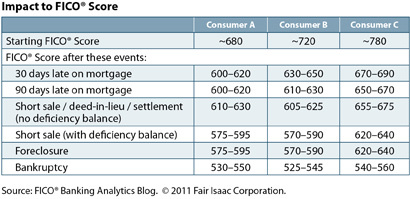

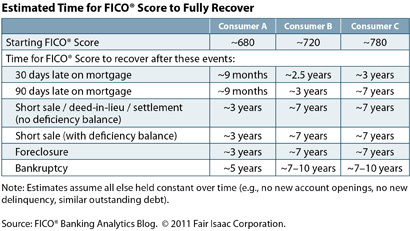

Being 30 Days Late On House Payment Can Knock 100 Points Off Credit Score

Usually very closed-mouth about how it calculates scores, FICO released a whole bunch of data about how being late on your mortgage payments affects your credit score. For instance, being 30 days later on a mortgage payment can chop your 780 credit score down to 670. And a short sale or deed-in-lieu of foreclosure will hurt your score just as bad as a foreclosure if the service reports it as having a deficiency amount or an unpaid balance. Yikes! Here’s some sexy tables with more details:

Research looks at how mortgage delinquencies affect scores [bankinganalyticsblog.fico.com]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.