Whether it was due to theft, fraud, forgetfulness, or calamity, many of us have needed to replace our debit cards post-haste. For many JPMorgan Chase customers, that usually just meant popping by the neighborhood branch and getting a replacement in minutes. So why has the bank reportedly ditched this convenient and popular program? [More]

jpmorgan chase

JPMorgan Chase To Pay $264M To Settle Corruption Allegations For Hiring Friends, Family Of Government Officials

Over a period of seven years, JPMorgan Chase hired or gave internships to around 200 individuals, not because they were the best people for their positions (they often weren’t), but at the request of foreign government officials and clients. That practice, alleged U.S. regulators, was a violation of federal law. Now Chase has agreed to pay a total of more than $264 million to settle these allegations of nepotism-gone-too-far. [More]

Report: Chase CEO Jamie Dimon Says No To Being Trump’s Treasury Secretary

Last week, rumors circulated that Jamie Dimon, the JPMorgan Chase CEO whom President-elect Donald Trump had once called the “worst banker in the United States,” was being considered by the incoming Trump administration for the position of Secretary of the Treasury. However, a new report claims that Dimon has formally passed on the offer. [More]

Reports: Trump Considering Chase CEO He Once Dubbed “Worst Banker In U.S.” To Head Treasury

President-elect Donald Trump and his transition team are now in the process of selecting cabinet members and other top officials that will run many federal agencies under the direction of the White House. According to new reports, one of the names under consideration for Treasury Secretary is banker who Trump has slammed publicly in the past. [More]

Goldman Sachs To Pay $5B To Settle Charges Of Selling Troubled Mortgages Ahead Of The Financial Crisis

Federal and state prosecutors are closing yet another chapter in its investigation related to banks’ roles in the financial crisis. To that end, Goldman Sachs has agreed to pay $5.06 billion to settle claims it misled mortgage bond investors during the period leading up to the crisis. [More]

JPMorgan Chase Fined $48 Million For Failing To Comply With Robosigning Settlement

Years after being hit with billions in penalties, and after being told by federal regulators to stop screwing up the foreclosure and mortgage adjustment process by providing borrowers and courts with inaccurate and unchecked information, some banks continue to pay for the fact that they didn’t quite learn their lesson. [More]

JPMorgan Chase To Pay $367 Million For Secretly Steering Clients To Investments That Benefited Bank

When you pay a bank’s investment adviser to help you put your money in a smart place, you would hope that they would steer you to a product that best serves your interest. You’d also hope that if an investment product benefited the bank, this information would be clearly disclosed. But that’s not always the case, which is why JPMorgan Chase has to pay penalties totaling $367 million. [More]

Xerox’s Federal Student Loan Servicing Under Investigation Over Inaccuracies, Overcharges

When you think of Xerox, photos of large, office printers is likely the first thing to come to mind. But it turns out the company also dabbles in the education business. And it’s that venture that federal investigators are probing after discovering nearly a decade of errors. [More]

JPMorgan To Pay $100M To Settle Unlawful Debt-Collection Allegations In California

Four months after JPMorgan Chase agreed to pay at least $136 million to close the books on state and federal investigations into its credit card collections practices, the company reached a $100 million settlement putting an end to a similar investigation in California. [More]

Why Lower Gas Prices Are Really Good For Restaurants

When gasoline prices fall, that means that consumers who drive have more money to spend on things other than fuel. The JPMorgan Chase Institute, a global economics think tank affiliated with the bank, analyzed their customer credit and debit card data to figure out what we did with all of those savings. It may not surprise you that most of it didn’t go into our retirement accounts. [More]

Starbucks, 17 Other Companies Partner To Provide “Opportunity Youth” With Jobs, Internships

Teaching young adults responsibility — and showing them that responsibility can have financial benefits — pays off in the long run by cultivating a solid work ethic. That’s the thinking behind a new multi-company initiative spearheaded by Starbucks. [More]

Chase Credit Card Settlement Halts Collections On 528,000 Accounts

Earlier today, we told you of reports that JPMorgan Chase had agreed to pay at least $125 million to close the books on state and federal investigations into its credit card collections practices. Now that the details of the deal have been made public, we know exactly how much the bank will pay and how many credit card accounts are affected. [More]

![JPMorgan Chase To Pay $136M To Close Credit Card Debt Collection Probes [UPDATED]](../../consumermediallc.files.wordpress.com/2014/09/chasecard.png)

JPMorgan Chase To Pay $136M To Close Credit Card Debt Collection Probes [UPDATED]

UPDATE: The Consumer Financial Protection Bureau has released the details of the settlement, which put the total value at $136 million, $106 million of which will go to the 47 states (and Washington, D.C.) involved in the investigations. [More]

Four Years After Reaching Deal With Regulators, Six Banks Still Haven’t Fixed Foreclosure Problems

Back in 2011, several of the nation’s largest banks entered into a settlement with federal regulators that required the institutions to correct widespread foreclosure abuses that helped to trigger the housing crisis. While the agreement was revised in 2013 to make things a bit easier for the offending banks, regulators today announced that six of the lenders – including JPMorgan Chase and Wells Fargo – still haven’t met requirements and face new restrictions on their mortgage operations. [More]

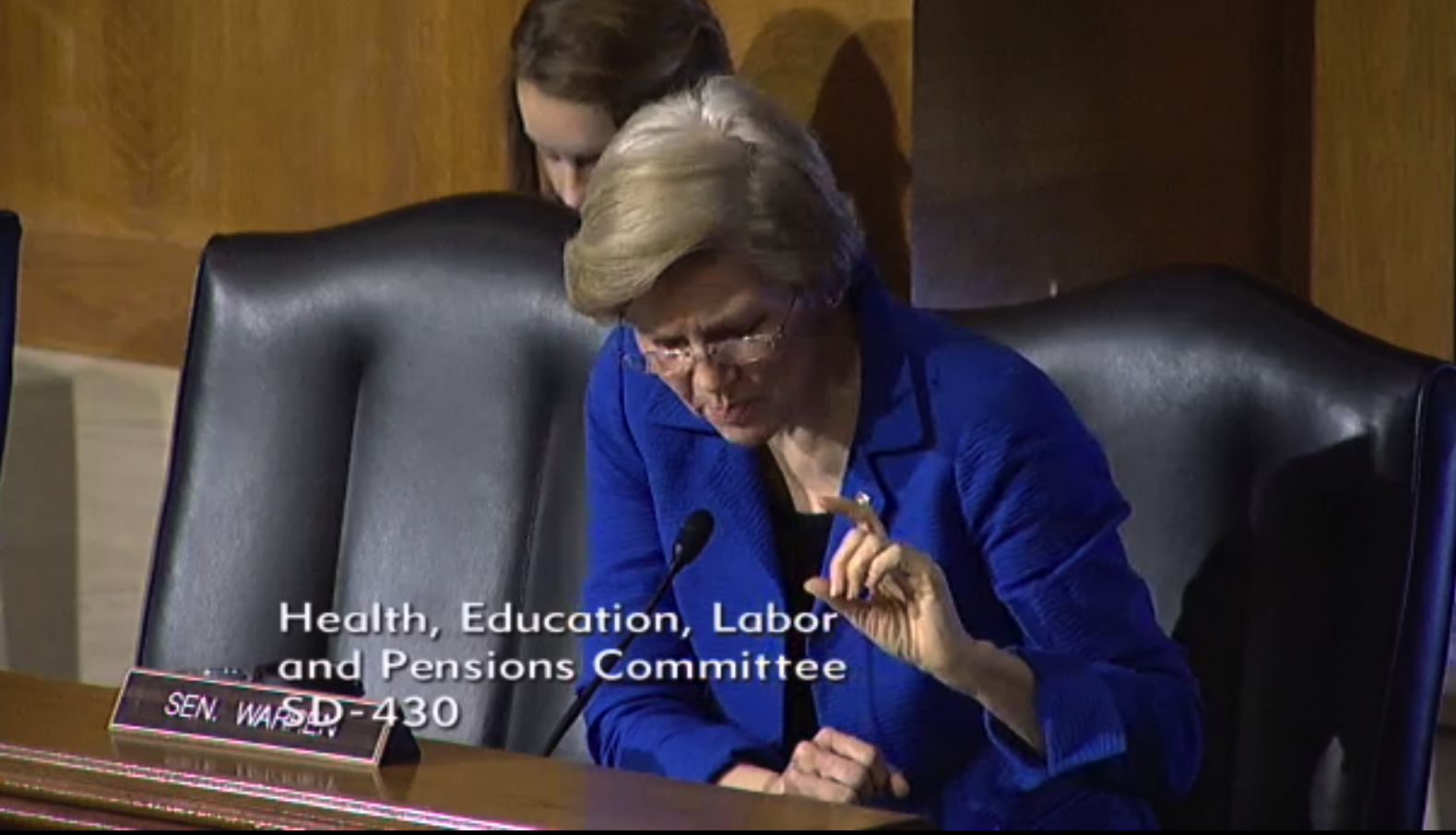

Sen. Elizabeth Warren Has Some Choice Words For Chase CEO Jamie Dimon

Earlier this week, JPMorgan Chase CEO Jamie “It sounds like Diamond” Dimon, was quoted as saying that Sen. Elizabeth Warren, an outspoken advocate of financial reform who helped create the Consumer Financial Protection Bureau before becoming a lawmaker, was clueless about how banks actually work. The Massachusetts senator says that Mr. Dimon doth protest too much. [More]