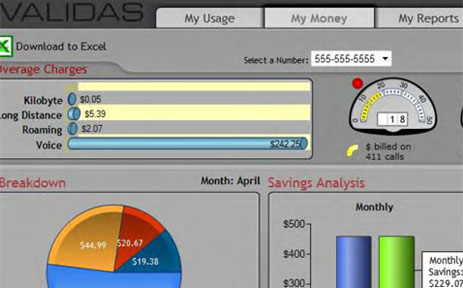

Validas is a new service that aims to help consumers save on their cellphone bills by analyzing their cellphone bills and providing suggestions about how they could adjust their plans and save money. To use it, you create an account, validate your email address, download your cellphone bill from your cell provider’s website, upload it to Validas for processing, then wait a few seconds for your report.

personal finance

../../../..//2007/10/09/dont-withhold-more-taxes-than/

Don’t withhold more taxes than necessary, you could be missing out on valuable interest earnings. [Kiplinger]

What's The One Thing You Hate To Spend Money On?

WiseBread asks an interesting question this week: what’s your frugal obsession? You know, that one thing you can’t stand spending money on: “Some people refuse to pay for bottled water; others refuse to shell out $4 to rent a movie when they can get them from the library for free.” Responses so far include software, soft drinks at restaurants, and gift wrap.

Find Out Your Nest Egg Score

A.G. Edwards has a short online quiz that determines your “nest egg score” based on criteria like how long before you plan to retire, how aggressively you invest, and where you live. It’s not meant to provide an in-depth portfolio review, just a quick sketch of where you stand—you’ll get a score very similar to a credit score, along with a comparative national average and a list of tips on how to improve your score.

Feeling Poor? Get Rid Of Clutter

If your empty wallet makes you feel the same, one way to boost your spirits is to get rid of crap around your house you don’t need, writes Debt-Proof Living.

2. CURB THE CLUTTER. I don’t care how clean your house may be, if you have clutter it’s pulling you down. Clear your closets, drawers, cupboards, garage and counters of everything that you do not need or brings beauty to your life. Clean open spaces, tranquility and simplicity chase away feelings of poverty. Clutter invites chaos which leads to depression and feelings of deprivation.

Toss it, garage sale it, give it away, burn it. Unnecessary objects steal energy and attention. Freeing up physical space frees up psychic space and boosts your mood, maybe even giving you enough energy to tackle a project that will more directly impact your bottom line, like figuring out a way to make more money, or reducing expenses.

../../../..//2007/10/05/the-recent-shutdown-of-netbank/

The recent shutdown of NetBank is a good opportunity to review what happens when a FDIC insured bank closes and gets taken over by another bank. Basically, you’re safe, as long as your deposits didn’t exceed $100,000. [Kiplinger]

The Non-Fancy Way To Buy A House

With all the talk about people finding out their no-money-down, interest-only, and option-ARM mortgages weren’t such a great deal, it’s refreshing to hear these pieces of advice about the fiscally conservative way to buy a house, via Moneycrashers:

6 Signs You've Got Too Much Credit Card Debt

Swiping the plastic so much your credit cards have skid marks? Via Kiplinger, here’s six warning signs to watch out for that might indicate you’re abusing your credit cards.

Money Lessons For Your Kids

If you have kids and aren’t teaching them about money, you’re setting them up to be one of those clueless college kids with a free burrito and $12,000 in credit card debt. Don’t do it!

Verify Funky Online Banks

So you just found some awesome interest rate at an online bank. Only problem is, you’ve never heard of the place before. How do you know if your money is secure?

Mint.com Initial Review

Mint.com, a new free personal finance management site, is easy to get started, though we’re not sure we’re completely satisfied with where we end up.

../../../..//2007/09/28/buoyed-by-the-fed-rate/

Buoyed by the Fed rate cut and hope for another, indexes near July’s record levels. [NYT]

Personal Finance Roundup

Getting taken for a ride: Airline fees [CNN Money] “Plans often change and flights must be rescheduled, but airline penalties can be harsh.”

Use Quicken To Fully Grasp The Scope Of Your Comic Book Addiction

J.D. over at Get Rich Slowly really likes comic books.

8 Personal Finance Lessons Learned From Monopoly

Remember those cold winter nights when your family stayed up late and fought to bankrupt each other? Recall the number of times you cheered a little metal dog (or hat or thimble) to move around a square board quickly? Recollect regularly screaming “come on seven!” only to roll a six? Who knew that all that time you were really learning about personal finance? Well, Blueprint for Financial Prosperity now knows this was the case. He’s detailed eight personal finance lessons he learned from Monopoly.

HSBC Direct Cuts Rates To 4.5%

We checked HSBC Direct’s front page daily after the Fed interest rate cut, in fear that our fave online saving account would also cut its high 5.05% interest rate. We chuckled as complaints rolled in about people’s various money market accounts getting their rates trimmed. After we were lulled into a false sense of security and stopped checking, a reader pointed out that HSBC has slashing the rate to 4.5%. Noooooooooooo…