Three of the nation’s biggest banks have teamed up to offer a new payment service that lets you transfer money from your bank account using only a cell phone number or email address. It’s called clearXchange and it’s being offered to Chase, Bank of America and Wells Fargo customers. An inkling of how it will work is revealed on the initiative’s placeholder web page. [More]

wells-fargo

Call Every Time To Make Sure Extra Payments Go To Paying Down Principal

People trying to get ahead on their car and house payments are sometimes shocked to discover the default way that banks handle their extra payments. Instead of paying down the existing principal, they apply it to the future interest. Not only that, but you can’t just call them up one time and ask for them to change how they handle your payments. You need to call them every month you make a payment. Here’s a tale from reader Katherine: [More]

Wells Fargo To Test Chip Embedded Cards With Travelers

Wells Fargo is going to send 15,000 EMV chip-embedded credit cards to frequent travelers this summer, the largest US bank to make a move towards these international-style credit cards. Consumers had complained about troubles using their credit card abroad with kiosks that only accept chip cards or with merchants who refused to take cards that only have the magnetic strip. [More]

Letter To Wells Fargo Execs Finally Gets Loan Check In Reader's Hands

In February, law school grad and Consumerist reader Stephanie applied for a $5,000 loan to cover the cost of her bar exam and related review course. Should have been no big thing, considering that she’s been an account-holder at Wachovia, which Wells Fargo scooped up after it failed a few years back. Alas, it turned into a nightmare. But after several weeks of dead ends, one well-composed Executive E-mail Carpet Bomb to Wells Fargo got the mess cleared up. [More]

Wells Fargo Is Worst Friend Ever, Borrows $377.09 For Two Weeks Without Asking

Tom is angry at Wells Fargo, because they’re borrowing $377.09 from him without his permission. When Wells Fargo purchased Wachovia a few years ago, Tom’s car loan came along with it. Every month, the bank would draft a payment of $384.43 from Tom’s account. His last payment was due in March, and it was only $6.34, but Wells Fargo just went ahead and took the entire $384.43 out of habit. [More]

Zombie Wells Fargo Account Rises From Dead, Collects Overdraft Fees

Leigh thought that she had laid her Wells Fargo checking account to rest. It was closed, gone, out of her life forever. When some forgotten auto-payments hit the account, though, instead of rejecting the payments, the bank zombified the account, brought it back to life, and charged Leigh and her husband a $35 overdraft fee for each item that hit their account. Wells Fargo put them on a payment plan to repay their balance, then turned around and sent the account to collections less than a month into the agreed-upon payment plan. Now they’ve been flagged as overdrafters in the Chexsystems database, and are still watching the account to make sure that no erroneous auto-payments hit it and trigger more overdrafts. [More]

Wells Fargo & SunTrust Cancel Debit Rewards Programs

Last week, we wrote about JPMorgan Chase’s decision to get rid of rewards programs for debit card users in response to a new law that will slash the amount of money banks receive per debit card transaction. Now comes news that at least two other banks — Wells Fargo and SunTrust — have followed suit. [More]

Worst Company In America Round One: Wells Fargo Vs. Chase

Get ready for some more financial fisticuffs as Chase tries to avoid getting run over by the Wells Fargo wagon. [More]

Couple Spends 7 Months Trying To Buy A Short Sale House, Only To Watch Wells Fargo Foreclose At The Last Moment

Nestor and his wife have been working for months to buy a house listed as being a short sale. They even bought new furniture and kitchen appliances for it in expectation, stowing the items in their garage. They had finally gotten approved and were making moving plans. Then at the last moment, Wells Fargo decided they’d rather not take Nestor’s money and would prefer to foreclose instead. [More]

Consumerist Talks About The Man Who Made A Fool Out Of Wells Fargo On Bloomberg Today At 5:45 ET

Consumerist is back on Bloomberg TV today! Once again, Ben Popken will be appearing on Taking Stock, where he’ll be chatting about the Philadelphia homeowner who foreclosed on Wells Fargo. Tune in to Bloomberg TV, or watch online at Bloomberg.com/tv, at 5:45 p.m. ET. [More]

Philly Homeowner Who "Foreclosed" On Wells Fargo Settles Dispute

As Consumerist was the first to report last Friday, the Philadelphia homeowner who made national news by not only winning a judgment against Wells Fargo, but also scheduling a sheriff’s sale of the bank’s property, was meeting face-to-face with the bank he’d embarrassed so thoroughly. Now he’s confirmed that the two parties had reached an agreement. [More]

Wells Fargo Meeting Today With Philly Homeowner Who "Foreclosed" On Them (Here's How He Did It)

Wells Fargo is meeting today at noon with the Philadelphia homeowner who “foreclosed” on them, The Consumerist has exclusively learned. Patrick says he “received a call from upon high” late yesterday and that he now has an appointment, “with a very senior Wells Fargo person.” It will be interesting to see how this plays out. But how did Patrick go from embattled and ignored homeowner to seated across the negotiating table with leverage? I spoke with him to find out more about both how and why he did what he did. His story is an inspiration to anyone who’s dreamed of going toe-to-toe with the big banks and winning. Turns out that armed with persistence, and a little legal know-how, Davids can take down Goliaths. [More]

Dead Woman's Parents Told To Repay Her Wells Fargo Student Loan

Many young adults complain that they will be trapped in student loan debt for the rest of their lives. It could be worse: yes, really, worse. A young woman in Kansas died of cancer shortly after graduating from college, and the lenders of her $45,000 in student loans decided to come after the balance from her estate: in her case, her parents. Because every grieving family needs to fight banks. [More]

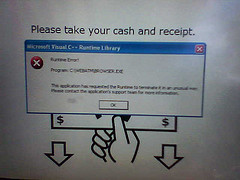

Wells Fargo ATMs Crash Across The Country

Most of Wells Fargo’s 12,000 ATMs crashed starting Monday afternoon and lasting several hours, reports the Star Tribune, and no one knows why. [More]

Wachovia Settles "Pick-a-Payment" Mortgage Loan Class Action

If you got a “Pick-a-Payment” mortgage from Wachovia between Aug 1 2003 and Dec 31 2008, you might be up for claiming some cash in a $50 million settlement. [More]

Know Your Bank's New Checking Fees To Avoid Getting Slammed

The first reaction to your bank instituting new fees on your “free checking” account in 2011 might be sheer, overwhelming panic, or maybe rage, indignation, or some combination thereof. But don’t be afraid, fee-haters, there are ways around extra charges to your account. [More]