There are no shortage of surveys and studies that have found consumers aren’t doing so great with their finances: from 45% of Americans carrying at least $25,000 in debt to one-in-four families failing to seek medical attention because of financial worries. Now, another survey — this time from the Consumer Financial Protection Bureau — found that more than 40% of adults struggle to make ends meet. [More]

finances

Gap Closing 200 Banana Republic, Gap Stores; Opening 270 Old Navy, Athleta Locations

It’s out with the old — or underperforming — and in with the new at Gap. In a bid to turn around sales and get people into stores, the mall staple says it will close about 200 Banana Republic and Gap locations, while opening 270 Old Navy and Athleta stores over the next three years. [More]

Surprise Charges: Feds Advise Retailers To Make “No Interest” Store Credit Offers More Transparent

Three years ago, the Consumer Financial Protection Bureau warned consumers that some credit card companies weren’t clearly disclosing the risks of promotions, including deferred-interest offers that promise not to charge interest on purchases as long as the balance is paid off by a certain date. However, if that doesn’t happen customers can find their bill nearly doubled thanks to retroactive interest charges. Now the agency is setting its sights on retailers, urging them consider more transparent promotions for store-branded credit cards. [More]

Wells Fargo Takes Back Another $75M From Former CEO & Exec Blamed For Fake Accounts

The Wells Fargo board of directors has completed its investigation into the bank’s fake account fiasco, which saw Wells employees open more than two million bogus accounts in customers’ names. For their failure to curb this bad behavior, “retired” CEO John Stumpf and former head of retail banking Carrie Tolstedt have had an additional $75 million in compensation clawed back.

[More]

Lawmakers Introduce Legislation That Would Abolish The CFPB

The future of the Consumer Financial Protection Bureau continues to remain in question with yet another attack being lobbed at the Bureau this week as lawmakers introduced new legislation both in the House and Senate that would abolish the agency. [More]

Are Cardless ATMs Safe? $3,000 Goes Missing From Man’s Chase Account

Last year, Chase began installing cardless ATMs that allowed users to withdraw cash and perform other tasks by inputting a code sent to their banking app at the machine. While the system can be convenient and might relieve some of the worry of using ATMs compromised with a skimmer, the new machines pose other threats as one man learned when $3,000 disappeared from his account. [More]

Illegal Debt Collectors Prey On Victims’ Doubts To Collect Money They Don’t Owe

For years, Consumerist has written about unscrupulous debt collectors that have attempted — sometimes successfully — to collect thousands of dollars from consumers who don’t actually owe a debt. This type of scheme is apparently alive and well in Illinois, where investigators say the ploy is one of the most popular for alleged con artists preying on residents, prompting the state’s Attorney General to file suit against at least one such operation. [More]

Unregulated Preparers, Lack Of Disclosures & Costly Financial Products Put Your Tax Refund At Risk

Each year during tax time millions of consumers put their financial future in the hands of strangers, trusting that these tax preparers — who are largely unregulated — know the rules, will get them the best possible result (hopefully a refund), and won’t sell them on a product that costs more than it’s worth. But in the world of complicated tax codes and credits, consumers continue to face a long list of risks, including untrained preparers, undisclosed fees, and dangerous refund anticipation products. [More]

CFPB Launches Monthly Reports To Showcase Financial Difficulties In Specific Areas Of The U.S.

Have you ever wondered if people on the other side of the country run into the same difficulties dealing with financial institutions as you do? Well, wonder no more, as the Consumer Financial Protection Bureau announced today that it will provide a peek into the overall state of consumer complaints in the U.S. and how individuals in certain areas deal with companies providing financial products and services through a new monthly series. First up: Milwaukee, WI, and debt collection. [More]

CFPB Releases Educational Guides To Help Non-English Speakers Avoid Scams, Understand Financial Issues

Understanding the world of finance can be difficult for just about anyone in this country, but especially so when the rules of the industry are written in a language that you might not be proficient in. For these consumers, the Consumer Financial Protection Bureau has created a new set of guides aimed at helping them avoid financial devastation. [More]

New York Regulator Finalizes First-Of-Its-Kind Plan To Govern Virtual Currency With “BitLicense”

Nearly a year after the New York Department of Financial Services took steps to regulate businesses that operate in virtual currency, the Department announced the finalization of the “BitLicense” plan, making it the first set of guidelines for the use of cybercurrency. [More]

CFPB Launches Financial Coaching Program For Transitioning Servicemembers, Financially Underserved

The first step in living a fiscally responsible life is to understand what financial products are available and how they fit into your goals. Or at least that’s the idea behind the Consumer Financial Protection Bureau’s recently launched Financial Coaching Initiative that aims to assist certain groups of consumers become financially independent and knowledgeable. [More]

California Suspends GI Bill Eligibility For ITT Tech

Thousands of California students planning to use veterans benefits to enroll at ITT Technical Institute campuses will need to find other means of financing their education after the state’s Department of Veterans Affairs suspended ITT Educational Services’ eligibility for GI Bill funding. [More]

CFPB Launches Effort To Bring Financial Education To Schools

While it’s never too late to become financially literate, it certainly helps if you start early. That’s why the Consumer Financial Protection Bureau is launching a national effort to improve financial education in schools.

American Apparel Founder Dov Charney Under Investigation By SEC

Any hope founder of American Apparel Dov Charney had of returning to the company may have gone out the window this week, after it was revealed that the Securities and Exchange Commission opened an inquiry into the circumstances leading to his departure. [More]

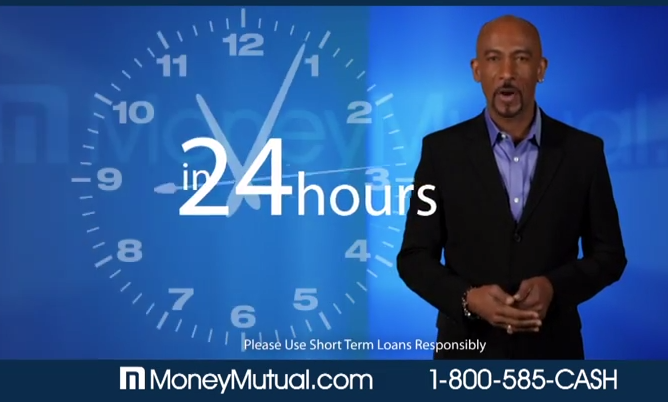

Montel Williams Defends Hawking Payday Loan Generator Money Mutual

By now we know that celebrities (and pseudo-celebrities) often lend their names to products that may or may not have devastating effects on consumers. Of course, hawking a product for a paycheck doesn’t automatically make the spokesperson in question an expert on the product or the consequences of using it. [More]

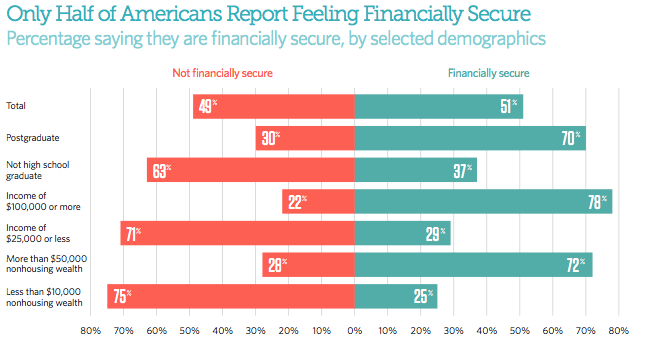

Report: Americans Are Optimistic About Their Finances But Few Actually Feel Secure

Americans’ positive feelings about the economy have officially returned to the level they were at on the eve of the Great Recession, according to a new study from Pew Charitable Trusts. While that might sound comforting, it doesn’t mean consumers are actually feeling secure in their own financial stability. [More]