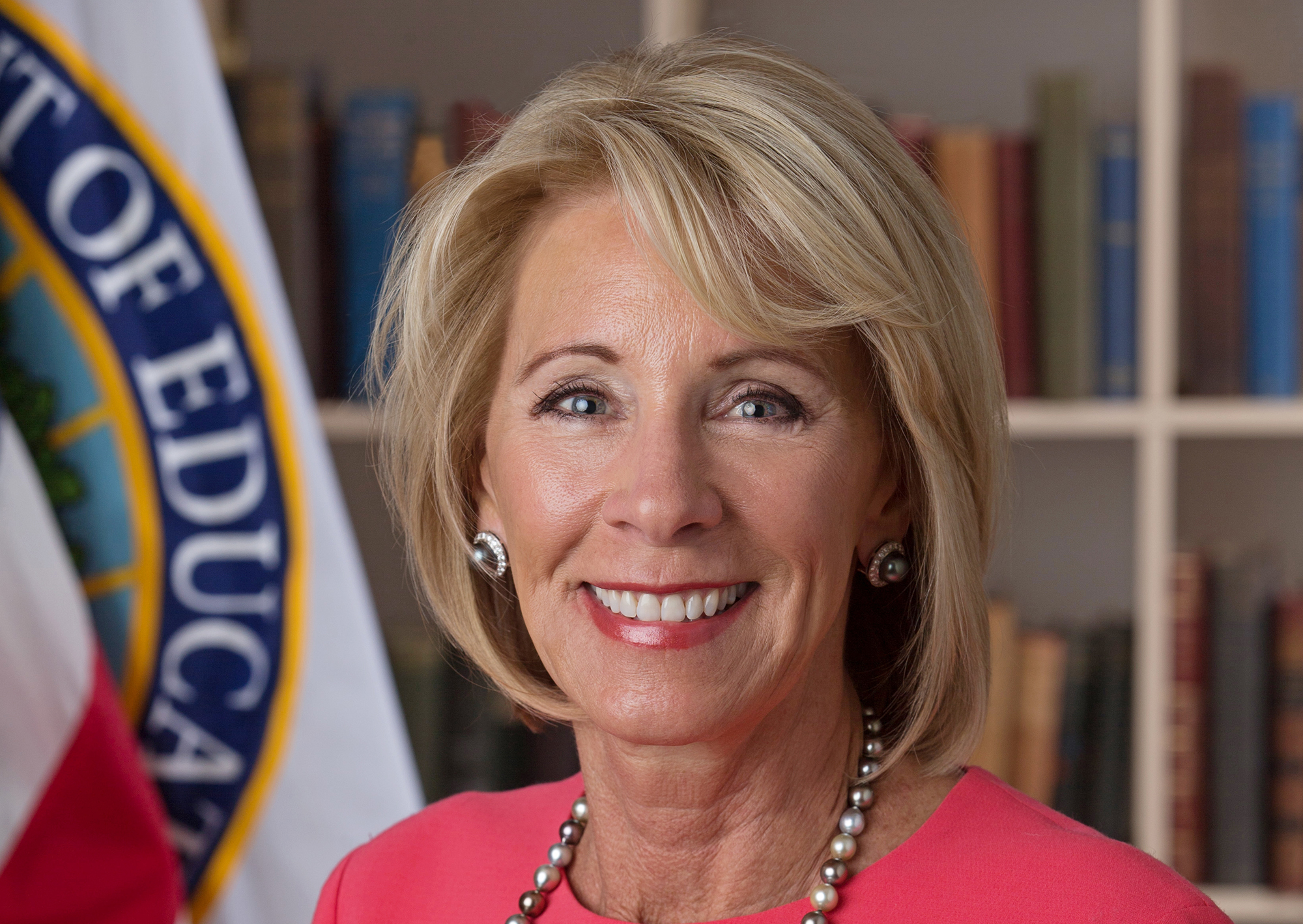

Education Secretary and champion of for-profit colleges Betsy DeVos is once again siding with this controversial industry and against students who were defrauded by schools that tricked them into paying top dollar for a bottom-dollar education. [More]

student loans

Borrowers In Student Loan Forgiveness Program Shocked To Learn Loans Won’t Be Forgiven

This month is the first in which student loan borrowers enrolled in the Department of Education’s Public Service Loan Forgiveness program were expecting to see their student loan tab cleared. But that’s not happening for some borrowers after learning they were never actually enrolled in the programs, despite assurances from the companies servicing their debts. [More]

25 States Urge Betsy DeVos To Not Let Student Loan Companies Sidestep The Law

Since Betsy DeVos took over as Secretary, the Department of Education has been — to put it mildly — generous to the student loan industry. Through DeVos, the Trump administration has stopped cooperating with federal financial regulators to rein in unscrupulous loan servicers, and announced its plan to put all federal student loan accounts into the hands of a single company. But several states are letting it be known that they will not go easy on student lenders and servicers, even if they ask nicely. [More]

Student Loan Debt Relief Operations Allegedly Bilked $95M From Borrowers

The federal government and 11 states have joined together to accuse 30 purported debt relief operations of using deception and false promises to swindle more than $95 million from student loan borrowers. [More]

Student Loan Defaults Increase For First Time In Five Years; 8.5M Borrowers Now In Default

For the first time in half a decade, the rate of education loan defaults among recent college students has risen, highlighting the struggle many recent graduates face when it comes to paying their educational debts. [More]

Student Lender, Debt Collector To Refund More Than $3.5M To Borrowers

Two months after private student loan lender National Collegiate Student Loan Trust came under scrutiny amid reports that the company, along with its debt collector TransWorld, filed illegal student loan debt collection lawsuits against defaulted borrowers without citing proper or correct paperwork, federal regulators have ordered the companies to pay $21.6 million in refunds and penalties, and revise their collection practices. [More]

CFPB Asks Education Secretary DeVos To Not Give Up On Protections For Student Loan Borrowers

A week after Secretary of Education Betsy DeVos essentially broke up with the Consumer Financial Protection Bureau, ending the agencies’ agreements to work together to root out bad players in the student loans servicing arena, the CFPB is firing back, accusing DeVos of misunderstanding just what the Bureau does. [More]

Major Student Loan Company Accused Of Overcharging, Delaying Forgiveness For Some Borrowers

A student loan servicing company that handles accounts for millions of borrowers nationwide now stands accused of preying on people in a federal program that forgives the loans of borrowers who work in public service and education jobs. [More]

$183M Settlement Means 41,000 Former Corinthian Students Will Get Private Loan Forgiven

Nearly 41,000 former students of now-defunct for-profit educator Corinthian Colleges will soon receive refunds for the private student loans they received to attend college, after a coalition of state attorneys general and federal agencies reached a $183.3 million settlement with Aequitas Capital Management, the issuer of these loans. [More]

From Forbearance To Garnishments: 5 Things We Learned About Student Loan Debt Collection

Student loans are big business, both for private lenders and the federal government. And with $1.4 trillion dollars in education debt outstanding, it should come as no surprise that these companies and the government would want to recoup these costs. However, that often comes at a cost to borrowers, from those who have fallen on hard times, to those failing to receive proper notice and options from servicers, or those who believe they were defrauded by the educators who promised them a better life. [More]

Student Loan Company With Allegedly Shoddy Recordkeeping Under Investigation

New York Attorney General Eric Schneiderman’s office has opened an inquiry into the business practices of National Collegiate Student Loan Trust following reports that the company often files collection lawsuits against defaulted borrowers without proper or correct paper. [More]

$5 Billion In Private Student Loans Could Be Wiped Away Because Of Shoddy Record Keeping

Wiping away private student loans is a difficult, almost impossible task, for borrowers. But some debtors are finding their tabs zeroed out as the result of a long-running legal battle between former students and a group of student loan creditors attempting to collect on defaulted loans. In the end, the courts could forgive up to $5 billion in private education loans if the creditor continues to fail in providing critical paperwork. [More]

States To Education Secretary DeVos: Stop Delaying Loan Forgiveness For Students Deceived By Corinthian Colleges

Two months after the Attorneys General from dozens of states sent letters to former students of defunct for-profit college chain Corinthian Colleges reminding them to apply for federal student loan discharges, a number of those same state officials are calling on Education Secretary Betsy DeVos to stop delaying loan forgiveness. [More]

Feds Shut Down Alleged Scam Promising Student Loan Relief & Forgiveness

A federal court has shut down a Florida-based operation that charged customers $1,200 up front and $50/month with allegedly false promises of getting their student loan payments reduced or forgiven, sometimes in the impossible timeframe of only three years. [More]

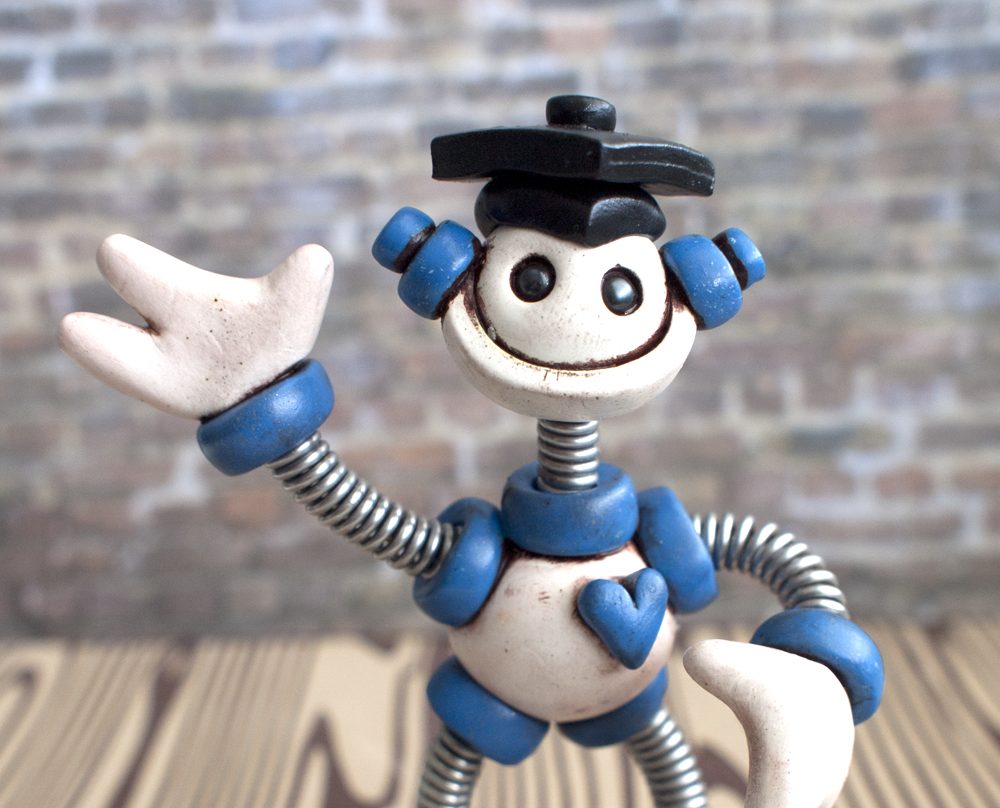

Head Of $1.3 Trillion Federal Student Aid Office Resigns Amid Tension With Betsy DeVos

New Education Secretary Betsy DeVos is making sweeping changes to federal student aid programs, like taking away protections from borrowers and putting all loan servicing in the hands of one private firm. Now the top official at the Office of Financial Aid has resigned after reportedly butting heads with DeVos and warning his colleagues concerns with the Department’s management. [More]

DeVos Education Budget Could Make It Harder To Obtain, Repay Student Loans

Days after the Department of Education revealed it would give all student loan accounts to one servicing company and strip away more protections for federal student loan borrowers, Secretary of Education Betsy DeVos outlined the Department’s proposed budget, which goes even further by eliminating or completely overhauling programs intended to make student loans more accessible and easier to repay. [More]

Education Secretary DeVos To Give All Student Loan Accounts To One Company; Strip Away More Protections

Education Secretary Betsy DeVos has made another sweeping change to the student loan system that consumer advocates claim favors student loan collectors over the American people repaying those loans. [More]