Shortly after surviving the death of her husband and a life-threatening medical crisis, Ann Howe of Seattle decided to refinance her home mortgage. Everything went smoothly until the bank informed her that the refinance couldn’t be completed because the credit bureau Experian was convinced that she was dead.

credit reports

Your Credit Report Isn't The Only Report You Should Monitor

When an insurer decides whether to offer you a new policy, or whether to raise rates on a current one, he most likely pulls a CLUE report that lists any homeowner or automobile insurance loss claims (or sometimes even just inquiries) that you’ve made over the past 3-7 years. Hopefully you monitor your consumer credit report for errors, but as you can see, that’s not the only one you should keep an eye on.

Denied A Credit Card? Try A Reconsideration Letter

Frugal Travel Guy has a story of how he was able to get a credit card for his son after the company first denied him. The magic bullet was a well-crafted “reconsideration letter.” What’s that?

Negotiating Reduced Payoff Can Hurt Credit Score

Did you know negotiating a reduced payment payoff with a lender negatively affects your credit score?

How A Disputed Item On Your Credit Report Can Screw Up Your Home Loan

Thanks to federal regulations, when you dispute an account on your credit report and the dispute is resolved in your favor, the credit reporting agency is required to remove or correct the account. Credit reporting agencies often don’t do this, though, and the Washington Post notes that it can come back and interfere with your next home loan application.

HSBC Really, Really Doesn't Want Reader To Cancel Best Buy Credit Card

James applied for a Best Buy Mastercard from HSBC. The initial application was easy enough, but the three separate confusing calls from outsourced customer service reps, and the low limit and annual fee on the card he eventually received led him to cancel his account. This should have been a straightforward transaction, but company representatives tried to bully James into keeping the credit card.

Thief Runs Up $10,000 Credit Card Bill Using Only Name, Address, Social, DOB

John says that his wife’s identity was stolen two weeks ago and since TransUnion shows your full credit card numbers on your credit report, the thief was able to run up a $10,000 credit card bill in his wife’s name.

FTC Wants Your Input On How To Improve AnnualCreditReport.com

The problem with annualcreditreport.com—other than its name—is that getting your reports from the site is a little like dealing with GoDaddy: you have to deal with upsells and side-sells at every step. You can indeed get your free credit reports from the site, but you’ll also have to keep turning down other offers from the three participating bureaus. Hell, there are even ads (sorry, “sponsor” links) on the home page, the one place where you’d hope for the least consumer confusion.

Help! My Credit Card Is Adding An Annual Fee!

Michael is in a situation that we anticipate will become very, very common in the coming months. His credit card company has imposed a $99 annual fee. He can accept the fee, or close his account. Not only is this his only credit card, but it’s the oldest credit line he has, so closing it would hurt his credit score. What would you do?

You Paid Your Bill 3 Hours Early? Then It's 30 Days Late

John’s fiancee bought an Apple computer earlier this year, financing it with a Juniper Visa account, then paying the account off early. That’s the responsible thing to do, right? Not according to Juniper, which branded her as a filthy, filthy deadbeat. The bank marked the payment she sent in as “late” for arriving three hours before the end of the billing cycle.

Freescore.com Sues Yahoo To Reveal Blogger's Identity

Freescore.com is one of those online companies that offers a free trial, and then attempts to enroll its customers in a $30/month subscription service. Now they’re suing Yahoo in an attempt to reveal an anonymous blogger who quoted a Reuters article when criticizing the service, and who pointed out that Freescore is owned by a company with a reputation for billing customers without permission.

Seven Free Sites To Track Your Personal Information

The Consumer Reports Money Adviser has compiled a great list of sites that store your personal information and will provide free copies of their reports to you if you ask.

36 Risk Factors Creditors Use To Deny You Credit

Lenders can use the data from your credit report to deny you credit for any one of several reasons. If you are denied, you receive a letter identifying the credit reporting agency that provided the report, along with a risk factor reason code. Bargaineering published a list of the common risk factor codes that lenders use to deem you unworthy of credit. For all three reporting agencies, the cardinal sins are owing too much and failing to pay your bills. The list of codes, inside.

Hiring Consultant Warns: "No Connection Between Credit History And Job Performance"

Almost half of all employers use credit reports to judge job applicants, even though credit histories have no relation to job performance. Personal finance goofs are only relevant for jobs that deal directly with money—cashiers, account managers, and the like. For everyone else, negative credit reports keep otherwise capable people from securing a job to help avoid further financial problems. So why do so many companies still ask for credit reports?

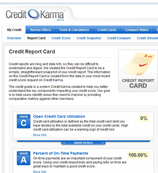

Take Your Score From 650 To 800 With The Credit Karma Report Card

Credit Karma recently launched the free Credit Report Card service that assigns letter grades to each component of your credit score. If you want to improve your credit score, try to bring up your performance in areas where you have low or failing grades. Not every component has the same bearing on your score, so underneath each section Credit Karma tells you how much weight it has. For those who look at their reports and scratch their head, the Credit Karma report card, which is drawn from your TransUnion report, makes understanding why your credit score is the way it is a snap. Full screen shot inside.

Why Credit History Employment Inquiries Matter

Last week, we covered a story in which a job seeker was denied a job because of his credit report.