It seems Wells Fargo has an employee whose actual name is “Dispute Representative.” Or at least so it would appear by the letter he received in his response to his request to have an erroneous item removed from his credit report. Guess the guy found his perfect job. [More]

wells-fargo

Wells Fargo Repossesses Fully Paid-Off Car

Looks like banks are really bad at more than just home foreclosures. A woman in Tacoma, WA, was left car-less after Wells Fargo had her vehicle repossessed, even though she owned her car outright. [More]

Wells Fargo Hits Girl With Secret Fee Trifecta

Christina is broke as a joke. Wells Fargo doesn’t think this is funny and decides to shut down her account for having no money in it and no activity on it. No big whoop, she’ll just open another account. She does this twice. Then, whups! Those accounts were never closed! And we’re charging you fees because they were actually fee-based savings accounts! And you’re in collections! Good times, let them roll: [More]

Check Fraud Leads To Kafkaesque Nightmare For Wachovia Customer

What do you do when you have tried every possible tactic you can think of to resolve a situation, and you can still make no progress? Michael, a 20-year Wachovia customer, now finds himself in just this situation with the bank. No one at Wachovia has the power to straighten out his customer service nightmare that began when someone forged a check on his account back in June. [More]

Wells Fargo To Make $772 Million In Mortgage Adjustments Following Investigation

Wells Fargo has reached a nearly $800 million settlement with Attorneys General in eight states where the company — more precisely, Wachovia, which was acquired by Wells Fargo after it failed — was under investigation for allegedly deceiving some borrowers into taking out loans they could never pay back. [More]

Wells Fargo Wouldn't Accept My Deposit – So Where Is It Now?

Adrienne tells Consumerist that she did something very mundane: she deposited a payroll check that her fiancé had signed over to her in her Wells Fargo bank account using an ATM. Based on previous experience, and assuming that a payroll check from a Fortune 1000 company is a straightforward enough deposit, she then paid bills using the money that she thought was in her account. [More]

Wells Fargo Says It Won't Foreclose For 30 Days, Then Does So Within A Week

A week after Wells Fargo rejected a couple’s loan mod app and said it wouldn’t start foreclosure proceedings any sooner than 30 days later, a guy showed up on their steps. He said he was with an investment firm that had just bought the house at a real estate auction, and if they would leave within 2 weeks, he would give them $1,500. [More]

Wells Fargo Makes Family Submit Essay With Mortgage App

Before reviewing this woman’s mortgage application, Wells Fargo asked her to write a “motivational letter” to explain why they were moving, with the essay to include reflections on her plans to “increase/decrease” her family or property size and her commuting distance to work. Besides being rude, the request could also be against the law, something the woman picked up on, because she is a lawyer. [More]

Wells Fargo Ordered To Pay $203 Million For Processing Transactions High To Low, Maximizing Overdraft Fees

A California judge ordered Wells Fargo to pay California customers $203 after finding that the bank had deliberately manipulated the way it processed transactions in a way that turned one overdraft fee into as many as 10, at $35 a pop. [More]

Oops, You Didn't Buy A House, You Bought Its Worthless 2nd Mortgage, And Now It's In Foreclosure

A couple thought they were snagging a $97,606 foreclosure fixer upper at a courthouse sale, only to find out months later they had actually bought its worthless second mortgage. The original was in arrears, and now the house would be sold at another courthouse auction. [More]

Rejoice Penguins, Wells Fargo Has An ATM In Antarctica

Wells Fargo is the undisputed leader in Antarctic banking thanks to a pair of ATMs at McMurdo station. Despite the monopoly, the bank acts as a benevolent despot by allowing non-customers to draw cash without a surcharge. But who replenishes the stock of $20s? What happens when the ATMs break? Wells Fargo VP David Parker explained it all in a recent interview. [More]

Even Wells Fargo CEO Powerless To Reduce Your Punitive APR

The APR on Kevin’s Wells Fargo credit card got jacked up from 9.6% to almost 23%. He owes $16,000. At 9.6, he could afford to make double the monthly payments, but now he’s paying $300+ a month in finance charges alone. He’s begged up and down the hierarchy, from the CEO to any exec or VP he could reach, to please reduce his APR so he can carry this debt. Nope. The numbers have spoken. The odds are calculated. Your risk has been assessed, and the verdict has been issued: you lose. [More]

Fix Mortgage Errors By Promising The CSR "Phone Fun," At Least At Wells Fargo

According to a lawsuit filed in New Jersey, a CSR at Wells Fargo’s Home Mortgage Division refused to correct a payment error for Jamie Nelson unless she had some “phone fun” with him first. Phone fun, in this case, seemed to mean naked pics of the woman. She’s suing for emotional distress, since you can’t take someone to court simply for being a skeevy jackass. Wells Fargo says they’re taking the allegations seriously. [More]

Wells Fargo Pulls $4,000 From Checking Account To Repay Student Loan

When you borrow from a bank where you also keep your day-to-day cash, you might be opening yourself up to problems down the line. Most banks have a right of setoff, which means they can tap other accounts you hold with them to repay themselves money you owe. For a woman in Atlanta, this meant Wells Fargo legally drained her checking account without warning, leaving her and her husband with no cash and $385 in overdraft fees, due to some ongoing confusion over a student loan. [More]

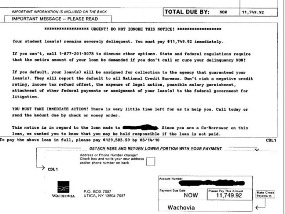

Wachovia Hassles My Dad Because They Mistakenly Think My Loan Is In Default

Consumerist reader Jake got a big scare a few weeks back when his father called to let him know he’d been contacted by Wachovia. The bank told Jake’s dad that not only was Jake’s law school loan in default, but that, as a co-signer, he was responsible for paying $11,750 immediately. Two problems with that: 1) The loan wasn’t in default. 2) Jacob’s dad wasn’t a co-signer. [More]

Faux-Hawked Wells Fargo Manager Allegedly Embezzled $900,000+ From Elderly

An ex-Wells Fargo bank manager is accused of embezzling more than $900,000 from customers, most of whom were frail and elderly. [More]

BoA Kills Overdraft Fees On Debit Purchases

Bank of America announced they will stop charging overdraft fees on debit card purchases. If you don’t have enough money to buy the item, the transaction will be declined. [More]