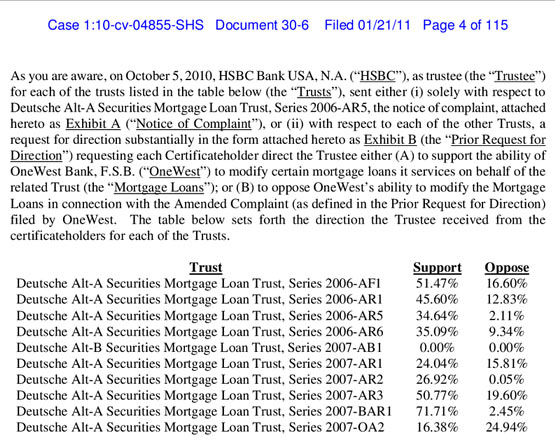

Homeowners trying to get loan mods often run into resistance by banks who say they’re powerless because they need to protect the interests of investors. But ProPublica reports a recent lawsuit uncovered a document where, when HSBC polled investors, a majority of those responding say they favored letting the loans being modified. [More]

We'd Rather Pay Our Credit Card Bills Than Our Mortgages

The Great Recession and the subsequent housing crisis has turned Americans all weird when it comes to which bills we pay: A new study says we’re more likely to pay our credit card bills than our mortgages. It’s a trend that should’ve reversed itself by now, say experts. But that hasn’t happened yet. [More]

Man Who Torched Car To Save Home Ends Up In Court

A Utah man had a bold plan, which we told you about last year. His house was going into foreclosure unless he could come up with $21,638.02 to pay HSBC. So he announced to the world that he would burn his car and post the video online in exchange for donations. He raised about $15,000 and even sold $1,200 worth of advertising on the side of the car. He tried to work with local fire departments to get them to let him burn the car, to no avail. So he did it on public land and now he’s in court and getting fined, reports KSL. [More]

Georgia Jury Awards Soldier $21 Million Over Mortgage Mix-Up

A Staff Sergeant in the U.S. Army went up against a terrifying enemy — the mortgage industry, in the form of PHH Mortgage Corporation — in court and came away victorious after a jury awarded him $21 million for his troubles. [More]

BofA Comes To Trash Out House After It's Sold

Bank of America is apologizing after a frustrated realtor took her venting to YouTube in a dramatic recounting, reports the Charlotte Observer. The realtor was representing a seller who was selling house through short sale. The realtor found a buyer, the seller was happy, and supposedly, the bank was happy. A week later when the new homeowners were moving in, a “trash out” crew rolled up in a truck with tinted windows, sporting black tshirts with an image of a gun on the front and the word “agent” on their backs. They were there to throw everything in the house out and change the locks. [More]