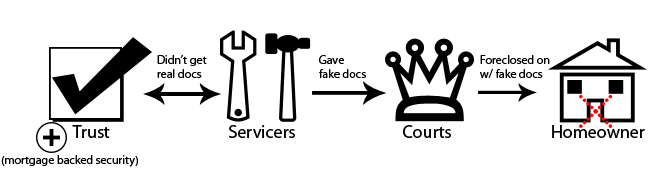

A simplified way to understand how the current foreclosure fraud crisis got started. It all became unwound when a foreclosure mill “robo signer” admitted in a deposition to signing more than 10,000 affidavits in one day, little lies on slips of paper that got people thrown out of their houses. [More]

mortgages

Bank Sends Scary Person To Break Into Your House

Nancy was sitting at home when someone busted the lock on her door. She was afraid she was being robbed, but it turned out that Chase had mistaken her home for a foreclosure and sent someone to change its locks. It took a visit from police to figure that out. [More]

Wells Fargo To Make $772 Million In Mortgage Adjustments Following Investigation

Wells Fargo has reached a nearly $800 million settlement with Attorneys General in eight states where the company — more precisely, Wachovia, which was acquired by Wells Fargo after it failed — was under investigation for allegedly deceiving some borrowers into taking out loans they could never pay back. [More]

Bank Of America Freezes All Foreclosures In 23 States

Bank of America announced Friday that it was halting foreclosures in each and every case that hadn’t gone to judgement. They became the third major bank to put the brakes on foreclosures after revelations that document processing firms were allegedly forging papers and signatures on a massive scale. [More]

JPMorgan Chase Suspends 56,000 Foreclosures

JPMorgan became the second major lender after GMAC/Ally Bank to halt pending foreclosures, halting proceedings on 56,000 homes. This follows revelations that “robo-signer” “foreclosure mills” were filing paperwork that would be gracious to call “sloppy,” at the rate of 10,000 a day. [More]

Fannie Mae Gives Wounded Soldiers A Break On Mortgages

Fannie Mae yesterday announced that military families with a member who was injured or killed while on active duty can apply for a forbearance of up to six months if they’re having trouble making their mortgage payments. [More]

Bank Reverses Erroneous Foreclosure On Family With Very Sick Child

After the Washington Post reported on their plight, a family with a gravely ill child that got foreclosed on a day after they were told their loan modification was approved, the bank investigated and found that they had screwed things up. [More]

Chase Forecloses On Family With Son Crippled By Rare Genetic Disorder

A family whose son has debilitating cerebral adrenoleukodystrophy got foreclosed on by Chase, just days after they were told their loan modification was approved. [More]

NPR's Pet Toxic Asset, "Toxie," Dies

To see what would happen, reporters for NPR’s Planet Money pooled their money and bought a toxic asset for $1,000. At 99% off, it seemed like a bargain. This week, “Toxie,” as they dubbed their pet, gave up the ghost. Contrary to expectation, she was killed not by foreclosures, but by loan modifications, which reduced the amount of cash flowing into the bond. Planet Money tells the whole story in this awesome and hilarious animation. [More]

Foreclosure Firm Allegedly Forged Bank Execs' Signatures On Affidavits

A foreclosure firm listed “Bogus Assignee” as the mortgage owner on the documents they submitted to the court to process the foreclosure. That’s one of the many oddities surfacing in the investigation of a Florida foreclosure firm for allegedly using improper documentation to speed up foreclosures. Another is an employee “Linda Green” who signed of on thousands of foreclosure affidavits claiming to be executives from Bank of America, Wells Fargo, U.S. Bank and other lenders. [More]

BofA Forecloses On Man's House, Even Though He Has No Mortgage

Bank of America stole Jason’s house from him, putting it through foreclosure even though he has no mortgage, with them or anyone, and he paid for it in cash. [More]

GMAC Bungled Foreclosure Affidavits In 23 States

GMAC Mortgage is taking the eye-opening step of stopping evictions in 23 states because the affidavits used to support the kickouts contained information the employees didn’t themselves personally know to be true, and they were sometimes signed without a notary present, according to a company statement. [More]

GMAC Halts Evictions In 23 States

GMAC has told brokers and agents to immediately stop evicting homeowners in 23 states. In a memo, the Ally Financial Inc. subsidiary cited “corrective action in connection with some foreclosures” that may need to be taken. Smells like some people got foreclosed on that shouldn’t have, though we’ve been hearing scattered reports about that for a while without the banks doing much, so why drastic action now? Have they uncovered something massive? [More]

Massachusetts Regulators Rarely Acted Against Subprime Brokers And Lenders

An investigative report finds that Massachusetts regulators only acted against 3% of its licensees during the sub-prime peak, the lowest among fellow New England states, while publicly preening that it was being “aggressive.” In fact, as foreclosures rose during ’06-’08, enforcement actually dropped. Forget who watches the watchdogs, who watches? [More]

Unexpected Work Transfer And An Upside-Down Mortgage Create Sticky Financial Situation

In a secure profession that very rarely requires people to relocate, John made what seemed like a pretty solid financial decision. He and his wife bought a house. He tells Consumerist that this seemed like a great idea until his employer transferred him (involuntarily) across the country. He left behind his wife, who works in the same field but was not transferred, and the house, on which he is upside down. This has left the couple in a nasty financial situation they never anticipated. He wonders: can the Consumerist hive mind offer him any wisdom? [More]

BofA Pays To Fedex You Multiple Loan Mod Opps You Don't Care About

BofA has been Fedexing Eli a loan mod opportunity once every two months for the past eight months. He has no intention of doing a refi, he’s never been late on a payment and likes his 5/1 ARM and low interest late. Wonder how many other homeowners is BofA frittering away their bailout bucks on by FedExing junk mail. Meanwhile, the people who actually want loan mods are stuck in purgatory. [More]

BofA Tries To Foreclose On Couple With Current Mortgage

Even though they have made every payment in full and on time, Bank of America sent one couple a letter asking them for the deed to their house. [More]

Wells Fargo Makes Family Submit Essay With Mortgage App

Before reviewing this woman’s mortgage application, Wells Fargo asked her to write a “motivational letter” to explain why they were moving, with the essay to include reflections on her plans to “increase/decrease” her family or property size and her commuting distance to work. Besides being rude, the request could also be against the law, something the woman picked up on, because she is a lawyer. [More]