Even though President Trump recently promised that your 401(k) retirement accounts would not be negatively affected by the ongoing effort to cut taxes, the folks in Congress who are actually deciding what tax laws will be changed say that putting limits on retirement plans is still a distinct possibility. [More]

retirement

Trump Promises Tax Overhaul Will Not Include Cuts To 401(k) Plans

The Republican tax outline currently calls for large scale cuts to some taxes but has not yet provided much in the way of detail about how some of the government would offset some of those revenue losses. Recent reports said that the GOP was looking at lowering the maximum amount you can contribute to your 401(k) retirement savings — a proposal that chafed more than a few Americans. Now, President Trump is claiming that the tax plan will not touch your 401(k). [More]

Will Republican Tax Cuts Mean Lower Limit On 401(k) Contributions?

Some people with 401(k) retirement plans will put as much money into it as they can, but there are whispers that the tax cuts being drafted by Republicans in Congress could reduce the maximum amount of money you contribute to your retirement savings each year. [More]

Investment Advisors Will Be Required To Work In Your Best Interest, But Will Trump Administration Enforce Rule?

After a nearly four-month delay, the Trump administration has decided to allow the Department of Labor to move forward with a rule intended to stop investment advisors from pushing customers into products that primarily benefit the advisor. However, some question whether the administration will actually enforce this rule. [More]

Reminder: You Can Still Cut Your 2016 Taxes By Making IRA Contributions

Looking for a way to cut your tax bill or boost your refund before you file? Don’t forget that contributions that you make to your retirement accounts between Jan. 1 and April 16 of this year can count toward either your 2016 or 2017 tax return. [More]

Do Investment Advisors Have Your Best Interests In Mind? They Don’t Have To

The Department of Labor’s Fiduciary Duty Rule aims to protect families from conflicts of interest by requiring advisors to act in the best interest of customers. Sounds pretty common sense. But it’s now in jeopardy as President Donald Trump on Friday signed an executive order directing the Department to take the first step toward changing or eliminating the rule, before it even formally takes effect. [More]

5 Ways To Improve Your Finances With Minimal Effort

Improving your finances doesn’t always require a big investment. Sometimes a single phone call or a small tweak are all you need to improve your financial future or present. Looking for some ideas as you change to your new “366 Kitten Photos” desk calendar? Here are some ideas from our financial friends down the hall at Consumer Reports to get you started. [More]

Sorry, Class Of 2015: You Will Have To Be At Least 75 Before You Can Retire, Study Says

Retirement always feels like forever away when you’re in your early twenties. But for the young adults among the most recent cohort of college graduates, the age of retirement really is receding further and further into the distance than it is for their older peers. [More]

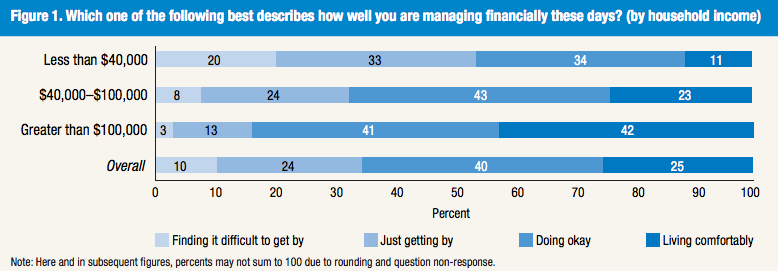

Fed Survey Finds Most Consumers Are Happy With Their Finances, Despite Lack Of Retirement Savings

As the economy continues to bounce back from the Great Recession, consumers have adopted a more optimistic outlook when it comes to their finances despite the fact that a third of the country has no savings put away for the future, according to a new survey from the Federal Reserve. [More]

McDonald’s CEO Will Step Down March 1, Mayor McCheese Not Named Successor

McDonald’s announced that its CEO Don Thompson, who is not to be confused with Ron Johnson, will retire from the position as of March 1st. The current senior executive vice president and chief brand officer will take over, but what will it take for the brand to win over franchisees and younger Americans? [More]

The Average Middle-Class American Only Has $20,000 Saved For Retirement

Consumers’ lack of savings for the future isn’t a new phenomena: Just two months ago we reported that one-in-three Americans have no retirement savings. Today we know a little more about just how much those other two have saved; and it isn’t nearly enough. [More]

101-Year Old Man Still Working At Same Lighting Company After 73 Years

Think you’ve been at your job a long time? Odds are you’re nowhere close to one 101-year-old New Jersey man, who’s been working at the same lighting company almost nonstop since he started as a shop clerk in 1941. [More]

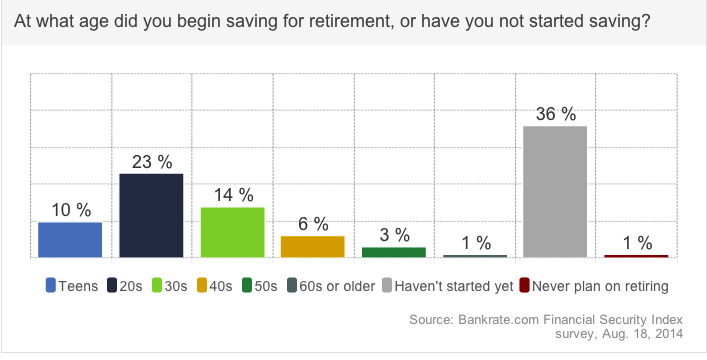

1-In-3 Americans Have No Retirement Savings

Thanks to medical science — and the fact that we have yet to resort to a Logan’s Run-style system that determines your maximum age — humans are living longer than our forebears did. The downside of that fact is that while you might be forced to retire from your job, you can’t really retire from paying the bills. Alas, a new survey confirms that way too many Americans are shrugging off retirement. [More]

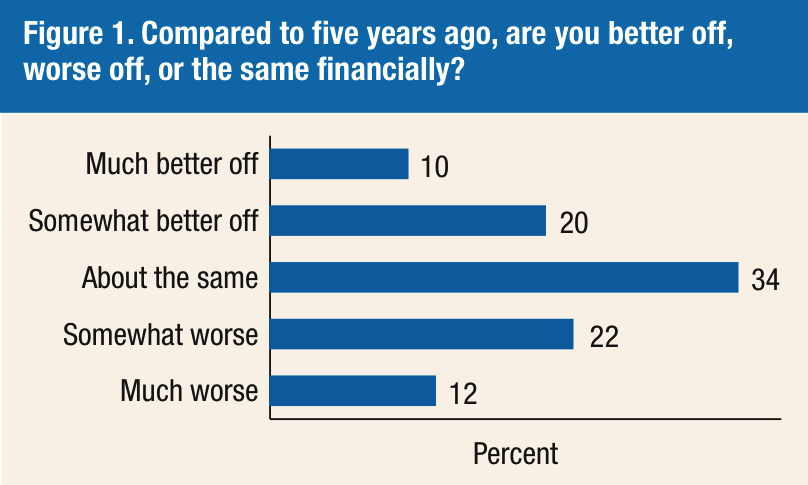

1-In-3 Americans Still Feeling The Sting Of Recession

While many Americans are now doing better than they were during the Great Recession, those dark days took such a toll on many consumers’ savings that some people who are currently doing well enough to pay the bills and enjoy a decent living aren’t able to make necessary longterm investments, like buying a new home or saving for retirement. [More]

Feds Warn Consumers Against Taking Pension Advances

Unfortunately, not everyone currently in retirement has enough cash on hand to stay afloat, even those fortunate enough to receive a pension from their former employer. That’s why it might be tempting to solve a short-term money problem by taking out a pension advance, which pays you a lump sum now for signing over your pension payments to the lender for anywhere from a few years to a decade. Today, the Federal Trade Commission warned consumers to think twice before agreeing to one of these loans. [More]

Forget Everything You’ve Heard, The Best Place To Retire Doesn’t Include Sandy Beaches

Somedays when sitting in a crowded cubicle with phones incessantly ringing it’s inevitable that your daydreams will turn to retirement. Those thoughts might entail lounging by the beach in Florida or hitting a few balls on the lush greens in Arizona, but a new report found the best places to retire aren’t in either of those popular snowbird states. [More]

10 Ways To Not Suck At Spending Your Tax Refund

Tax season is finally over, and hopefully you’re one of the lucky ones who is expecting a tax refund rather than one of those who has to send even more money to the IRS. But before you spend that money on a third 72″ LED for your yacht, there are several more sensible ways to use your refund. [More]