A group of homeowners in San Jose, CA, are so fed-up with the messy conditions at a bank-owned, abandoned home that they picked up the garbage themselves — and took it straight to Wells Fargo in protest. Unfortunately, it looks like they dumped their troubles in the wrong lobby. [More]

foreclosures

Wells Fargo Forecloses On, Auctions Off House With Dead Owner Inside

Last year, Wells Fargo foreclosed on and auctioned off a modest townhouse on Cape Canaveral in Florida. The owner hadn’t made any mortgage payments or used any electricity in over a year, and neighbors didn’t recall seeing her. Her possessions and car were still in the house. Did she walk away from her mortgage and leave town entirely? Not quite. The house’s new owner found something Wells Fargo’s inspectors and property managers had missed when they inventoried the contents of the house and garage: the homeowner’s mummified remains in the front passenger seat of her car. Her cause of death remains unknown. [More]

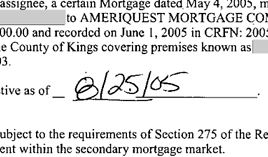

Paperwork Shows GMAC Created Fake Document To Foreclose On Property

Last summer, GMAC was looking to foreclose on a property here in Brooklyn. Only problem was, it didn’t have documentation proving that it actually owned the mortgage and the original lender, Ameriquest, couldn’t help because it had gone the way of the dodo a few years earlier. So what’s a mortgage servicer to do but fabricate the paperwork? [More]

Banks Letting Foreclosed NYC Homes Fall Into Dangerous Disrepair

Though New York City real estate remains at a relative premium, a new report says that banks have ignored the upkeep of thousands of seized foreclosure properties, allowing them to fall into horrid levels of disrepair. [More]

Protesters Stop Foreclosures For Strangers In Spain

Some people don’t even know their neighbors’ names, but in Spain protesters are gathering in front of people’s houses to stop or stall foreclosures. And they’re getting results. [More]

Recession Turns Homeowner Association Fights Brutal

Florida is full of condo complexes run by homeowner’s associations. After you’ve bought and paid for your condo, all you have to do is pay the monthly maintenance fees and you get trim lawns, a snappy billiards room, and a clean shuffleboard area. But as the economy stews in its own juices, the AP reports, some seniors living on a fixed income are having trouble making these monthly payments – and no wonder, with special assessments of $6,000 – and are getting foreclosed on by their own neighbors for as little as being 60 days past due on their fees. Some of them have also stopped making payments in protest over things like the rats, and the sewage raining on their head: [More]

Lawsuit Alleges Citi Illegally Foreclosed On Thousands Of Soldiers' Homes

An Iraq War veteran has filed a potential class-action lawsuit against CitiGroup’s CitiMortgage division, alleging that the lender violated the Servicemembers Civil Relief Act by foreclosing on his home and that of “thousands” of other active-duty soldiers. [More]

HOAs Feeling The Financial Sting Of Abandoned Houses

With a sea of homes left empty by erstwhile homeowners who couldn’t afford the mortgage, a number of homeowner associations around the country have are stuck having to pay for the upkeep on vacant properties lest the value of the remaining homes be harmed any further. [More]

Unemployed Homeowners Will Have Longer Before Facing Foreclosure

If you’re unemployed and worried about losing your home, here’s some news that might make your day a little brighter. The White House announced earlier today that all FHA-approved mortgage servicers must extend the forbearance period for unemployed homeowners, currently four months, to one year. [More]

Man Buys House With Cash, Bank Of America Tries To Foreclose

A Sacramento man nearly lost a house he paid for in cash when Bank Of America tried to sell it in a foreclosure auction. The mistake prevented the owner from renting out the house, but luckily the bank caught the error, caused by a data entry mistake, and called off the sale the day the house was scheduled to go up for auction. [More]

Retiree Loses Everything After Bank Mistakes His House For Foreclosure

An eighty-two year old Tampa Bay man has lost everything he owns, including pictures of his dead wife, after a clean-out crew hired by Bank of America mistook his house for the foreclosure next door. [More]

Will Take NY 62 Years to Get Through All The Foreclosures

At their current pace, it will take New York State lenders 62 years to repossess all the houses currently in foreclosure or severe default, NYT reports. That’s good news for some homeowners looking to get a break while they try to get out from behind the eight-ball with their debts. Some of them could even be dead by the time the house repo man comes to collect. [More]

Homeowner Says Bank Of America Foreclosed On Her After Advising Her To Miss Payments

A woman says she lost her home to Bank of America by following its advice to her that she skip mortgage payments. The woman had lived in the house for 25 years and began struggling with payments when she began battling breast cancer. When she asked the bank to help adjust her mortgage in 2009, she said the bank told her it couldn’t help her because she was current with her payments. Once she allowed herself to miss three payments, as she said the bank advised her to do, BofA did lower her mortgage payments, only to later foreclose on her. [More]

Millions Of Homeowners Have Not Made Mortgage Payments In Years

It now takes an average of 565 days from a homeowner’s first missed payment until a lender ultimately forecloses on a property. It takes significantly longer — 807 days on average — in Florida, a state with a large number of underwater mortgages. And then there are all the people who won’t necessarily go into foreclosure but who have been advised not to make payments in order to qualify for a loan modification. This all adds up to millions of Americans who have gone at least one year without making a single payment. [More]

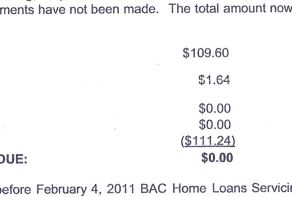

Bank Of America Threatens To Foreclose On Homeowner If He Doesn't Pay $0.00 ASAP

Oh, Bank of America… will you never cease to amuse/amaze/horrify us? Yet another computer glitch from this year’s Worst Company in America runner-up had one Massachusetts homeowner scratching his head when he received a foreclosure notice from BofA warning him that his property would end up in foreclosure if he didn’t immediately pay the amount of $0.00. [More]

Court Threatens BofA Bank Manager With Jail Over Foreclosure

A Bank of America bank manager could end up in jail if the bank doesn’t demolish a fire-damaged eyesore, a Georgia court has warned. [More]

Government May Hit Banks For $17 Billion Over Foreclosures

State attorneys general have warned the nation’s top banks that they may face as much as $17 billion in lawsuits over foreclosure practices if they don’t reach a settlement with the government. That number comes on top of billions more that the banks could owe to federal agencies including the Department of Justice. [More]

Maine Supreme Court Reverses HSBC Foreclosure On "Untrustworthy" Paperwork

Maine’s Supreme Judicial Court has overturned a foreclosure brought by HSBC against a local homeowner, citing affidavits submitted by the bank as “inherently untrustworthy.” In vacating an earlier decision, the court declared that HSBC’s records “are not of the quality that would be admissible at trial.” [More]