Dave can’t get Bank of America to accept that his parents are gone, even after sending over the death certificates. He keeps telling the bank to take the house, because nobody in his family wants it and the mortgage is underwater. Bank of America keeps threatening his parents with letters about how behind they are on payments. Oh sure, everything about this story is funny on the surface, but not when Bank of America tries to extract money from a closed account you once shared with your dad, forcing it to re-open and siphon funds from your real accounts. [More]

mortgages

Self-Styled Robin Hood Banker Pleads Guilty

An ex-vp at a bank plead guilty last week to modifying over 100 loans to make it look like the customers were still current on their loans instead of overdue. This was not a money-making scheme, he was trying to help them. Nevertheless, it was fraud, and he could face up to 30 years in prison and a $1 million fine. [More]

Fed Votes To Buy Up Treasuries, Keep Mortgage Rates Low

The Fed voted Tuesday to reinvest expiring mortgage-backed securities by putting the money into longer-term Treasuries. That, and the decision to keep rates at 0 to 1/4 percent, should keep mortgage rates low. Here’s the full statement following their coffee klatsch: [More]

Before I Strategically Default, Can I Get A New House? Pwease?

Old news: homeowners strategically defaulting on their loans. New news: They first want to get financing for a new house. [More]

Rare Superman Comic Saves Home From Foreclosure

See through walls, bounce bullets off his chest, save homes from foreclosure, is there anything the man of steel can’t do? [More]

Mortgage Broker Told Me To Open Up A Bunch Of Credit Cards, Should I?

One of our readers is looking to buy a house and his mortgage broker suggested that he open up about four credit cards to establish some credit history. Should he? [More]

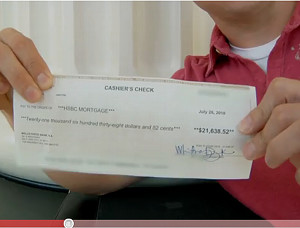

Man Who Offered To Set Car On Fire Saves Home

The guy who offered to set his car on fire in exchange for “loanations” (his word–he says he’s going to pay back all donations) managed to raise enough money to prevent the foreclosure sale of his house yesterday. Below is a video of him handing over a check for $21,000. The only problem is, now he’s saying he might not burn the car. [More]

Man Offers To Set Car On Fire To Save Home From HSBC Foreclosure

John admits on his blog that he’s responsible for falling six months behind on his mortgage. But once he got over his divorce and losing his adopted son and started trying to make things right, he ended up in loan modification limbo at HSBC. The bank never moved forward on any modification, and now he has to pay $21,638.02 today if he wants to keep his house. Logically, he’s offering to burn his car and post the video online in return for donations. [More]

Rich People: More Likely To Default On Mortgages Than You Are

Are you a fancy person? Then you have a 1 in 7 chance of defaulting on your mortgage, says a new study of data compiled for the New York Times. Those of you with mortgages of less than a million dollars only have a 1 in 12 chance of defaulting, the paper says. [More]

Letting Mortgage Go Delinquent To Qualify For Short Sale Damages Credit

In order to qualify for a “short sale,” in which the lender agrees for the house to be sold for less than the remaining amount owed and takes a loss, the lender sometimes requires the homeowner to be several months delinquent on their mortgage payments. But while getting out of a house you can’t afford can be a good idea, bear in mind that the delinquency will stain your credit report. [More]

Countrywide Sued For Discriminating Against Black And Latino Mortgage Buyers

The Illinois AG filed a lawsuit this week against Countrywide, alleging that the now imploded mortgage lender steered blacks and Latinos into riskier subprime loans more often than whites, even when they qualified for safer mortgages. [More]

HOA Board Member Says They're Not All Money Grubbing Scumbags

Yesterday we wrote about how in Texas, there’s been a bit of a spree of homeowner’s associations (HOAs) foreclosing on people’s houses over just a few hundred in late dues, then selling the house to themselves and turning it around for a juicy profit. And now, the other side of the story. Robert is an HOA board member in Texas and while his association does sometimes foreclose in order to collect, there’s more to the situation than meets the eye. Here’s his take: [More]

HOAs Foreclose On Homes Over $500 In Late Dues Then Flip For Personal Profit

In Texas, Homeowner’s Associations (HOAs) are on a foreclosing spree, selling members’ homes on the courthouse steps for just a few thousand dollars simply because they are a few hundred dollars behind on their homeowner’s dues. Sometimes they’re even selling it to HOA board members, who turn around and sell the house for half of what it’s worth, netting a tidy profit. [More]

Mortgage Rates At All Time Low, But You're Not Buyin' A House

Freddie Mac recently announced that rates for a 30-year mortgage fell to 4.69%, the lowest level since they started keeping track. [More]

Mortgage Applications At Lowest Level Since Spice Girls Were Popular

Remember 1997? It was my last year of college so I don’t have too solid a grasp on it, but I do remember being inundated with songs by the Spice Girls and Third Eye Blind. And apparently it was the last time that the demand for mortgages was as low as it is right now. [More]

Strategic Foreclosures Can Bring Financial Relief

If you’re a harried homeowner buried in debt and have no chance of covering your mortgage, one option is just to stop paying your mortgage and save up as you wait for the gears to slowly grind toward your eviction. [More]

Fix Mortgage Errors By Promising The CSR "Phone Fun," At Least At Wells Fargo

According to a lawsuit filed in New Jersey, a CSR at Wells Fargo’s Home Mortgage Division refused to correct a payment error for Jamie Nelson unless she had some “phone fun” with him first. Phone fun, in this case, seemed to mean naked pics of the woman. She’s suing for emotional distress, since you can’t take someone to court simply for being a skeevy jackass. Wells Fargo says they’re taking the allegations seriously. [More]