Embittered homeowners and activists packed the yard of a Bank of America executive on a recent weekend, and they brought their bullhorn. [More]

mortgages

265,000 Homeowners Stuck In "3 Month" Trial Loan Period For 6+ Months

Newly released data shows 265,000 homeowners are trapped in loan mod limbo, stuck in “3 month” trial loan periods for over 6 months, reports ProPublica. [More]

Some Homeowners Worse After Getting Rushed Into Gov't Loan Mod Program

Despite fulfilling every obligation under trial government-sponsored loan modification programs, some homeowners can end up far worse off than if they had never joined up at all, Propublica reports. That’s because if they’re denied a permanent modification, they have to pay the entire amount that was being discounted, often within a very short period of time. This pushes already strapped families past the breaking point. [More]

BoA Sued For Taking TARP $ But Not Helping Foreclosures

A class action lawsuit has been filed against Bank of America for taking $25 billion in federal TARP bailout money but intentionally failing to live up to its part of the bargain. The deal was that banks were supposed to use use the money to allow struggling homeowners to reduce their payments to affordable levels. “Bank of America came up with every excuse to defer the Kahlo family from a home loan modification, from stating they ‘lost’ their paperwork to saying they never approved the new terms of the mortgage agreement,” said the plaintiff’s attorney. “And we know from our investigation this isn’t an isolated incident.” Bank of America declined to comment.

Washington homeowners file class action against Bank of America [Seattle PI]

Man Seals Self Inside Foreclosed Home

Now we finally understand the secrets of the pharoahs: a bunch of angry people in Stony Ridge, Ohio have sealed up a home with the homeowner inside, with his permission, leaving only a golf ball-sized hole in the front door. The man, Keith Sadler, says he fell behind last year after paying on his mortgage for 12 years, and that his bank promised to work with him but instead proceeded with foreclosure. [More]

Woman's $10K Mortgage Payment Vanishes Into Thin Air

File this one under “U” for Uncool: After a woman transferred $50,000 over five days from her bank account to her mortgage lender to pay down her mortgage, somehow $10,000 of that money just… disappeared. Or so it seemed. [More]

Did Paulson Violate The Fair Credit Reporting Act?

When the SEC announced its fraud complaint against Goldman Sachs, people noted that the penalties involved would involve money, not jail time. But an attorney writing for seekingalpha.com argued over the weekend that John Paulson, the hedge fund manager who worked with GS to create “synthetic derivatives,” accessed FICO scores to create his financial product and therefore violated the Fair Credit Reporting Act (FCRA)–which could mean a penalty as high as $1 billion, and even jail time if the FTC or Justice Department decides to go after him. [More]

Bank Of America Employee Allegedly Demanded Illegal Fees To Prevent Foreclosures

It’s bad enough that banks have been negligent at implementing the government’s loan modification program, but now a BoA mortgage loan officer is being sued for making extra money illegally on struggling homeowners. According to the Boston Globe, a new lawsuit claims the employee was demanding as much as $1,500 from each borrower before offering help foreclosure help, and routing the funds through his own company, Foreclosure Alternatives. The lawsuit also alleges that the man falsely represented himself as an attorney for BoA. [More]

Are Credit Monitoring Sites Really Worth The Money?

Now that everyone is so obsessed with their credit reports and FICO scores, credit monitoring services have popped up everywhere. For a modest recurring fee–one that easily adds up to over $100 a year–you can have a company constantly watch your credit report and alert you of any changes in it, so you can always be on top of your creditworthiness. But should you bother? The consumer director of the U.S. Public Interest Research Groups federation (U.S. PIRG) tells BusinessWeek that credit monitoring is a “protection racket” that turns people into “financial hypochondriacs… who are scared of their own financial shadows.” [More]

Government Mortgage Relief Plan May Buoy Underwater Homeowners

A new program announced by the Obama Administration today could help homeowners whose homes have declined in value by offering new government-backed loans and getting lenders to reduce the principal owed on homes whose values have fallen by at least 15%. The catch? Investors who own existing mortgages won’t be forced to participate in the new, voluntary program. [More]

When Should I Make Extra Mortgage Payments?

We get a surprising amount of letters from people who regularly make extra mortgage payments. (Extra payments sometimes confuse the bank and causes headaches.) It seems like it would always a good idea to pay off debt if you can afford it, but with current mortgage rates as low as they are.. does it still make sense? [More]

TD Bank Will Pay Off Your Mortgage

Free house! TD Bank is running a new contest: apply for a new mortgage, get a chance to have them pay it off in full for you. [More]

Reach Chase Executive Offices For Mortgage Modifications

Here is a fun-pack of executive escalation contact info you can use if you’re trying to get Chase to modify your mortgage. With the bureaucracy and indifference staring you down, you’ll need every vector you can get your hands on. [More]

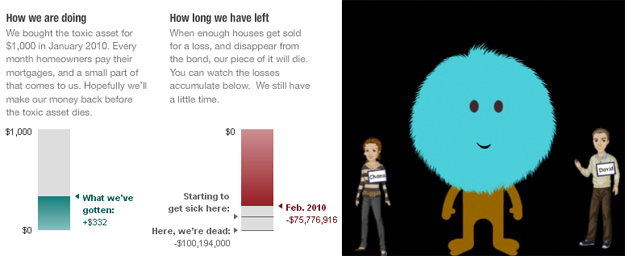

Reporters Buy Up Toxic Assets

To dig right into the meat of the story they’ve been tracking for over a year, NPR Planet Money reporters David Kestenbaum, Chana Joffe-Walt plunked $1000 down and bought up a securitized pack of Countrywide mortgages. At one point it was worth $75,000. Will the homeowners pay their mortgages and the reporters make their money back or will too many houses get sold at a loss and the asset implode? Follow along and find out. [More]

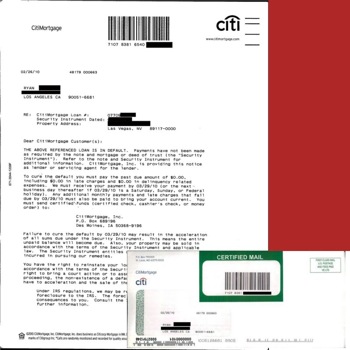

Citi Demands You Pay $0 Or They Will Foreclose On Your House

In these tough times, homeowners with difficulties paying their mortgage dread receiving that letter from the bank informing them that their loan is in default. Except for Consumerist reader Ryan, who recently got some certified mail from CitiMortgages telling him his home was at risk of foreclosure, unless he immediately forked over $0.00 [More]

New Program Wants To Help You Sell Your Home At A Loss

While some indicators seem to say that the economy is turning around or at least not getting worse, there are still millions of homes out there that are at risk of foreclosure. And since so many of those outstanding mortgages were based on grossly inflated home prices, the odds of finding a buyer that will pay off the mortgage are slim. However, a new program about to take effect in April will encourage lenders to accept less than they’re owed. [More]

BoA So Messed They're Incapable Of Taking Your Money

It’s a real junkyard over there at Bank of America. We have yet another complaint about their online system being so jacked up that it won’t even take your money. That’s the last thing you want to happen when you’re trying to pay your mortgage in these foreclosure-happy times. Jason has already escalated to the executive office, and they still suck. [More]