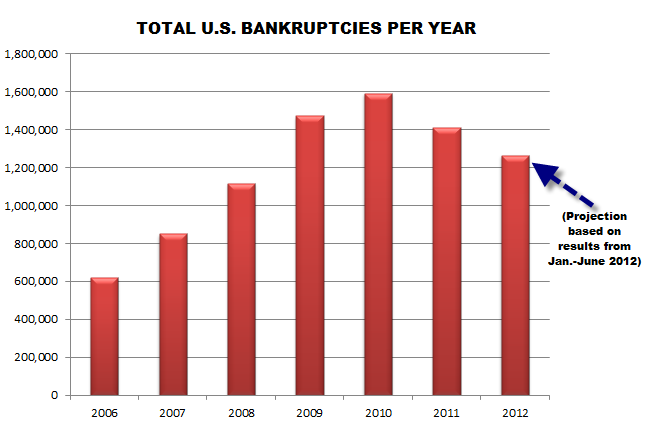

We’re nearing the All-Star break for baseball, which means it’s time to enjoy the annual tradition of looking at the American Bankruptcy Institute’s half-year stats. The bad news is that a butt-ton of people and businesses in the U.S. are still filing for bankruptcy, but on the up side, that number continues to show a downward trend after its most recent peak in 2010. [More]

silver linings and whatnot

Consumers Spent A Bit More Than Expected In July

A 0.8% increase in consumer spending may not seem like something to throw a parade over. And really, it’s not. But it is the largest gain in 18 months and the first increase of any sort since April, so it’s a reason to not frown. [More]

Personal Bankruptcy Filings Down In First Half Of 2011

If you’re looking for some not-so-bad news on the economy, here’s a morsel for you: The number of individuals filing for bankruptcy during the first six months of 2011 is down significantly compared to the same time period in 2010. [More]

Banks Back In Business Of Lending Money, People Back To Borrowing

The New York Federal Reserve just issued its latest quarterly Household Debt & Credit report — which looks at the state of mortgages, home equity borrowing, auto loans and credit cars — and, for the first time in a few years, there are a number of not-so-bad things to say about things. [More]