Several states and major banks are said to be close to sealing a deal that would protect banks from civil suits over sketchy mortgage practices in exchange for $25 billion that would help underwater homeowners refinance their loans. The deal could help the weak housing market. [More]

foreclosures

Escrow Company Error Lands Home In Foreclosure

When you’re buying a home, you fork over some cash to pay for title insurance to cover your butt in case there are any existing liens on the property. But what do you do when your home ends up in foreclosure because the company that’s supposed to be providing that insurance screws up royally and then tells you not to file a claim? [More]

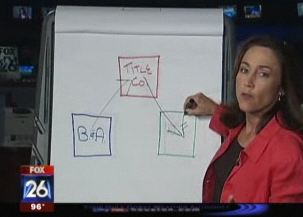

Wells Fargo Forecloses On Home Because The Title Was Never Transferred

We’ve covered a number of stories of homeowners who weren’t behind on their mortgage payments but found themselves the subject of foreclosure because someone at the bank transposed a number or didn’t pay attention to the documents they were robo-signing. But here’s one about a Houston couple who find themselves facing foreclosure from Wells Fargo, all because someone never transferred the title. [More]

Wells Fargo Ignores Homeowners Trying To Make Good On Missed Loan Payments

While it might make sense for lenders would go after homeowners who can pay their mortgage but choose not to, what about those people who missed payments because they were out of work but are now trying to make good on their debt? [More]

More Banks Going After Strategic Defaulters To Get Back Balance Of Unpaid Mortgages

Since the housing market went smash-bang-crash into a deep ravine a few years back, we’ve written numerous stories of homeowners with mortgages they couldn’t pay — and some who could pay and chose not to — who opted to walk away and let the bank sell the house at a foreclosure auction. But if these people thought that they could abandon the home and have only a damaged credit rating to show for it, there’s a chance they could be very, very wrong. [More]

Protesters Take Trash From Foreclosed House To Bank Of America Branch

Protesters chanting, “Bank of America, bad for America” tried to dump ten plump black garbage bags of trash in a BofA branch in Malden, Massachusetts. The bags contained refuse collected from the yard of a house the bank foreclosed on and let fall into disrepair, becoming a blight in the neighborhood and threatening to drag down property values. [More]

Slew Of Foreclosed Homes To Hit The Market In Early 2012

Last year, several of the country’s largest mortgage servicers — Bank of America, GMAC/Ally, JPMorgan Chase, among others — were forced to hit the pause button on foreclosure procedures after it was revealed that many foreclosure documents were being rubber stamped by untrained, ill-informed “robo-signers.” This delay caused a bottleneck of foreclosure-worthy properties waiting to be reviewed. But now it looks like those homes are starting to trickle out into what could be a flood in early 2012. [More]

With Only $37,000 Left On Mortgage, House Gets Foreclosed

They only had $37,000 left to go on their mortgage they’d been paying off for 25 years, but now a California family’s house is going into foreclosure. [More]

Irene Knocked My Neighbor's Tree On My Deck, But He's Run Away From His Foreclosure

Irene blew a listing tree onto Brian’s property from his neighbor’s yard, smashing both his deck and fence. A seeming wrinkle is that his neighbor has long ago skipped town, leaving behind his foreclosed house with its drowsy trees untended. Brian wants to know how he can track the guy down, private eye style, and get reimbursed for the tree removal. [More]

County Tells Foreclosed-Upon Homeowners: We May Have Some Money For You

The typical image of a foreclosure auction involves a seized house being sold for, at best, the remaining value of the mortgage. But that’s not always so, with some auctions attracting buyers who pay above what’s owed on the home. That money usually belongs to the former owner, but it looks like many aren’t aware of this fact. [More]

Man Pays Bank Of America Mortgage On Time, Still Ends Up In Foreclosure & Has Credit Ruined

Ever since the housing bubble burst, we’ve run a number of stories about homeowners who had been told the only way they could qualify for a loan modification was to stop paying their mortgage for a few months, only to end up in foreclosure because the lender had no record of a modification application. This is not one of those stories, though the ending is the same. [More]

Number Of Delinquent Mortgages Sneaks Back Up

After several quarters of decreasing mortgage delinquency rates, that number saw a slight uptick in the second quarter of 2011, according to the Mortgage Bankers Association’s latest survey data. [More]

Chase, Bank Of America, Citi & Wells Fargo Allowed To Start Foreclosing Again In New Jersey

It’s been a quiet 2011 on the foreclosure front in New Jersey, as several banks froze seizure proceedings late last year following the revelation that foreclosure documents were being rubber-stamped by untrained “robo signers.” But a judge in the Garden State has given the go-ahead for Bank of America, JPMorgan Chase, Citigroup and Wells Fargo to resume uncontested foreclosures. [More]

Bank Of America Customer Gathers 10,000 Signatures In Attempt To Save Home & Business

After 18 months of trying to get a loan modification from Bank of America, the owner of a Seattle-area property that includes both her nursery business and her home, decided to get a little help from 10,000 of her friends, hoping that a hefty petition would help convince BofA to modify the mortgage. [More]

"Foreclosure Factory" Draws Critics

It’s a one-stop foreclosure shop. Under one roof is a law office, title company, and auction house. They act as their own notaries and can foreclose. Its owner and several of his top attorneys are even VPs at the Mortgage Electronic Registration Systems Inc (MERS) which gives them the ability to transfer mortgages from owner to the other. The Boston Globe profiles a local law firm that has attracted criticism from homeowners and consumer advocates for its vertically integrated approach to foreclosure that can speedily ride over homeowners who thought they were in the middle of working out a deal with the bank. [More]

Bank Tries To Foreclose On Gas Station Owner For Being One Day Late With Mortgage Payment

A gas station owner in Florida’s monthly mortgage payment bounced on October 12th. The next day he put the money required into the bank account. In November and December he tried to make his mortgage payments as normal, but BB&T wouldn’t take his money. 10 months later, they still won’t take it. Instead, they want to foreclose on his gas station. All for being one day late. [More]

BofA Bulldozing Foreclosed Homes

Now here’s one to reduce the oversupply in the housing market. As the reluctant owners of vast amounts of foreclosed and abandoned houses it can’t sell, Bank of America is going to start bulldozing patches of them. [More]