The Securities and Exchange Commission may file a civil action against former Freddie Mac chief executive as it concludes an investigation of Freddie Mac and Fannie Mae’s disclosure practices. [More]

mortgages

U.S. Investigating Morgan Stanley Subsidiary For Unlawfully Foreclosing On Military Families

A Morgan Stanley unit is under investigation by the Justice Department for foreclosing on nearly two dozen military families without a court hearing, a violation of Federal law meant to protect active duty service members. [More]

Clergy Perform Exorcism On Chase Bank

A group of clergy gathered together on the steps of JP Morgan Chase on Park Ave in New York City to perform an exorcism on the bank. They said that the bank was possessed by the demons of “selfishness and avarice” because according to the group’s new study, only 6% of New York homeowners seeking a loan mod have gotten it in the past year. The exorcism happens at 0:57. No satanic spirits fly out of the banks, but money does fly out when the clergy closes down their bank accounts. [More]

HSBC Joins List Of Banks Warning It Will Probably Get Fined For Improper Foreclosure Practices

HSBC is the latest in a string of banks who warned investors via their SEC filing that they expect to get fined after getting a letter from regulators chastising their improper foreclosure practices. On Friday, Wells Fargo, Ally Financial (formerly GMAC) and SunTrust banks made similar announcements. [More]

Philly Homeowner Who "Foreclosed" On Wells Fargo Settles Dispute

As Consumerist was the first to report last Friday, the Philadelphia homeowner who made national news by not only winning a judgment against Wells Fargo, but also scheduling a sheriff’s sale of the bank’s property, was meeting face-to-face with the bank he’d embarrassed so thoroughly. Now he’s confirmed that the two parties had reached an agreement. [More]

Wells Fargo Meeting Today With Philly Homeowner Who "Foreclosed" On Them (Here's How He Did It)

Wells Fargo is meeting today at noon with the Philadelphia homeowner who “foreclosed” on them, The Consumerist has exclusively learned. Patrick says he “received a call from upon high” late yesterday and that he now has an appointment, “with a very senior Wells Fargo person.” It will be interesting to see how this plays out. But how did Patrick go from embattled and ignored homeowner to seated across the negotiating table with leverage? I spoke with him to find out more about both how and why he did what he did. His story is an inspiration to anyone who’s dreamed of going toe-to-toe with the big banks and winning. Turns out that armed with persistence, and a little legal know-how, Davids can take down Goliaths. [More]

Congress Issues Subpoena For Info On Countrywide's VIP Mortgage Program

Let’s look back to the summer of 2008, when it was revealed that Angelo Mozilo, the curiously orange former CEO of Countrywide, had the company offer below-market “VIP” mortgages to certain politicians and other influence peddlers. Fast forward to the present, where Congressman Darrell Issa, chairman of the House Committee on Oversight and Government Reform, has issued a subpoena to Bank of America, looking for related documents, e-mails and names. [More]

Philly Homeowner Declares He's 'Foreclosed' on Wells Fargo

Frustrated with Wells Fargo Home Mortgage, a Philadelphia homeowner took the bank to court under the Real Estate Settlement Procedures Act and won a $1,000 default judgment because it wouldn’t answer his formal questions about a dispute. The bank blew him off, so the man got the sheriff to schedule a sale of contents of a Wells Fargo Home Mortgage location to pay for the judgment and $200 in court and sheriff’s fees. [More]

A Miserable Life Inside A Foreclosed Apartment

Living inside an apartment building that has been foreclosed on can become a living hell when the building crumbles into disrepair around you and there’s no landlord to call. Bursting heat pipes, cockroaches, mice, hunks of ceiling falling on you, and black mold seeping up the walls have become the new neighbors to tenants in one low-income apartment building in the Bronx where the landlord has long since checked out. [More]

Wachovia Settles "Pick-a-Payment" Mortgage Loan Class Action

If you got a “Pick-a-Payment” mortgage from Wachovia between Aug 1 2003 and Dec 31 2008, you might be up for claiming some cash in a $50 million settlement. [More]

Bad Mortgages Could Cost Bank Of America $10 Billion

Bank of America, which earlier this month agreed to pay over $2.8 billion to Fannie Mae and Freddie Mac to settle claims about faulty mortgages, says it could spend another $10 billion to address outstanding claims. The company says the number is the “upper range” of its estimated housing bubble liabilities. [More]

Bank Of America To Charge Fee To Some For Making Mortgage Payment Within Grace Period

Bank of America is making an 11th-hour push for inclusion in the upcoming Worst Company In America tournament. Starting in February, folks with BofA mortgages who don’t have BofA bank accounts will see their current 15-day grace period for making payments cut by 40%. [More]

Chase Overcharged Over 4,000 Military Families On Mortgages, Improperly Foreclosed On 14

Chase has admitted that it overcharged over 4,000 military families on their home mortgages, as well as wrongly foreclosed on 14 of them. Some of these are families of troops that are fighting in Afghanistan. [More]

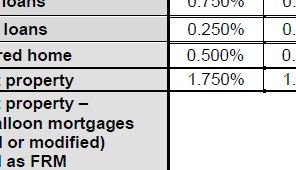

What Risk Factors Will Make My Mortgage More Expensive?

When you’re in the market to buy a new home or investment property, it’s one thing to get a pre-qualification over the phone and a completely different thing when you later sit down and actually apply for a loan. So before you get too far into the process, you should know which factors could end up inflating the interest rate on your mortgage. [More]

Citigroup Still Selling Mortgages That Violate Quality Standards

15% of the mortgages Citigroup sold to government-owned Freddie Mac from the second half of 2009 and the first part of 2010 were riddled with flaws, according to an internal report obtained by Bloomberg. The error rate should be about 5%. The mistakes included missing insurance docs, missing appraisals and income miscalculations. [More]

Now Banks Are Also Walking Away From Foreclosures, Just Leaving Them To Rot

It’s not just underwater homeowners just flat out walking away from their houses. Now some mortgage servicers, having decided certain properties would be too expensive to try to foreclose, secure, maintain and market, are just abandoning the properties entirely, to let nature, and whatever else, take its course. [More]