When you can’t give a pet the care that it deserves anymore, you find a new home for it. Accounting software company Intuit is packing up its original product, the personal finance program Quicken, and sending it off to live with new owners. The private equity firm H.I.G. Capital and Eric Dunn, the general manager of the Quicken brand will purchase the program and its brand. [More]

personal finance

Study: Ordering Pizza Online Adds Up When It Comes To Calories And Cash

The appeal of ordering food online is obvious — it’s easy, you don’t have to talk to anyone and it’s perhaps less likely that your order will get screwed up with the list of toppings, extras or instructions entered in with your own two hands. But summoning grub with the touch of a button, especially ordering pizza, really stacks up the calories and drains the wallet, a new study says. [More]

SCOTUS Decision: The Financial Benefits For Married Same-Sex Couples

While most things about marriage have changed throughout human history, one thing remains true. No, not love: marriage for love is a modern innovation. Married couples have always been an economic unit, from ancient farms to modern condos. This morning’s Supreme Court decision legalizing same-sex marriages nationwide will have important effects on the finances of married gay and lesbian couples, whether they live in a state that currently allows them to legally marry or not. [More]

9 Things We’re So Grateful Mom Taught Us About Money

Today is the day we pause to reflect on everything our mothers have given us, from kisses on scraped knees and comfortable laps to sit on, to financial wisdom that has the power to stick with us through adulthood. We asked you to share the personal finance tips your mother imparted to you, because hey, sharing is caring and she’d probably approve. [More]

What Did Your Mom Teach You About Money?

When I was in first grade, the lunch lady at my school informed me that my parents had overpaid for my meals for the month, and sent the extra money home with me, as I remember it. I took it to my mom, who said that everyone should have a bank account, and that we could use that $18 or so to start one for me. And to add to that — she said that moolah could grow to a larger amount all by itself through a magical thing called “interest.” [More]

4 Ways You Can Save Your Self Into Financial Trouble

In general, saving money is good. But if you are overzealous about your thriftiness or think only in terms of immediate or short-terms savings, you could end up paying more in the long run. [More]

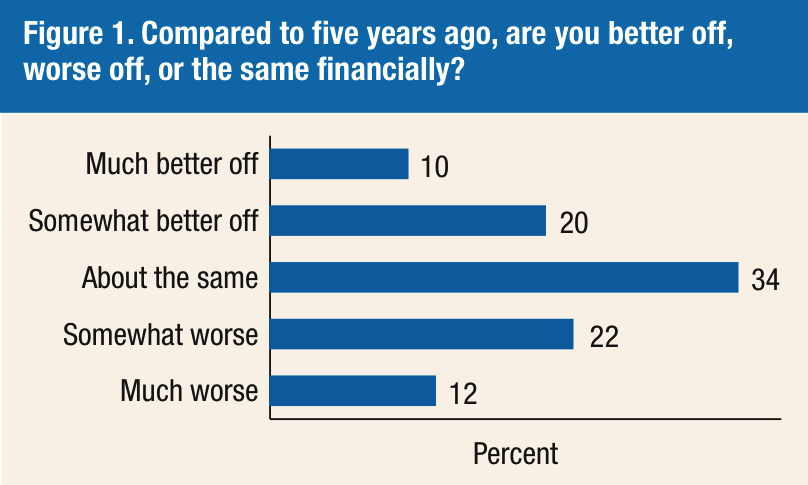

1-In-3 Americans Still Feeling The Sting Of Recession

While many Americans are now doing better than they were during the Great Recession, those dark days took such a toll on many consumers’ savings that some people who are currently doing well enough to pay the bills and enjoy a decent living aren’t able to make necessary longterm investments, like buying a new home or saving for retirement. [More]

How Long Should I Hold On To My Old Bills & Other Documents?

Thank goodness for electronic billing, bill-pay and account access. The digital world can help you save time, be more organized and cut down significantly on paper… Significantly — but not completely. [More]

How To Not Suck At Making The Transition From School To The Real World

All around the country, people who’ve never had a full-time job or paid their own way are going to be pushed out of safe bosom of school. Maybe you’re one of them. Well, now that you’re done with your cap and gown and you have a diploma in your hand, it’s time to join the rest of us in the real world. [More]

Here Is A Guaranteed Strategy To Win The Lottery

There was only one winner of the $425 million Powerball drawing this week, and the ticket was sold at a gas station in California’s Bay Area. As you spend that money in your head, as we inevitably all do, you might wonder how you could win the lottery. You don’t need luck. Here’s a guaranteed winning strategy. [More]

Lifestyle Creep Is Gobbling Your Savings

At first, grabbing drive-thru coffee was an occasional indulgence to get you going on a slow Monday morning. Then you gradually picked up coffee more and more, until one day you realize that you’re spending a couple hundred bucks a year on paying other people to pour water over ground-up beans for you. That’s lifestyle creep, and you can put a stop to it before it eats your entire budget. [HEY YOU, POOR KID!] [More]

How To Not Suck… At Getting Out Of Debt

You’re in debt and you know it. But (a brief pause, while I invoke my inner Jersey) whaddya gonna do about it? Credit card debt can seem like a never-ending spiral. As you try to pay it down, more interest charges accrue, and it seems your balance isn’t getting anywhere. Stop the bleeding already so that you can ultimately get back in the black. [More]

We Have Some Problems With Visa’s Sample Budget For McDonald’s Employees

Someone meant really well. We think. A few years ago, Visa and McDonald’s partnered to launch a personal finance site for McDonald’s employees to help them better manage their money. Unfortunately, whoever wrote these materials had no grasp of what it’s actually like to live on $8 or so per hour. [More]

How Does Emmy-Winning Comedian With Her Own MTV Show Have $57,000 In Debt?

Comedian Sara Schaefer already has two Emmys to her name, and her new TV show Nikki & Sara Live just debuted this week on MTV. But fame and notoriety don’t necessarily equate to being smart about your finances. [More]

Plenty Of People Wanted To Move Checking Accounts This Year But Banks Made It Too Tough

Fed up with your bank but too frustrated by how tricky it is to take your money elsewhere? You’re not alone: Our benevolent benefactors over at Consumer Reports have been busy polling bank customers to see how they’re feeling about their financial institutions and found that while almost one-fifth of all consumers with checking accounts flirted with the idea of switching to a new financial institution in the last year, many didn’t just because it was simply too difficult to do so. [More]

Personal Finance Roundup

8 Reasons You’re Not Earning the Salary You Want [US News] “Not getting the salary you think you deserve?”

Consumers Prefer to Get More Rather than Pay Less – Because They’re Bad at Math [Moneyland] “Is it better to get more or pay less?”

A Complete Guide to Saving at America’s Baseball Stadiums [Wise Bread] “The 411 on how to save more money at every Major League Baseball stadium.”

Answers to your awkward money questions [CNN Money] “What do you do about a spouse who won’t help with the finances or a pal who can’t repay a loan?”

How Married Couples Can Boost Their Social Security Checks [SmartMoney] “There are certain complex strategies that can help pad a married couple’s retirement savings with tens of thousands of dollars of additional income.”

Personal Finance Roundup

7 Credit Myths Even Smart People Believe [Moneyland] “Credit counseling professionals share the most common myths they have to debunk.” [More]