The retail industry has already politely asked Congress to please not roll back financial reforms involving debit card transactions, but as lawmakers on Capitol Hill inch closer to undoing these protections, retailers are once again voicing their concerns that undoing the 2010 law will lead to higher prices and hurt small businesses. [More]

financial reform

Bank-Backed Congressman Introducing Law To Gut Consumer Financial Protections

Less than a week after President Trump signed a mostly symbolic executive order directing federal regulators to revise the rules established by the 2010 financial reforms, one lawmaker (whose campaign just happens to have been heavily financed by big banks) is planning to introduce legislation to scale back consumer protections and allow banks to take more risks. [More]

Chase Drops Plan For $3 Debit Card Fee

Chase joins U.S. Bancorp, Citigroup, PNC, KeyCorp and other large banks that have recently moved away from the plan to charge consumers a monthly fee when they use their debit cards to make purchases, reports the Wall Street Journal. The bank recently tested the fee in both Washington and Georgia. [More]

Poll: Overwhelming Majority Of Voters Want A Strong, Undiluted CFPB

While Republicans in the Congress and Senate continue to grouse about the structure of the newborn Consumer Financial Protection Bureau, a new poll indicates that those politicians’ actions may not be a reflection of their constituents’ desires. [More]

House Committee Battles Elizabeth Warren Over Consumer Protection Bureau

At a hearing held by the House Committee on Oversight and Government Reform today, the committee’s GOP leadership debated Elizabeth Warren, the White House’s pick to run the new Consumer Financial Protection Bureau. As the committee argued that new regulations are required to keep the watchdog agency from having “unchecked discretion” over financial matters, Warren responded that such efforts serve to “undermine the consumer bureau before it even begins its work of protecting American families.” [More]

More New Debit Card Fees Loom

Banks are making less money when you swipe your credit and debit cards because of new caps on interchange rates, the fee that they charge to process each of these transactions, that go into effect on July 1st. They have to make the money up somehow! We’ve seen new fee-incurring tripwires on checking accounts, and now they’re dreaming up even more fees for debit cards. Here’s what’s on their wishlist: [More]

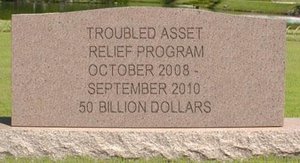

Geithner: TARP Will Cost Taxpayers Under $50 Billion

As the Troubled Asset Relief Program winds down, post-mortems for the program are rolling in. According to Treasury Secretary Timothy Geithner, the bailout effort — which was launched by former President George W. Bush in 2008 and officially ended last month — will end up costing taxpayers a mere $50 billion, rather than the $350 billion that the Congressional Budget Office pegged it at last year. [More]

Branch Manager Quits Rather Than Trick Bank Customers Into Signing Up For Overdrafts

The bank branch manager who felt uncomfortable that his bank was making him choose between misleading customers into signing up for overdraft protection and keeping his job has decided to quit. [More]

Get Customers To Sign Up For Overdraft Fees Or Get Fired

One of our readers is a bank teller branch manager and he feels queasy. His bank is making him trick customers into signing back up for overdraft fees, and if he doesn’t, he’ll get fired. [More]

Consumer Protection Bureau May Halt "Abusive" Financial Ads

The soon-to-be-created Consumer Financial Protection Bureau has at least some Wall Street insiders worried. No, not the bank bigwigs or hedge fund managers. The latest hand-wringing comes from the advertising community, which worries that the new agency may create “overly cumbersome, cost-prohibitive and possibly even onerous requirements” for financial ads. [More]

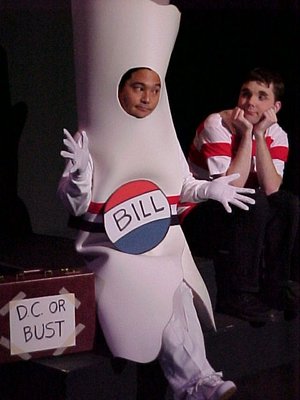

House Of Representatives Says "Okay" To Financial Reform

It doesn’t look like it’s going to make President Obama’s July 4 deadline, but the financial reform bill did manage to squeak through the House of Representatives on Wednesday with a final vote of 237-192. [More]

Financial Reform Bill Oks Minimum, Maximum Credit Charges

The financial reform compromise may keep our financial system from reprising Chernobyl anytime soon, but it will also change the way consumers use their credit cards. Merchants will soon be allowed to refuse plastic for purchases of less than $10, a rate the Fed can boost as they see fit. Both the Fed and universities will also gain the power to set maximum credit charges. That means no more free flights to Europe after charging your kid’s tuition to your rewards card. The changes will go into effect the day after the compromise is signed into law. [More]

So, What's In The Financial Reform Bill?

Our leaders were up late hashing out a version of the new financial reform bill and yes, apparently they have come to some agreement. But what’s in there? [More]

New Rules To Cap Credit Card Late Fees At $25

New rules announced today will take some of the sting out of those penalties that hit you when you don’t pay your credit card bill on time. Most fees will be capped at $25, regardless of your balance, and can be much lower in some cases. If your minimum payment is $10 and you’re late, your late fee can’t go above $10. [More]

Elizabeth Warren Wants To End Exploding Mortgages

Why does financial-reform advocate, Harvard professor and overall force of nature Elizabeth Warren want a Consumer Financial Reform Agency? It’s simple: “We stopped exploding toasters. We’re going to do the same with exploding mortgages and crazy credit cards.” [More]

What Does Congress Want From A Consumer Financial Protection Agency?

If you have a lot of time on your hands, you could probably read through the House and Senate versions of the financial reform bills, and get some idea of how each one addresses consumer financial protection. Or, you could just hope that a consumer lawyer would do it for you, and then summarize his findings in a tidy PowerPoint presentation. Guess what?

What's In The Financial Reform Bill?

Now that the Senate has passed the financial reform bill, it’s off to non-smoke-filled rooms, where it will go into a Blendtec with the version passed by the House last year. CNNMoney.com sifted through all 1,600 pages of the bill and came up with a handy cheat sheet explaining what’s actually likely to change when this thing becomes a law. [More]

Financial Reform Bill Heading To Final Vote

Despite opposition from most Republicans and a couple of liberal Democrats, the Senate today reached the 60 votes needed to block a filibuster threat, clearing the way to bring the financial reform bill to a final vote. In the 60-to-40 vote, Democrats were joined by three Republicans, including freshman Senator Scott Brown of Massachusetts. [More]