The Department of Labor’s Fiduciary Duty Rule aims to protect families from conflicts of interest by requiring advisors to act in the best interest of customers. Sounds pretty common sense. But it’s now in jeopardy as President Donald Trump on Friday signed an executive order directing the Department to take the first step toward changing or eliminating the rule, before it even formally takes effect. [More]

savings

Walmart Launches Revamped Credit Card Rewards Program

Saving money at Walmart is as easy as 1-2-3 — or 3-2-1? Either way, that’s the point the mega-retailer appears to be trying to get across with its newly launched Walmart Credit Card and Walmart MoneyCard cash-back rewards program. [More]

Sorry, Class Of 2015: You Will Have To Be At Least 75 Before You Can Retire, Study Says

Retirement always feels like forever away when you’re in your early twenties. But for the young adults among the most recent cohort of college graduates, the age of retirement really is receding further and further into the distance than it is for their older peers. [More]

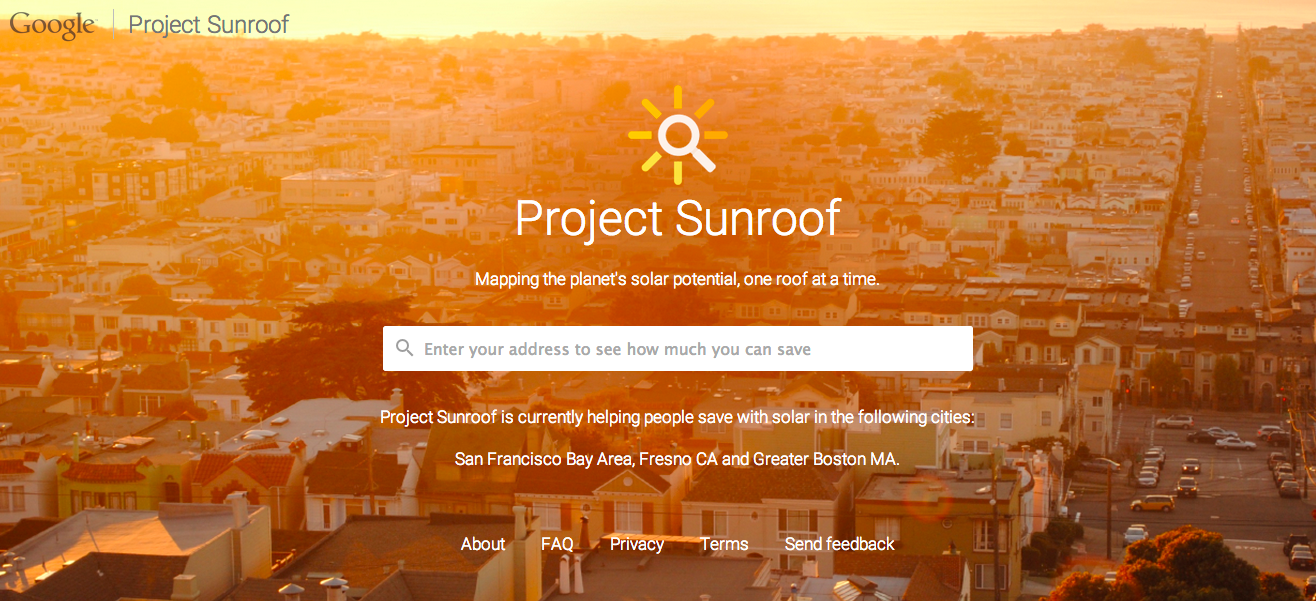

Google Launches Tool That Tells You If Solar Panels Can Save You Money

Are you thinking of putting a solar panel on your home, but not sure if the investment would be worthwhile? Google’s latest unusual online tool aims to take the guesswork out of the alternative energy investment. [More]

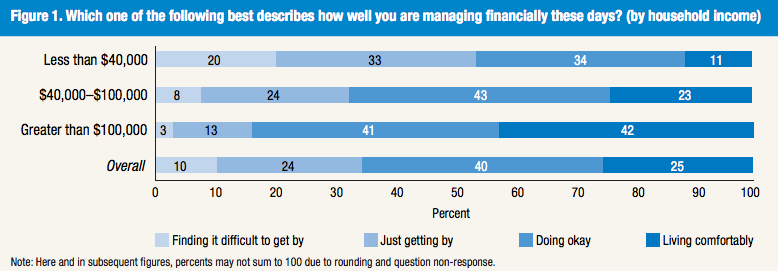

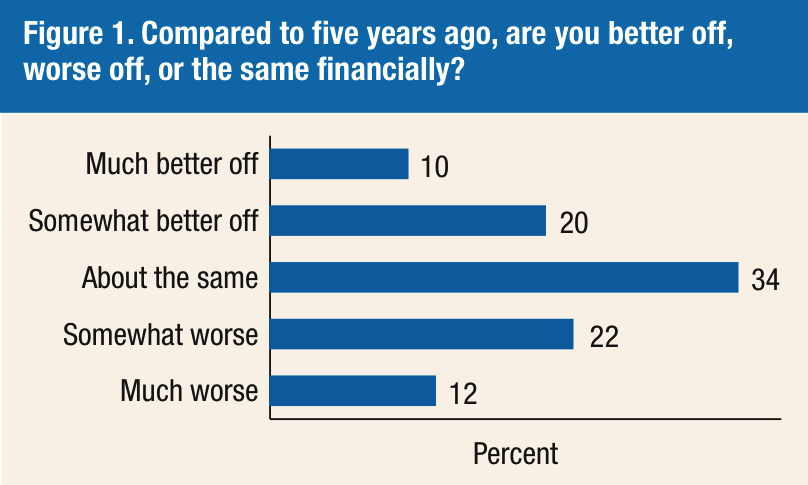

Fed Survey Finds Most Consumers Are Happy With Their Finances, Despite Lack Of Retirement Savings

As the economy continues to bounce back from the Great Recession, consumers have adopted a more optimistic outlook when it comes to their finances despite the fact that a third of the country has no savings put away for the future, according to a new survey from the Federal Reserve. [More]

Households Earning $75,000 Eat Out Too Much To Save Any Money

Earlier this week, the news broke that Americans are, as a whole spending more on dining out than on groceries. In a related piece of news, a study from bank SunTrust says that a surprisingly large portion of American households that earn $75,000 per year live paycheck to paycheck because they’re spending too much money on “lifestyle expenses” to put any money away. [More]

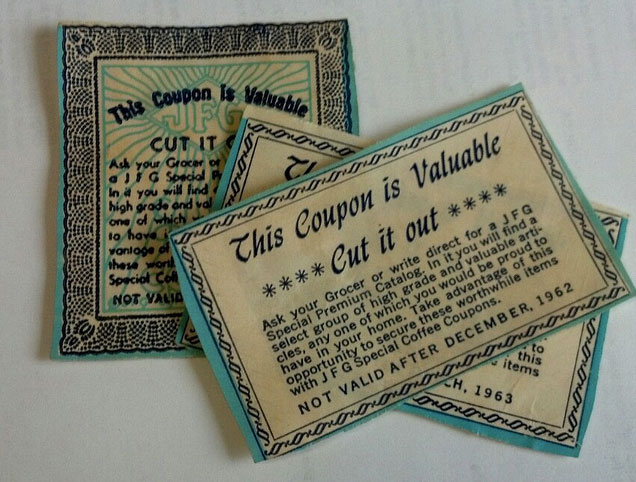

70% Of Coupon Users Still Use Print Circulars For Savings

If you use coupons, what type do you use? Some surprising information came up at this week’s Association of Coupon Professionals conference, which is an actual thing. It’s not surprising that such a conference would discuss how much consumers like coupons, but it is surprising that 71% of consumers reportedly still use paper coupons. [More]

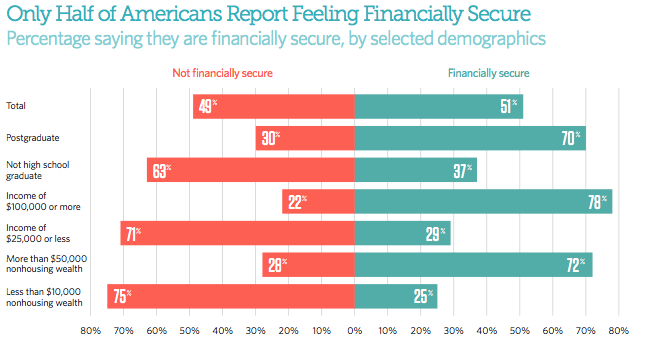

Report: Americans Are Optimistic About Their Finances But Few Actually Feel Secure

Americans’ positive feelings about the economy have officially returned to the level they were at on the eve of the Great Recession, according to a new study from Pew Charitable Trusts. While that might sound comforting, it doesn’t mean consumers are actually feeling secure in their own financial stability. [More]

Bill Would Allow 529 College Savings Plan Investors To Change Investments Twice A Year

With less disposable income and difficulty meeting the ever rising cost of tuition, parents often have a tough time saving for their child’s future education. A law poised to make its way though Congress aims to give parents using certain college savings plans more flexibility in their investments. [More]

The Average Middle-Class American Only Has $20,000 Saved For Retirement

Consumers’ lack of savings for the future isn’t a new phenomena: Just two months ago we reported that one-in-three Americans have no retirement savings. Today we know a little more about just how much those other two have saved; and it isn’t nearly enough. [More]

Newegg Wants You To Subscribe To Buy Vitamins And Toner Cartridges

You may think of Newegg as a retailer for electronics, but they sell a huge variety of items, from copy paper to pet supplies. Some of these items are useful to have a standing order for, and Newegg is happy to oblige with their new service: Newegg Subscription. This idea may sound a bit familiar. [More]

4 Ways You Can Save Your Self Into Financial Trouble

In general, saving money is good. But if you are overzealous about your thriftiness or think only in terms of immediate or short-terms savings, you could end up paying more in the long run. [More]

1-In-3 Americans Still Feeling The Sting Of Recession

While many Americans are now doing better than they were during the Great Recession, those dark days took such a toll on many consumers’ savings that some people who are currently doing well enough to pay the bills and enjoy a decent living aren’t able to make necessary longterm investments, like buying a new home or saving for retirement. [More]

Despite Lessons From Great Recession, Few Consumers Save For Emergencies

Did consumers learn nothing from the Great Recession? Okay, they learned several things, but putting away for a rainy day doesn’t appear to be one of them. [More]

More Families Are Saving For College, But It May Not Be Enough To Match Rising Tuition Costs

If we’ve said it once, we’ve said it a million times: college tuition is rising and along with it, student debt. While a new report shows that families are doing their best to help cover the costs by saving more, it likely won’t be enough. [More]