If you’ve just started investing, you’re bound to make a few mistakes as you find your footing. While there’s no guaranteed formula for success, there are ways to put yourself in the best position possible to start off strong and stick around for the long haul. [More]

retirement

What You'll Need To Do If You Want To Retire This Year

If you’ve got dreams of permanently clocking out of the workforce sometime in 2012, now is the time to start plotting out your escape into retirement. Before you begin the transition, you’ll need to take an inventory of your assets and planned income, set some goals and put together a budget. [More]

Reasons To Retire To A Foreign Country

Maybe you’ve always seen yourself running out the clock in Scottsdale or Miami, but if you want to make your retirement dollar stretch, you may want to expand your horizons. Some foreign countries cater to retirees with friendly tax rates and low cost of living, making them attractive alternatives to American retirement havens. [More]

6 Tips For Avoiding Early Retirement Seminar Scams

The idea of retiring early — putting the workday behind you and living a life of leisure before you’re too old to enjoy it — is incredibly tempting and there is no shortage of not-so-nice people out there willing to stoke that pipe dream at seminars where smooth-talking speakers make it all seem so attainable. Alas, it’s not so simple and a lot of these seminars will do nothing but leave you with less money than you had beforehand. [More]

Your 20s Aren't Too Early To Worry About Retirement

Although it’s tough to plan nearly half a century ahead, the moves you make now can greatly affect your outlook when it comes time to retire. Small sacrifices today can potentially pay off exponentially as the decades roll by. [More]

Are You Responsible For Bailing Out Your Financially Irresponsible Parents?

We often hear stories about beleaguered parents who continually dip into their bank accounts to keep their fiscally foolish offspring from ending up on Skid Row. But what about when the shoe is on the younger generation’s foot? [More]

Survey: Some People Think They'll Need To Work Until Age 80

An unforgiving economy combined with plundered pensions and worries about the sustainability of Social Security have apparently sucked some air out of the dream of retiring by age 65. According to a survey, a quarter of Americans believe they’ll need to keep clocking in until 80 in order to be able to save up enough to retire. [More]

3 Steps To Take To Plan Your Retirement

Conventional wisdom advises you to keep your money in indexed investments and rest assured that market forces will grow your nest egg with double-digit returns, allowing you to coast into retirement with ease. But the recession and current volatile stock market can make you re-think your retirement strategy. [More]

More People Using 401(K) Funds As Piggy Banks

Even though the economy has begun to demonstrate occasional signs of life, many Americans are still feeling the sting of those darkest days. Millions of homeowners are struggling to pay mortgages they can’t afford and those that have walked away from underwater loans now have battle-scarred credit reports. So in order to stay afloat, more consumers are taking loans from their own retirement savings. [More]

Bill Aims To Stop People From Using 401(K) As A Piggy Bank

A recent study found that a record number of people (around 28%) with 401(k) retirement funds had loans (averaging $7,860) outstanding on them in 2010, meaning that these same folks will not have as much money set aside when it does come time to retire. That’s why a pair of Senators have introduced legislation that would make it more difficult for people to tap their 401(k)s. [More]

Decisions You Need To Make About Retirement

At some point, whether by your own choice or that of those who pay you, you’re most likely going to have to call it a career and move on to a life of shuffleboard and early-bird specials. [More]

The 10 Worst States For Retirement

Most of us won’t be retiring anytime soon. But for those few who will be saying goodbye to the workforce forever in the next few years, the people at TopRetirements.com have put together their list of the worst states in which to live out your golden years. [More]

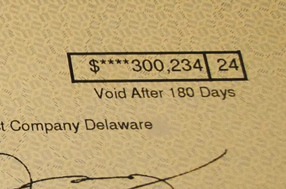

Fidelity Sent Me Someone Else's $300,000 Retirement Savings

Douglas received an unexpected delivery from UPS last week: a check from Fidelity Investments made out to Vanguard Fiduciary Trust Company for over $300,000, along with a bunch of 401(k) rollover paperwork that included the real account holder’s address, date of birth, SSN, and phone number. [More]

When It's Time To Start Running Out The Clock On Life, Tucson Is The Place

BusinessWeek came out with a list of the most affordable places to retire, and my hometown of Tucson topped the rankings. This is a big deal for Tucson, given it normally doesn’t top any national statistical categories other than impoverished education systems and cholla stings. [More]

5 Financial Tasks For Baby Boomers

MSN Money offers financial goal-setting advice for Baby Boomers that can just as easily be applied to any other stage of life. [More]

Soon-To-Be-Ex Bank Of America CEO Has $53 Million Pension

Ken Lewis is probably a little bummed out that he will no longer be the CEO of Bank of America — but how sad can he be with a $53 million pension?

These Places Are So Cheap They May Actually Allow You To Retire There

U.S. News & World Report names the 10 “Best Affordable Places To Retire.”

Retirement Savings Before College Savings

These days many parents are struggling with saving any amount of money. So imagine the difficulty of trying to tackle the seemingly insurmountable tasks of saving for college and retirement simultaneously. No question, it’s a tall order. To give parents some options to consider, US News offers suggestions for dealing with this double-headed financial dragon as follows: