Faster! Leaner! Meaner! Ben Popken rounds up Consumerist.com’s top stories of the week, from psychotic stewardesses to deadly foreclosures. This week we introduce a new feature: printing out the internet and turning it into a puppet show. [More]

wells-fargo

UPDATED: No, Wells Fargo, You Can't Leave Animals To Die

Wells Fargo foreclosed on a Rhode Island shelter for abandoned animals, barred former owner Dan MacKenzie from entering the property, and seems to be just letting the animals fend for themselves, the Providence Journal reports. [More]

Former Customer Says Wells Fargo Bills Him $101.70 On Closed Account

Royal says it’s costing him more than $100 to break free of Wells Fargo after he closed his checking account before waiting for all pending charges to clear.

Wells Fargo Also Pledges To Reduce Overdraft Fees

Chase and Bank of America aren’t the only ones suddenly growing pseudo-human faces and reducing their money-sucking overdraft policies. Today Wells Fargo squirted out a press release that says they “will eliminate overdraft fees for customers when they overdraw their accounts by $5 or less and will charge no more than four overdraft fees per day.”

Banker Uses Foreclosed Beach House For Totally Awesome Parties

It’s Saturday night! Let’s party! …But where? Oh, I know. I heard that there’s this foreclosed Malibu beach house where a Wells Fargo manager is having some killer parties. Well, at least until ACORN had to go and ruin everyone’s fun.

"What Do I Do When My Lender Isn't Playing Fair With Loan Modification?"

Yesterday, the New York Times wrote about a judge in Arizona who forced Wells Fargo to explain why it keeps stalling and being uncooperative with a customer who has been trying to get a loan modification request approved. Sadly, in the past week we’ve gotten two separate emails from homeowners who are also having trouble with getting banks to approve their requests for the government-sponsored loan modifications. “Who can we contact to complain?” asks one frustrated customer.

Wachovia Teller Refuses To Deposit Check Written In Two Ink Colors

“The best advice I can offer to those who wish to commit check fraud against Wachovia Bank,” writes Jim, “is to purchase a typewriter.” Although he’s been a customer of the bank for years and had a hefty balance that more than covered the deposit amount of his handwritten check, because the dollar amount was in black ink and the signature was in blue ink the teller said it might be fraudulent and refused to take it.

Wells Fargo Teller Explains The Ways Of The Desert To Customer

A misinformed bank teller at a Wells Fargo in Arizona was determined to explain how desert life worked to a woman who just wanted to buy some GPB (pounds sterling, aka British money).

Affidavits On How Wells Fargo Gave "Ghetto Loans" To "Mud People"

Here’s the official court filing (PDF) so you can get the full details on how Wells Fargo pushed or even fraudulently placed black borrowers into sub-prime loans, even when those borrowers could afford prime loans, along with an office environment where employees threw around racist slurs, calling black borrowers “mud people” and their mortgages “ghetto loans.” The official statements referenced in the NYT article are in this document in full. The affidavits begin on page 48. Two screenshots inside…

Loan Officers Detail Wells Fargo's Blatantly Racist Subprime Loans

UPDATE: Read the affidavits here.

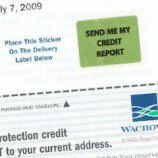

Wachovia Sends Out Its Own "Free Credit Report!" Offer To Customers

Tom just received a great offer from his bank. He can receive a free credit report just by peeling off this sticker and affixing it to another part of the same page. That’s right, a free motherloving credit report! Who doesn’t want one of those? Free, you say? Sign me up!

Wells Fargo Will Let You Refinance For No Closing Costs Online

If you’re saddled with a Wells Fargo mortgage, now would be a good time to slash your rate and payment through little effort by hitting up the bank’s streamlined refinancing program, which under certain circumstances lets you refi without being gouged for closing costs.

Here's A Phishing Site Disguised To Trick Wells Fargo Customers

Freddie writes that his friend was tricked by a phishing email. All the warning signs were there to tip off his friend—an email saying he needed to click a link, a suspicious url, a page asking for his login info—but he clicked and entered the info anyway. Please do not be like Freddie’s friend, who is now probably on the phone with the real Wells Fargo trying to get his account number changed.

Government To Banks: Why Are You Making Predatory Loans With Taxpayer Money?

The bailed-out banks have found a new way to annoy the government, according to the Congressional Oversight Panel, the body named by Congress to oversee the federal bailout. Chair of the committee and friend of the blog, Elizabeth Warren, is concerned that the same people who are subsidizing the banks are being targeted by abusive lending practices, says the Wall Street Journal

Threat Of Small Claims Court Gets Wells Fargo Overdrafts Refunded

After he got some overdraft fees that he felt were unfair, Karney Hatch decided to put the banking system on trial, and make a documentary about it.

HSBC, Wells Fargo Accused Of Racism In Mortgage Issuing

The NAACP this week filed a class action suit accusing Wells Fargo and HSBC of charging unfairly high interest rates to African American homeowners with high incomes and high credit scores. The banks were quick to slap down the charges as “totally unfounded and reckless,” even in the face of convincing evidence from the NAACP.