One of our readers is looking to buy a house and his mortgage broker suggested that he open up about four credit cards to establish some credit history. Should he? [More]

credit reports

Western Dental Upsells Relentlessly, Then Pulls Dirty Trick With Billing

Ryan recently went to a clinic operated by Western Dental Centers, a franchise that operates in California, Arizona and Nevada, and now he regrets that decision. He writes that first he was forced to endure $800 worth of upsells while he was stuck in the chair, even though he was just going in for a cleaning. What happened with billing, though, was worse and may lead to lasting credit issues. [More]

Five Things To Do Before Losing Your Wallet

Look, it’s going to happen eventually. Whether it’s pickpockets or carelessness, you’re going to lose your wallet. When you do, you’ll be glad you took these five steps to make recovery simple and painless. [More]

Letting Mortgage Go Delinquent To Qualify For Short Sale Damages Credit

In order to qualify for a “short sale,” in which the lender agrees for the house to be sold for less than the remaining amount owed and takes a loss, the lender sometimes requires the homeowner to be several months delinquent on their mortgage payments. But while getting out of a house you can’t afford can be a good idea, bear in mind that the delinquency will stain your credit report. [More]

How To Dispute Credit Report Errors

Over 80% of credit reports have errors on them, errors which could be lowering your credit score and keeping you from getting credit or paying more for it than you should. Here’s how to fix them: [More]

How Can You Fix A Broken Credit Report?

Just the words “credit report” make many want to cringe as they think of those late payments they made, or that time something just didn’t go through, causing what you might think might be irreparable damage to that record almost every consumer carries with them as they go about the business of buying things. But if something isn’t right, how can you fix it? [More]

"Help, Equifax Won't Give Me My Credit Report!"

A reader just had his credit limit lowered on a credit card due to some bad credit history that he says isn’t his. He’d like to see what’s going on with his credit report, but Equifax says he’ll have to pay for the privilege, because they have no record of any inquiries in the past 60 days. The reader asks, “Has this happened to anyone else, where a credit card company waited over 60 days to notify them of credit limit reductions? Also, does this violate the FCRA?” [More]

Are Credit Monitoring Sites Really Worth The Money?

Now that everyone is so obsessed with their credit reports and FICO scores, credit monitoring services have popped up everywhere. For a modest recurring fee–one that easily adds up to over $100 a year–you can have a company constantly watch your credit report and alert you of any changes in it, so you can always be on top of your creditworthiness. But should you bother? The consumer director of the U.S. Public Interest Research Groups federation (U.S. PIRG) tells BusinessWeek that credit monitoring is a “protection racket” that turns people into “financial hypochondriacs… who are scared of their own financial shadows.” [More]

Do You Need Identity Theft Protection Against The Census?

Several alert readers sent us this advertisement that ran on the front page of CNN.com today. Wait–is the census going to steal my identity? Is my name, race, and birthdate all someone needs to open a credit card in my name? No. You do not need identity theft protection because of the census. Equifax has just mashed up some good information about how to avoid census scams with a sales pitch for credit monitoring services. [More]

Go Ahead And Cancel Your Credit Card, The Score Ding Is Minimal

New answers pried from the secretive FICO corporation that overlords our credit scores kill a longstanding myth. It turns out that cancelling your credit cards won’t destroy your credit score. [More]

Credit Checks For Jobs On The Rise

Some HR departments use credit checks to help determine whether to hire an applicant. The practice has always had critics, since credit histories can have errors that are hard to correct, and since there’s no strong correlation between credit history and job performance. But in this economy the practice may be even less fair, notes MSNBC, even though more organizations are relying on it. [More]

Experian Sued Over Deceptive FreeCreditReport.com Ads

Freecreditreport.com is getting class action sued, baby. Their ubiquitous singing ads make it sound like you’ll go their website and get a free credit report, but they don’t tell you that’s only after you sign up for a $14.95 monthly credit monitoring service. “FreeCreditReport.com tells people they will get something for free, and you do, but you have to pay for something else, and there’s not sufficient notice,” said John Balestriere, lead attorney. I agree, so I made up my own parody Freecreditreport song: [More]

Don't Flush Your Credit Down The Drain

We don’t like services that charge for access to your credit reports, but we are in favor of making it easier to learn about the risks of runaway debt. So, we think you should go ahead and take a look at this chart from . Just stay away from those “Free Credit Report” links and head over to AnnualCreditReport.com instead.

New Rules Require Lenders To Say Why They're Gouging You

Under new rules issued by the Federal Trade Commission and the Federal Reserve Board, lenders will be required to tell consumers why they’re sticking them with high rates or other lousy terms. How will creditors perform this incredible feat? By lying, of course. No, just kidding. They’re going to give you a free credit report and a note explaining their decision. [More]

Experian Fixes Messed Up Credit Report By Deleting Everything

Monique X. is trying to get a loan to consolidate her debts into a more affordable payment. She writes that she’s been careful with her credit history and knew that her credit score was adequate to get approved at her bank, “even with the economy the way it is.” That’s when she discovered that someone else’s accounts had been folded into hers, and that Experian’s solution to their error was as bad as the problem. [More]

Chase Gave Me A Credit Card I Didn't Want

Steven writes about how he feels he was tricked into opening a credit card he didn’t want, then still received the card even after he was vehement about canceling his unauthorized application. [More]

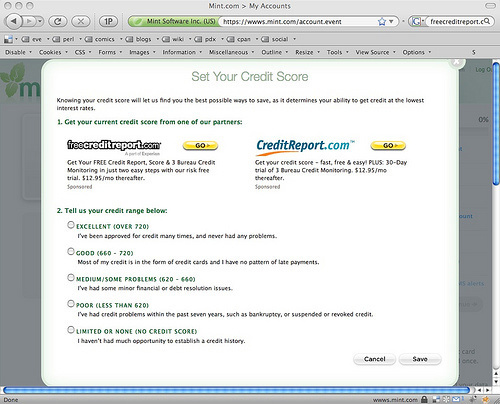

Mint Upselling To "Free"CreditReport.com

It didn’t take long for Intuit to start ruining a great product. They’ve begun upselling Mint.com customers to two “free” credit report sites that are anything but. UPDATE: Turns out Mint was already doing this pre-Intuit. Bully for them.