Each year, banking customers spend an estimated $32 billion on overdraft fees. While many banks have modified their policies regarding the costly fees, recent reports found those changes aren’t enough to protect most consumers. Now, in an effort to add to those protections, one lawmaker is pressing banks for more information on their policies. [More]

overdraft protection

As Fewer People Overdraft, Banks Are Raising Overdraft Fees

If you’re still opted-in to overdraft “protection” — which protects you by slapping huge fees on every purchase you make beyond the available funds in your account — you should probably opt out, as the costs associated with this lucrative system are on the rise. [More]

Bank Of America’s New Debit Card Charges $5/Month For Something That Is Free On All Accounts

Bank of America is in the news because it’s testing a new debit card that won’t let customers overdraft. For that privilege, cardholders will pay a $4.95/month fee and they won’t be able to write paper checks. Thing is, anyone with a bank account can turn off overdraft protection without being required to pay a fee. [More]

CFPB: Bank Customers Leaking $225 In Overdraft Fees Per Year On Average

Why is your bank account leaking so much money ever year? Where does it all go? Checking account customers are bleeding funds to the tune of about $225 per year on average, the Consumer Financial Protection Bureau says in a new study. That means that despite regulations aimed at lessening the effects of overdraft fees and clear up the whole process. [More]

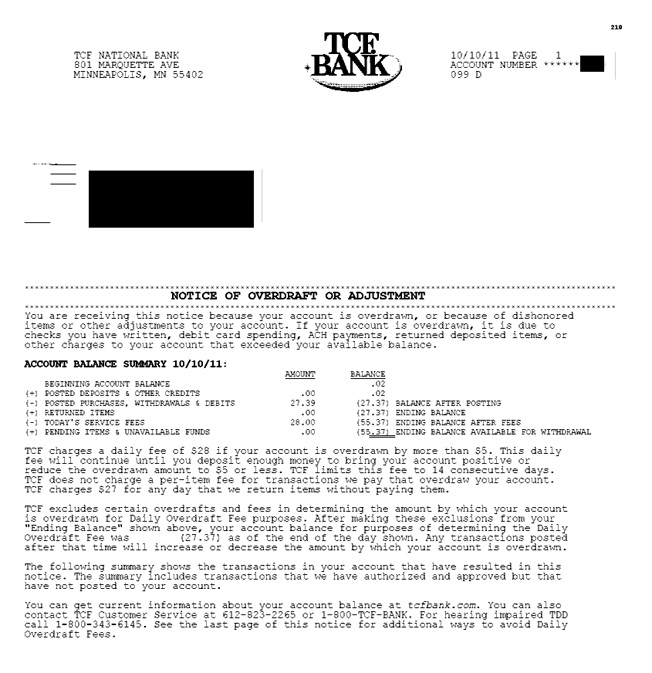

TCF Bank Adds New $28 Daily Overdrawn Balance Fee

Reader Jeff used to intentionally overdraw his bank account in order to have enough money to feed his family and gas the car. At $35 a pop, that’s a pretty cheap loan. But now that’s not going to be a viable option because TCF Bank has started to assess him a daily fee of $28 if his account is overdrawn by $5 or more. [More]

Opt In To Overdraft Protection Right At The ATM

ATMs exist for routine banking transactions…deposits, withdrawals, balance inquiries, opting out of overdraft protection. Wait, what? GitEmSteveDave noticed, but didn’t test, this option on a Sovereign Bank ATM. “I wonder how many people hit the button by accident and end up giving their rights up,” he writes. Convenient, or dangerous? [More]

Chase Just Goes Ahead And Adds Overdraft Protection To Your Account

Lori called up Chase to tell them that she was traveling internationally in the next few weeks. She wanted them to note her account so there wouldn’t be any blocks when charges from far-away countries started appearing. Then the fast-talking rep just sort of added overdraft protection to Lori’s account, just casually worked it in there, like she was doing her a courtesy. [More]

BofA Customers, Watch Out For Overdraft Protection Auto-Enrolling

Will was meticulous about avoiding the succubus that is overdraft protection in his Bank of America checking account. So you can imagine what happened to him: The bank automatically stuck him with the so-called protection thanks to an automatic function that stuck him with a $100 credit card cash advance, along with the accompanying finance charges. [More]

Remember: Checks Can Still Overdraft

Just remember, even though starting this week banks can’t charge you overdrafts unless you opted into their overdraft program, they can still authorize overdrafted checks, ATM withdrawals, and automatic bill payments at their discretion and charge you a fee for it. [More]

Look Out For These Fees As Bank Legislation Goes Into Full Effect

This is the first business day financial institutions have been required to give existing checking account customers the choice to opt in to overdraft protection. Since banks are looking for ways to make up for the lost revenue by sticking it to customers in other ways, they’ve dreamed up some new ways to trick you out of your money. [More]

Branch Manager Quits Rather Than Trick Bank Customers Into Signing Up For Overdrafts

The bank branch manager who felt uncomfortable that his bank was making him choose between misleading customers into signing up for overdraft protection and keeping his job has decided to quit. [More]

When It Comes To Overdraft Opt-In, Chase Won't Take No For An Answer

According to Robert, Chase is taking the Steve Urkel approach to persuasion, asking him again and again if he would like to partake in its delicious overdraft protection, brushing off his continuous “no” answers as Steve always did to Laura in Family Matters. [More]

Get Customers To Sign Up For Overdraft Fees Or Get Fired

One of our readers is a bank teller branch manager and he feels queasy. His bank is making him trick customers into signing back up for overdraft fees, and if he doesn’t, he’ll get fired. [More]

Chase Now Has Human ATM Greeter Who Helpfully Sells Overdraft Protection

As the August 15th deadline for bank customers to opt in to overdraft protection on their existing accounts looms, banks are trying some innovative new tactics. Nicole tells Consumerist that she visited an ATM Chase branch on a Saturday morning to withdraw some cash, and encountered an employee stationed near the ATMs, asking customers whether they had “made a decision” about their “debit card overdraft coverage.” [More]

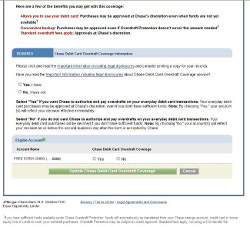

Is Chase's Overdraft Fee "Opt-In" Purposefully Confusing?

Reader Victor, a former WaMu customer who wasn’t exactly pleased to end up with Chase, thinks the bank’s Federal Reserve mandated on-line overdraft fee “opt-in” form is purposefully confusing. He’s sent a screenshot so you can take a look for yourself. [More]

Consent-Only Overdraft Protection: Maybe Not So Great

Starting on July 1st, the Federal Reserve has required banks to get consent from customers before enrolling them in overdraft protection programs so they can experience the excitement of cascading overdrafts. The problem is that consumers may be trading overdraft fees for insufficient funds fees and good old-fashioned bounced checks…and end up worse off in the long run. [More]