Between homeowners eager to get out from underwater mortgages and real estate speculators looking to scoop up below-market properties, there are a lot of people out there eager to grease the wheels to make a short sale happen. And federal authorities say one now-former Bank of America employee accepted at least $1 million in bribes to improperly approve short sales and falsify bank records. [More]

short sales

Citi Has A Very Loose Definition Of “Expedited” When It Comes To Fixing Huge Holes In Roof

When a bank approves a short sale, you would think that it would do everything it can to not put that sale at risk, lest it lose even more money on the deal. But one pending short sale property in New Jersey has had holes in its roof for months because Citi thinks that not approving repairs to the roof is somehow a good idea. [More]

If You're Going To Leave Your House Vacant, Don't Be Surprised To Find Kids Partying There

Like bloodhounds on the scent — or maybe more like pigs sniffing for truffles — industrious teens will find places to get drunk and do other things they have seen in movies. And with a large number of houses sitting vacant while awaiting sale or foreclosure, it’s a partier’s market out there. [More]

New Guidelines Aim To Make Short Sales Less Of A Pain In The Butt To Everyone

Short sales now account for nearly 1-in-11 home sales in the U.S., so there’s a decent chance that anyone who has been house-shopping recently has visited a for-sale property only to have the realtor say, “Now I have to warn you, it is a short sale.” At this point, many of you would go running for the hills rather than be stuck in bank-approval muck for months. But new guidelines issued by the Federal Housing Finance Agency are aimed at speeding up the process. [More]

Banks Realize Short Sales Are Better Than Foreclosure, Pay Homeowners To Sell Now

It’s been nearly a half decade since the housing market imploded like an old stadium packed with explosives and the ground is still rumbling from the impact. Realizing it’s better to recover some money now rather than trying to get all their cash back eventually, more banks are making it easier for homeowners to unload their houses for less than what is owed on the mortgage. [More]

The Ins And Outs Of Short Sales

When you owe more than your ever-plummeting home is worth, a foreclosure or short sale — in which you sell the home for less than you owe — can seem like an attractive escape. The move may make financial sense, but it comes with repercussions to your credit and somewhat strict qualification parameters. [More]

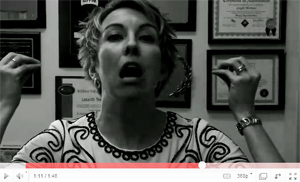

BofA Comes To Trash Out House After It's Sold

Bank of America is apologizing after a frustrated realtor took her venting to YouTube in a dramatic recounting, reports the Charlotte Observer. The realtor was representing a seller who was selling house through short sale. The realtor found a buyer, the seller was happy, and supposedly, the bank was happy. A week later when the new homeowners were moving in, a “trash out” crew rolled up in a truck with tinted windows, sporting black tshirts with an image of a gun on the front and the word “agent” on their backs. They were there to throw everything in the house out and change the locks. [More]

Home Buyer Takes Consumerist Hive Mind Advice, Emerges Victorious

Remember Frank? He asked Consumerist readers for advice about his short-sale purchase of a house gone terribly, terribly wrong. He’s back, with an update! As you may recall, the hive mind advised him to walk away from the deal. Better yet, run away. Or drive away in a supercharged muscle car. Frank writes that he took this advice to heart, and emerged victorious. But not in the way you might expect. [More]

Letting Mortgage Go Delinquent To Qualify For Short Sale Damages Credit

In order to qualify for a “short sale,” in which the lender agrees for the house to be sold for less than the remaining amount owed and takes a loss, the lender sometimes requires the homeowner to be several months delinquent on their mortgage payments. But while getting out of a house you can’t afford can be a good idea, bear in mind that the delinquency will stain your credit report. [More]

Realtor's Incompetence Means I Can't Move Into My Vandalized, Deteriorating Short-Sale House

One might think that with the collapse of the housing market and the global economy, realtors and banks might have some idea how to handle a short sale transaction. A short sale, after all, is when a homeowner sells their home for less than they owe on the mortgage in order to avoid foreclosure. Frank writes that he would like very much to move into the house he signed a contract to buy back in November, but the seller’s realtor forgot to submit documents to the seller’s bank, leaving the house vacant to be vandalized and deteriorate for months on end. [More]

What It's Like To Buy A Short Sale House (Hell, With Benefits)

With the housing bubble burst and evaporation of credit, short sales have grown in popularity as debtors behind on their mortgage seek to offload their depreciated property and avoid the derogatory effects a foreclosure can have on their credit report. Ads in the paper and tacked onto telephone poles at intersections scream about the great steals to be had.But what is it actually like to go through this process whereby the bank agrees for the house to be sold at a small loss instead of incurring the sizable fees a full foreclosure would entail? A lot harder than the brightly colored bold letters would have you believe. Long-time reader kyleorton walks us through what he went through to buy his a house listed at $274k via short sale for $229,000, a procedure complicated by Bank of America bureaucracy and a seller’s agent that didn’t feel like doing any work. [More]

The Town With The Most Screwed Housing Market In America

Nearly 90% of the homeowners in Mountain House, CA owe more on their mortgages than their house is worth. The average homeowner is down by $122,000. What are they doing to cut back? No more dinners at Applebee’s, buying 1 DVD a month instead of 50, canceling remodeling projects, and playing board games at home instead of going out to the movies, “But not Monopoly,” reports NYT, “with its real estate theme, it reminds them too much of real life.” One man is even cutting back on his scub and flying hobbies, and waiting until after Christmas to buy a high-def television. Wow. I think you’re going to have to dig a little deeper…

4 Things To Try Before Foreclosure

Usually one has somewhat of an advance notice that they’re going to miss a mortgage payment, so before that happens and the bank comes to take your house away, Kiplinger’s advises calling up your lender and discussing one of these four options: