As the country tried to crawl out of the last recession, homeowners all across America sought mortgage modifications to make their home loans more manageable. However, some homeowners say that Wells Fargo not only modified their loans without asking, but that this lower rate added years — perhaps decades — to the terms of their mortgages. [More]

mortgages

CitiFinancial, CitiMortgage To Pay $28.8M Over Mortgage Servicing Issues

Millions of consumers lost their homes when the housing market bubble burst. But federal regulators say some of those people may have been able to stay in their homes had mortgage lenders fulfilled their requirements. To that end, the Consumer Financial Protection Bureau has ordered two Citigroup subsidiaries to pay $28.8 million to resolve allegations that some of its mortgage units harmed home borrowers. [More]

Former Wells Fargo Employees: Borrowers Forced To Pay For Bank’s Mortgage Delays

Even though you can now get an initial approval for a home loan in a few minutes, the actual underwriting process can take so long that the interest rate you were promised at the beginning has since increased. If the delay is the borrower’s fault, they can usually pay a hefty fee to extend that lower rate, but if the bank caused the delay, it usually eats that charge. However, some former Wells Fargo workers say the bank forced borrowers to pay for these rate extensions even when it was Wells’ fault. [More]

Trump Administration Suspends Mortgage Insurance Discount For New Homeowners

The new Trump administration has already made one of its first moves, directing the Department of Housing and Urban Development to suspend a recently announced program that would have reduced mortgage insurance rates for a number of new homeowners. [More]

Guidelines Intend To Protect Homeowners As Foreclosure Relief Programs Expire

Nearly a decade after the housing bubble burst and the government created programs to provide relief for homeowners facing foreclosure, the Consumer Financial Protection Bureau is working to ensure that consumers continue to receive needed assistance tailored to changing home retention needs. Today, the Bureau has released new a new outline to guide the creation of new solutions for foreclosure relief. [More]

Wells Fargo To Pay $1.2 Billion To Settle Govt. Lawsuit Over “Reckless” Mortgages

In Oct. 2012, the U.S. Department of Justice sued Wells Fargo, alleging that the mega-bank had defrauded taxpayers by issuing “reckless” mortgages then misleading the Federal Housing Administration about the quality of those loans. Today, Wells revealed that has agreed to pay $1.2 billion to close the book on this issue. [More]

NJ-Based Bank Must Pay $33M To Settle Discriminatory Lending Charges

“Redlining” is the act of denying services, either directly or through selectively raising prices, to residents of a certain area based on race or ethnicity. Federal law prohibits creditors from this type of discrimination, but New Jersey-based Hudson City Savings Bank is now on the hook for a total of nearly $33 million for allegedly providing unequal access to credit in parts of four states. [More]

Auto Loan Debt Tops $1 Trillion For First Time; All Consumer Debt Nearing $12 Trillion

Now that the Great Recession has gone from “is it really over?” to “remember when?” more Americans are buying cars, pushing auto loan debt beyond the $1 trillion mark for the first time in U.S. history. [More]

Mortgage Servicer To Pay Back $1.5M To Screwed-Over Homeowners

Residential Credit Solutions is a mortgage servicer specializing in delinquent loans and “credit-sensitive” (read: high-risk for default) residential mortgages. But after allegedly screwing over homeowners by, among other things, not honoring loan modifications on mortgages transferred from other servicers, RCS is on the hook to pay $1.5 million in restitution and a $100,000 penalty to federal regulators. [More]

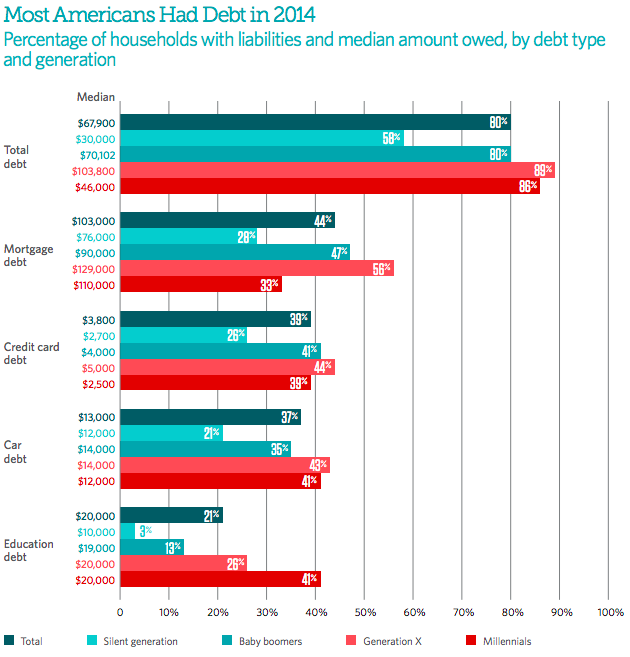

Nearly 80% Of Americans Hold Some Form Of Debt, But It Isn’t Always Bad

When most people think of debt, they probably conjure up a vision of consumers struggling to make ends meet after making unwise financial decisions. But that actually isn’t the case for most Americans. In fact, like other things, debt in moderation is actually a good thing. [More]

Western Union-Owned Mortgage Company Must Return $33.4M To Customers

A mortgage payment company owned by Western Union has agreed to return $33.4 million to consumers following allegations that it misled customers into thinking they could save thousands of dollars on their home loans. [More]

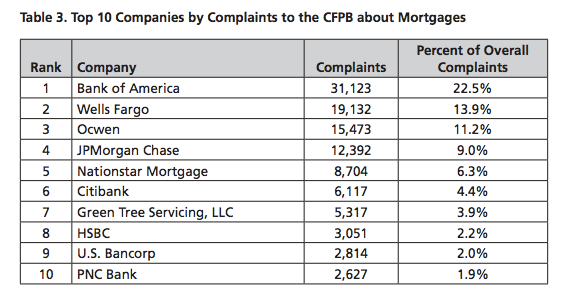

Bank Of America, Wells Fargo Top List Of Most Complained About Mortgage Issuers

For the past four years, the Consumer Financial Protection Bureau’s Consumer Complaint Database has seen its fair share of consumer issues related to mortgages. In fact, complaints regarding loan modification, collection, foreclosure, loan servicing, payments and escrow accounts continue to be one of the biggest financial thorns in consumers’ sides. And the worst offender? Bank of America. [More]

CFPB Proposes Delay Of New Mortgage Rules By Two Months

Prospective homebuyers anticipating a more streamlined disclosure process while buying their dream home may have to wait a little longer, as the Consumer Financial Protection Bureau is proposing a delay to new rules. [More]

Discover Financial Ditching Home-Lending Business

Just three years after getting into the mortgage origination business, Discover Financial Services plans to shutter its home lending operations. [More]

Abusive Lending Practices Can Lead To Negative Long-Term Consequences For Borrowers, Communities

Every year, more than 12 million Americans spend $17 billion on payday loans, despite the fact research has shown these costly lines of credit often leave borrowers worse off. Yet abusive lending practices are not relegated to borrowers in need of a couple hundred dollars to stay afloat until their next paycheck; there are mortgages, car loans, and other traditional lines of credit that can leave the borrower in a bind. Even if you never find yourself on the wrong end of a predatory loan, these products can still be a drain on your entire community. [More]