After years of anything goes loans-writing, the pendulum has swung far, far, in the other direction. Patrick tells the story of how his loan with Wells Fargo was denied, 1 day before he was set to close on a new condo. Even though he has an 800 credit score and was putting 20% down, this hiccup was enough to make Wells Fargo back up. And because of it, he and his five-month pregnant wife now have one week to find a new place to live. [More]

mortgages

Protesters Stop Foreclosures For Strangers In Spain

Some people don’t even know their neighbors’ names, but in Spain protesters are gathering in front of people’s houses to stop or stall foreclosures. And they’re getting results. [More]

Report: Mortgage Companies Continue To Use Robo-Signers

Mortgage companies apparently haven’t learned their lessons from the foreclosure fraud scandals, and continue to use automatic signatures on documents that employees never see. Last fall, major banks halted foreclosures, supposedly investigating why robo-signing was so prevalent. The banks re-started foreclosures in the winter after they re-submitted foreclosure paperwork with what they say were real signatures. [More]

Options For Those Who Are Underwater On Mortgages

With home prices plunging in the past several years, many homeowners owe more on their mortgages than their houses are worth. Those who are underwater and looking to ditch the scuba gear to rise to the surface once again have several choices at their disposal. [More]

Man Buys House With Cash, Bank Of America Tries To Foreclose

A Sacramento man nearly lost a house he paid for in cash when Bank Of America tried to sell it in a foreclosure auction. The mistake prevented the owner from renting out the house, but luckily the bank caught the error, caused by a data entry mistake, and called off the sale the day the house was scheduled to go up for auction. [More]

Chase And BoA Quietly Cutting Balances For Option-Arm Mortgagors

It’s a lovely surprise to get in the mail from your bank, a letter telling you they’re going to cut your mortgage balance in half while increasing your interest rate slightly. NYT reports that tens of thousands of option-arm mortgagors, homebuyers with a loan that had a low introductory interest rate that shot up after a set period, have been getting such letters from Chase and Bank of America over the past year. [More]

New Federal Program Offers Underwater Homeowners Loans They May Not Have To Repay

With millions of homeowners still having difficulties catching up to their mortgage payments, the federal government continues to look for ways to stem the tide of foreclosures. The latest effort provides loans of up to $50,000 that some homeowners will never have to repay. [More]

Homeowner Says Bank Of America Foreclosed On Her After Advising Her To Miss Payments

A woman says she lost her home to Bank of America by following its advice to her that she skip mortgage payments. The woman had lived in the house for 25 years and began struggling with payments when she began battling breast cancer. When she asked the bank to help adjust her mortgage in 2009, she said the bank told her it couldn’t help her because she was current with her payments. Once she allowed herself to miss three payments, as she said the bank advised her to do, BofA did lower her mortgage payments, only to later foreclose on her. [More]

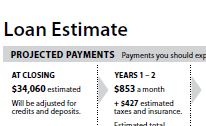

Elizabeth Warren: Mortgage Forms Should Be Comprehensible To Normal Human Beings

At yesterday’s White House Personal Finance Online Summit, Elizabeth Warren, Special Advisor to the Secretary of the Treasury on the Consumer Financial Protection Bureau, went into details about the still-nascent agency’s “Know Before You Owe” project and how the CFPB is working to simplify the documents that consumers are shown when shopping for a mortgage. [More]

Court Threatens BofA Bank Manager With Jail Over Foreclosure

A Bank of America bank manager could end up in jail if the bank doesn’t demolish a fire-damaged eyesore, a Georgia court has warned. [More]

Chase Screws Up Loan Modification, "Fixes" Error By Adding $8,000 To Balance Of Loan

The folks at ProPublica recently looked into the all-too-common problem of homeowners who thought they had successfully run through the loan modification gauntlet only to later find out that their bank had no record of the reduction and their house was suddenly in foreclosure. [More]

Family Of Three Lives Mortgage-Free By Downsizing To 320 Sq. Ft. Home

Until recently, one Arkansas family had been living well in a spacious 2,000 sq. ft. home. But after realizing that they were paying a mortgage for a house they didn’t fully utilize, they decided to downsize… significantly. [More]

Just Because You Defaulted On Your Mortgage Doesn't Mean You Can't Get A Loan These Days

As we reported last month, U.S. banks are finally getting back into the business of making loans to consumers. And a new report says that it’s not just those with pristine credit histories that are able to borrow. [More]

White House Wants Mortgage Firms To Help Homeowners Avoid Foreclosure

An Obama administration plan calls for the 14 largest mortgage companies to contribute to a federal fund that would help distressed homeowners avoid foreclosures. [More]

BofA Loses Check That Would Have Saved House From Foreclosure

CBS 13 has the story of a man who fell behind on his mortgage payments who was told by Bank of America that unless he sent them $4,175 he would lose his house that he had spent years putting work into. So he managed to put together the money and sent it in as a cashier’s check. Then the bank lost his check. [More]

Dumping 2nd Mortgage Through Bankruptcy Is No Cake Walk

For anyone considering getting rid of their second mortgage in the manner described in yesterday’s post, bear in mind that it is by no means a painless process. One of our readers is a staff attorney for a Chapter 13 bankruptcy trustee, and he writes in with more details about what this process entails. [More]

Bank Of America Does Something That Makes Sense, But Only Because It Has To

Ever since Bank of America got greedy and gobbled up the greasy, calorie-filled platter that was Countrywide, it’s been dealing with the indigestion caused by that company’s oodles of toxic mortgages. Now, after losing the Worst Company In America title by less than 1% to BP, BofA has decided to do something more than pay lip service to its crappy state of affairs. The bank has announced it will open 28 new foreclosure prevention centers in 22 states between now and July. [More]

28.4% Of All Homes Are Underwater

A new report by Zillow says that 28.4% of all single-family houses in America with mortgages are underwater. No, we’re not talking about flooding in the south, but homes that owe more on their mortgage than they are worth. It’s even worse in places where the bubble was the biggest. In Tampa, FL, 59.8% of homes have negative equity and in Phoenix, AZ, it’s 68.4%. Declines in home values are still happening and Zillow doesn’t see a bottom happening until 2012, at the earliest. [More]