“I love new clothes. However, I like getting rid of the clothes just as quickly to go buy new ones.”

personal finance

4 Online Budgeting Services Reviewed

SmartMoney reviews four of the most popular, or at least best-publicized, online budgeting and finance-tracking services: Clear Checkbook, Mint, Wesabe, and Yodlee Money Center. They’ve created a simple chart comparing features, to help you decide which best meets your needs—for instance, whether you want text message alerts, or the ability to manually enter transactions, and so on. The most robust offering of the four is Clear Checkbook, although it’s missing a couple of nice features that the otherwise paltry Mint offers (specifically, text message alerts and merchant-based spending breakdowns).

The Best Credit Cards Ever

The annual Kiplinger’s “Best Of” guide is out and here’s their picks for best credit cards. Best…

7 Things You Need To Know About Health Savings Accounts

As health care costs continue to soar (medical insurance premiums alone are expected to rise an average of 8.7 percent this year), Americans continue to look for ways to afford medical insurance and to pay the increasing costs of medical treatment.

Is Your Credit Card Rate Higher Than Average? Switch!

Here are the national averages for credit card interest rates, according to Bankrate. How does yours compare?

Verify Extra Payments Are Applied To Your Principal

The Chief Family Officer blog outlined her strategy for paying off student loans faster.

Make Sure You Know What You're Doing Before You Invest In Gold

A lot of financial advisors have suggested investing in gold lately, since the U.S. economy seems headed for the crapper and gold tends to increase in value as the dollar plummets. And a lot of people seem to be following that advice, because gold is up above $750 an ounce now, “its highest level since 1980,” says SmartMoney. But gold investments can change value quickly and can be even more difficult to predict than regular investments, so don’t go all Scrooge McDuck on the gold hoarding.

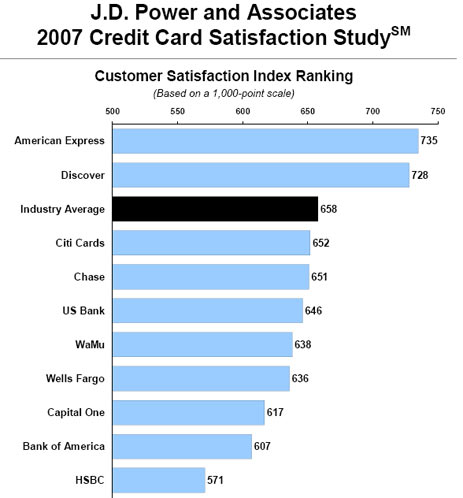

American Express Customers Are Most Satisfied, HSBC, Least

American Express ranks highest in customer satisfaction in the J.D. Power and Associates 2007 Credit Card Satisfaction Study. They said there’s two types of customers. One is transactors, who pay their bill off in full each month and for whom membership benefits are the most important drivers of customer satisfaction. The other is revolvers, who don’t pay their bill off in full each month, and for whom APR and fees are the most important drivers of customer satisfaction. So if we flip this survey over….

Credit Cards Encourage Spending More

A 2001 MIT study published in Marketing Letters found:

In studies involving genuine transactions of potentially high value we show that willingness-to-pay can be increased when customers are instructed to use a credit card rather than cash. The effect may be large (up to 100%) and it appears unlikely that it arises due solely to liquidity constraints.

No wonder Dave Ramsey encourages people trying to get out of debt to cut up their credit cards.

Citing "Market Conditions" Capital One Raises Reader's APR 4.99% to 13.5%.

I have had a Capital One Mastercard for about 10 years. My interest rate has been 4.99% for as long as I can remember. I received my statement for October to find that my interest rate had jumped from 4.99% to 13.5%.

Take Action On Money Tips You Read Online

David over at MoneyNing urges us to all take action on the money tips we read online—not just read them and then forget them, or dismiss them as unrealistic, or tell ourselves they don’t apply to us. “We read the tips, agree that it makes so much sense, then we sit there and flip on TV to watch other people make money while we spend money watching them.”

Save Money On Coffee With A Home Espresso Maker

CNN Money takes a different approach, suggesting fine coffee lovers consider buying a home espresso maker.

Virgin Money USA Helps Americans Lend To Family & Friends

VirginMoneyUSA, which launches today, is a lending service designed to manage personal loans between friends and family, by taking care of documentation, repayment schedules, and reminders. At first glance, the service sounds like an intrusive middle-man; however, anyone who’s ever been on either side of a personal loan knows how delicate the situation can be, so we can understand the appeal of putting some distance between the personal relationship and the fiscal one.

Budgeting Tip: Use What You Buy

A columnist at Get Rich Slowly describes how her family learned to focus on getting the most use out of the things they purchase, rather than using them once or twice and then moving on to the next new thing. While it sounds like an obvious tip, it can be a little harder to practice in real life—but, she writes, the results can be eye-opening.

Widow Loses Credit History Along With Husband

Widows finds that she’s lost more than just a husband, she’s also lost decades worth of credit history, as creditors are unwilling or unable to transfer the joint accounts into her name. Takeaway: married couples, make sure your credit history is correct and listed under your individual name. Free credit report copies available at annualcreditreport.com.

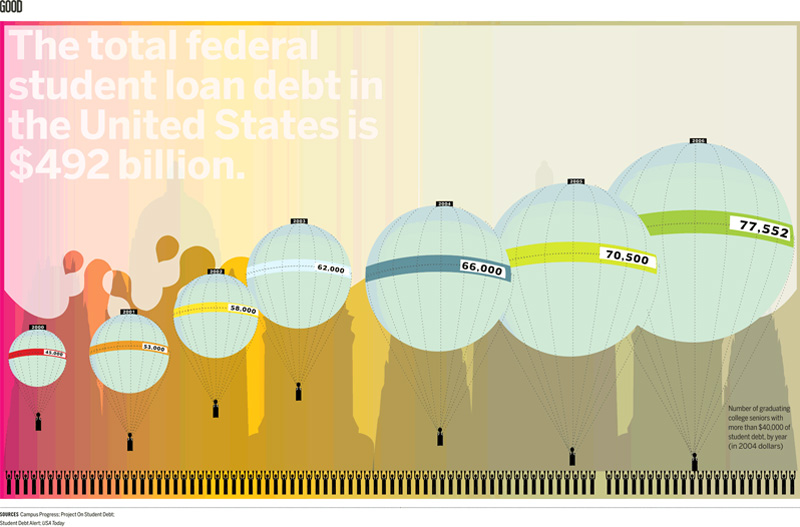

77,552 Of Graduating College Seniors Have $40,000+ In Student Debt

This graph from GOOD and FutureFarmers shows the number of graduating seniors with more than 40,000 in student debt by 2004.