Help wanted: must own enough upscale furnishings to fill a large house. Applicants must be meticulously neat and able to make a house look like someone lives there, but without making it look like someone lives there. Your compensation: being able to live in a luxury home for below-market rents. [More]

housing bubble

Are Wall Street Investors Pumping Up The Next Housing Bubble?

Areas like Las Vegas, Phoenix, and Miami — all hit pretty hard by the collapse of the last housing bubble — are now seeing home prices rise at rates above the national average. But rather than this being an indicator that these areas are finally recovering, some worry that it’s just a lot of hot air being pumped into another bubble by Wall Street investors. [More]

Today’s Young Adults: Home Ownership’s Lost Generation

The housing market is stalled, and the reason why is pretty simple: young adults aren’t all that interested in buying houses. It’s not hard to see why. Americans who are currently between 25 and 34 spent their formative years watching housing prices soar, then abruptly collapse, taking the entire global economy with them. Among those Millennials who haven’t already purchased and lost an underwater home…who wants to buy a starter condo after that? [More]

Home Prices Hit Lowest Levels Since '06

If you’re waiting for home prices to start going up before you sell your house, feel free to keep waiting. As of December, house prices were still slipping, reaching their lowest levels in five years according to one index. [More]

House Prices In April Rose A Whisker From March

Although house prices continue to tumble year over year, and analysts expect prices to continue to drop as the months roll by, April marked an ever so slight nudge in the opposite direction. Previously owned single-family home prices rose 0.7 percent from March, according to the Case-Shiller index, which examined sales in 20 cities. [More]

Government May Hit Banks For $17 Billion Over Foreclosures

State attorneys general have warned the nation’s top banks that they may face as much as $17 billion in lawsuits over foreclosure practices if they don’t reach a settlement with the government. That number comes on top of billions more that the banks could owe to federal agencies including the Department of Justice. [More]

28.4% Of All Homes Are Underwater

A new report by Zillow says that 28.4% of all single-family houses in America with mortgages are underwater. No, we’re not talking about flooding in the south, but homes that owe more on their mortgage than they are worth. It’s even worse in places where the bubble was the biggest. In Tampa, FL, 59.8% of homes have negative equity and in Phoenix, AZ, it’s 68.4%. Declines in home values are still happening and Zillow doesn’t see a bottom happening until 2012, at the earliest. [More]

New Home Sales Dive To Lowest Level In Nearly 50 Years

As housing prices sank to their lowest levels since 2002 in February, the number of new houses sold took a much harder fall, dropping 16.9 percent from the previous month. [More]

House Prices Sink To Lowest Level Since 2002

House prices are dropping like game-winning Derrick Williams and-ones, reportedly now sinking in February to an average of $156,100, the lowest point since 2002. [More]

SEC May Go After Former Freddie Mac Chief

The Securities and Exchange Commission may file a civil action against former Freddie Mac chief executive as it concludes an investigation of Freddie Mac and Fannie Mae’s disclosure practices. [More]

U.S. Homes Now At Pre-Bubble Affordability Level

A new study says that housing prices in the U.S. have finally gone back to a level of affordability that we haven’t seen since before the rapid price inflation of the mid-2000s housing boom. [More]

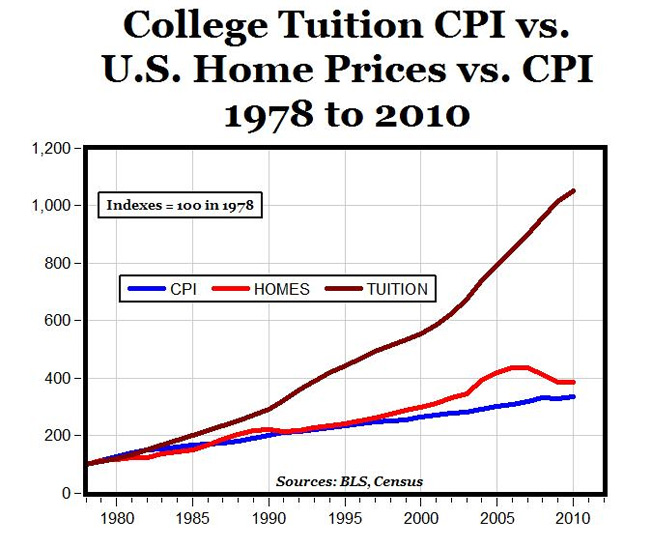

When Will The College Tuition Bubble Burst?

This is a chart from the Carpe Diem blog showing the increase in college education costs, U.S home prices, and the consumer price index. If we had a housing bubble, the skyrocketing costs of higher education is a super bubble. [More]

Government Mortgage Relief Plan May Buoy Underwater Homeowners

A new program announced by the Obama Administration today could help homeowners whose homes have declined in value by offering new government-backed loans and getting lenders to reduce the principal owed on homes whose values have fallen by at least 15%. The catch? Investors who own existing mortgages won’t be forced to participate in the new, voluntary program. [More]

Citi Promises No Foreclosures Or Evictions For One Month

About 4,000 borrowers who were either scheduled to have foreclosure sales or who were going to receive foreclosure notices will be left alone until January 17th, according to CNN. [More]

Chrysler Executive Has Fallen On Hard Times, Too

Are you struggling financially these days? You’re certainly not alone, and you even have something in common with Jim Press, one of Chrysler’s top executives. Press, hit hard by the housing market collapse and the lack of bonuses from Chrysler as the company failed, faces debts including a $800,000 unsecured personal loan and a $947,000 federal tax lien on his home.

Radioactive Chinese Drywall Is Stinking Up U.S. Homes

The government thinks radioactive industrial waste from China is responsible for a recent sulfur stench that has plagued hundreds of Florida homes. Demand for Chinese drywall spiked during the housing boom, but federal regulators believe the drywall contained phosphogypsum, a banned waste byproduct that features prominently in Chinese construction. When used in drywall, the probable carcinogen can corrode “air conditioners, mirrors, electrical outlets and even jewelry.”

What's In This New Obama Foreclosure Plan?

With the economic stimulus (or “e-stim,” as we’ve been calling it) signed into law, President Obama turns his attention to the foreclosure crisis. At an event in Arizona today, he announced the following proposals to help homeowners.