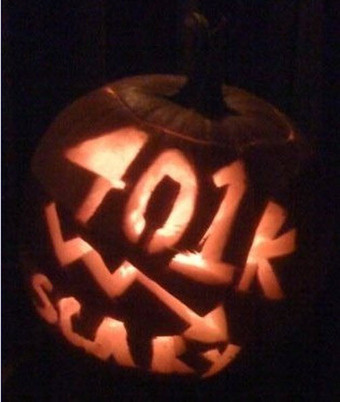

Christian personanl finance blog Redeeming Riches offers four revelations on how you may be mistreating your 401(k).

retirement

Setting a Retirement Number and Determining if You're Going to Make It

After the past year’s economic slump, it’s safe to say that most of our retirement accounts are not what they used to be. So how do you know if the stock market crash has derailed your retirement or not? Of course, the first step in the process is knowing how much money you’ll need for those future days on the golf course. Personal finance blog Wise Bread says we all have two main options for determining our retirement numbers, namely:

Old Workers Vs. Young In A Tough Labor Market

Forget about mall-walking and midday bingo games. It seems that workers over 55 just aren’t interested in retiring. This is problematic for the young people who, under different circumstances, would have replaced them in the workforce.

Should You Have a Mortgage in Retirement?

A growing personal finance debate centers around whether or not individuals should have a mortgage when they retire. A surprising number of retirees maintain a mortgage — 4 in 10 in 2007 — but is this good financial management?

The Five Universal Financial Truths

Saving can be boiled down to a few universal financial truths. The sooner you know and internalize them, the sooner you can start enjoying a responsible, sustainable lifestyle.

Why You Should Pay Off That Mortgage Before You Retire

If you planned on retiring soon you’ve probably had to readjust your expectations. But even if you’re still on target to take it easy soon, you should reconsider until you’ve paid off your mortgage.

LendingTree Launches Financial Advice Website

MoneyRight, a new website from LendingTree, seems at first aimed to take on Mint.com in the easy-to-read/use financial snapshot category of web services. However, it also offers financial advice based on your current situation and future goals.

AARP Tells You How To Love Your Money The Old-Fashioned Way

It’s not such a great time to be heading into retirement, which may be a reason prospective retirees may want to glance through the AARP’s 50 Ways To Love Your Money PDF.

../../../..//2009/06/20/here-are-5-personal-finance/

Here are 5 personal finance podcasts to subscribe to, download, and argue with during your commute or workout. [Automatic Finances] (Photo: uhuru1701)

Should I Reduce My 401k And Put The Money Toward Credit Card Debt?

Given the state of the economy today, is it better for me to reduce my 401k to a minimum and use the extra funds to pay off my credit card debt? This is a good time to put money into the markets, based on my admittedly limited understanding, but with interest rates going through the roof (my personal Chase card went from 12.99 to 23.99), I would like to kick down my cc debt (now at around $6,000) faster. I’m currently only putting 6% in my 401k, and I’m fairly young (35). Have you advice for me?

Woman Hides Life Savings In Mattress, Mattress Taken To Dump By Helpful Daughter

A woman in Israel hid her life savings—she says nearly $1 million dollars—in her mattress. Her daughter bought her a new mattress as a surprise upgrade and threw it out. Dump employees are now searching on behalf of the family while security has been hired to keep out treasure hunters, but they don’t know which of the two city dumps it was taken to. We imagine it’s the one where the rats are all wearing tiny gold rings and toasting each other with little glasses of champagne.

Tax-Saving Moves For 14 Big Life Events

Life is full of surprises and challenges. Luckily, there’s a tax form for just about all of them. Via Kiplinger’s, here’s 14 major life events that allow for smart tax-saving moves, and how to make those moves.

Get Ahead By Working For Yourself One Hour Each Day

For most people, their career is their most valuable financial asset. But for those willing to make the effort, even a small one, there might be something even more valuable—a side business that could potentially turn into a very large source of income.

WSJ Asks, "Is Your Home A Good Investment?"

Brett Arends at The Wall Street Journal has compared Case-Shiller house price data to annual inflation rates, and speculates that owning a home may not be a very good investment. “You can often do better on long-term inflation protected government bonds,” he writes.

How Does The Chrysler Bankruptcy Impact Your Mutual Fund?

What impact does the Chrysler bankruptcy have on regular investors who hold bond funds? Most likely little to none, it turns out. Consumer Reports points out that most mutual funds have been avoiding Chrylser, GM, and Ford debt for years now—and if your fund does include Chrysler, it’s probably a tiny portion of your overall investment.

Personal Finance Columnist's Financial Advisor Accused Of Fraud

Last week, New York Times personal finance columnist Ron Lieber discovered that his family’s financial planner was being investigated for fraud, because millions of dollars had been transferred out of clients’ accounts without authorization. What’s funny is Lieber found the financial planner while writing a column on how to comparison shop for one.