A record number of Americans classify as the poorest poor, according to a new report. Right now, 1 in 15 Americans live at least 50% below the official poverty level of $22,314 per annum for a family of four. That’s making do with about $11,000 a year split between four people. [More]

money meltdown

Drone Helicopters Used To Sell High End Real Estate

Helicopter drones looking for work outside the military might look well to apply at their local real estate office for a job. Turns out they’re not just good for conducting unmanned aerial strikes against insurgents, drones can also be used to sell mansions, via in-depth tour videos made with cameras mounted to their frames. [More]

Triple Dip Predicted For Home Prices

Home prices are headed for yet a third bottom, their lowest yet, says a new report by financial analytics company Fiserv. [More]

4 Fannie Mae Staffers Placed On Administrative Leave Pending Investigation

Four Fannie Mae staffers have been placed on administrative leave while federal investigators probe a series of foreclosed apartments the enterprise sold. [More]

What Wall Street Did To Earn The Ire Of Those Occupying It

If you need a catchup-slash-refresher on why those folks down at Occupy Wall Street are so mad at the street they’re occupying, ProPublica has put together a nice juicy primer. [More]

US Expands Mortgage Refi Plan A Smidge

The federal government announced on Monday an update to a program for homeowners that would let borrowers who were underwater – owing more on the mortgage than the house is worth – to refinance their loans at the new historically low interest rates of almost 4%. [More]

Painting Of Chase Branch On Fire eBays For $25,200

Tapping into popular sentiment, Alex Schaefer’s painting of a Chase bank on fire just sold on eBay for $25,200. Part of what drove up the price was online buzz after police questioned him while he was painting it, asking him if he planned to do what the painting depicted. [More]

Stocks Up After Days Of Bleeding

After swooning on Monday following S&P’s downgrade of US bonds, stocks posted gains on Tuesday as investors saw the over-reaction as a buying opportunity. Now investors look to see what the Federal Reserve policy board might say after their meeting later today. [More]

"Foreclosure Factory" Draws Critics

It’s a one-stop foreclosure shop. Under one roof is a law office, title company, and auction house. They act as their own notaries and can foreclose. Its owner and several of his top attorneys are even VPs at the Mortgage Electronic Registration Systems Inc (MERS) which gives them the ability to transfer mortgages from owner to the other. The Boston Globe profiles a local law firm that has attracted criticism from homeowners and consumer advocates for its vertically integrated approach to foreclosure that can speedily ride over homeowners who thought they were in the middle of working out a deal with the bank. [More]

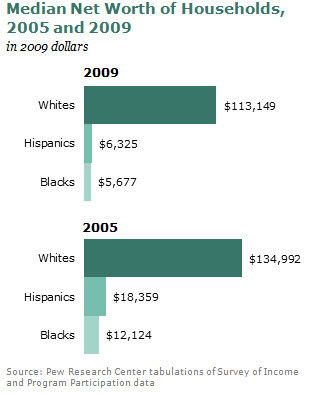

Wealth Gap Between Whites And Minorities Is Widest In 25 Years

The wealth gap between whites and Hispanics has increased to its widest in 25 years, according to new analysis of Census data by the Pew Research Center. We’re talking a 20-1 ratio between whites and blacks, and an 18-1 between whites and Hispanics. Like so many things, it comes down the the housing crisis. [More]

Wells Fargo Denies Mortgage 1 Day Before Closing To 800 Credit Score Buyer With 20% Down

After years of anything goes loans-writing, the pendulum has swung far, far, in the other direction. Patrick tells the story of how his loan with Wells Fargo was denied, 1 day before he was set to close on a new condo. Even though he has an 800 credit score and was putting 20% down, this hiccup was enough to make Wells Fargo back up. And because of it, he and his five-month pregnant wife now have one week to find a new place to live. [More]

It's Taking Longer For Small Businesses To Get Paid

Small business are experiencing a cashflow crunch as the average time it takes to get paid by customers has increased to 48 days, up from 42 days in 2010. [More]

Recession Turns Homeowner Association Fights Brutal

Florida is full of condo complexes run by homeowner’s associations. After you’ve bought and paid for your condo, all you have to do is pay the monthly maintenance fees and you get trim lawns, a snappy billiards room, and a clean shuffleboard area. But as the economy stews in its own juices, the AP reports, some seniors living on a fixed income are having trouble making these monthly payments – and no wonder, with special assessments of $6,000 – and are getting foreclosed on by their own neighbors for as little as being 60 days past due on their fees. Some of them have also stopped making payments in protest over things like the rats, and the sewage raining on their head: [More]

Four Charged In Alleged $2.5 Million Reverse Mortgage Racket

For their victims, the phone call sounded like salvation. Seniors, living on a fixed income and having trouble with the bills, they were glad to hear someone offering them a reverse mortgage that would allow them to turn the equity in their house into cash. But the four mortgage professionals charged with perpetrating a $2.5 million reverse mortgage fraud scheme are anything but angels. Their aftermath has left those who signed up with them impoverished and close to foreclosure. [More]

Will Take NY 62 Years to Get Through All The Foreclosures

At their current pace, it will take New York State lenders 62 years to repossess all the houses currently in foreclosure or severe default, NYT reports. That’s good news for some homeowners looking to get a break while they try to get out from behind the eight-ball with their debts. Some of them could even be dead by the time the house repo man comes to collect. [More]

Credit Card Reform Worked: Prices Not Increased, Just Clearer

Ignore all the haters. Credit card reform in 2009 did its job, making credit cards less confusing and safer for consumers. According to a new study from the Center for Responsible Lending, contrary to popular misconception, the reforms didn’t increase prices for credit cards, it just made the real costs clearer. Banks couldn’t tuck costs in hidden fees and sneaky practices, they had to put them on the sign out front. [More]

BofA Giving Away 150 Free Houses

Want a house for free? Bank of America is giving away 150 of them in Chicago. It’s a great plan. The bank gets some worthless properties off its books without the cost of trying to hold on and sell them, the city gets some cheap affordable housing, and BofA gets a PR bump. It’s win-win-win, with two of those wins being Bank of America’s. That’s the Chicago way. [More]

Feds Gave $220 Million In Bailout Bucks To Two Morgan Stanley Wives For Some Reason

Rolling Stone’s Matt Taibbi – the guy who famously referred to Goldman Sachs as “a great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money” – has an interesting expose of how the wives of two Morgan Stanley hot shots, though they had no previous financial experience, set up their own investing initiative and got $220 million in bailout funds. [More]