Todd’s subject line to us was, “Verizon FiOS hates me,” and maybe he’s right. Each time he tries to sign up for their package deal, they check his credit score, proceed with the sign-up process, then cancel everything at the last minute due to a “technical glitch.” They say he can try a third time if he wants. [More]

credit histories

25 Percent Of American Consumers Now Have Low Credit Scores

Before the recession hit, roughly 15% of Americans had FICO credit scores below 600. But after the past couple of years of late payments, defaults, and foreclosures, that number has grown to 25%, or about 43 million people. At the same time, the number of people with excellent scores (800 to 850) has increased nearly 5% from pre-recession average, which the Associated Press says is partly a result of people cutting spending and working to pay off loans more quickly. [More]

Washington Wants Better Oversight Of For-Profit Colleges

Enrollment in for-profit colleges like the University of Phoenix, DeVry University, and Kaplan University–Gawker calls them fake colleges–tripled in the past decade, and has become such a fast-growing segment of the education market that some members of Congress think it needs better oversight. [More]

Fighting About Money Frequently Increases Risk Of Divorce

You already know that it’s not healthy to fight about money all the time, but it might be a bigger risk factor for divorce than you think. A 2009 University of Virginia study found that couples who argue about finances every a week are 30% more likely to divorce than those who argue less frequently. In addition, a couple that marries with no assets are 70% more likely to divorce in three years than a couple bringing $10k in assets into the union. [More]

Credit Checks For Jobs On The Rise

Some HR departments use credit checks to help determine whether to hire an applicant. The practice has always had critics, since credit histories can have errors that are hard to correct, and since there’s no strong correlation between credit history and job performance. But in this economy the practice may be even less fair, notes MSNBC, even though more organizations are relying on it. [More]

Experian Fixes Messed Up Credit Report By Deleting Everything

Monique X. is trying to get a loan to consolidate her debts into a more affordable payment. She writes that she’s been careful with her credit history and knew that her credit score was adequate to get approved at her bank, “even with the economy the way it is.” That’s when she discovered that someone else’s accounts had been folded into hers, and that Experian’s solution to their error was as bad as the problem. [More]

Hiring Consultant Warns: "No Connection Between Credit History And Job Performance"

Almost half of all employers use credit reports to judge job applicants, even though credit histories have no relation to job performance. Personal finance goofs are only relevant for jobs that deal directly with money—cashiers, account managers, and the like. For everyone else, negative credit reports keep otherwise capable people from securing a job to help avoid further financial problems. So why do so many companies still ask for credit reports?

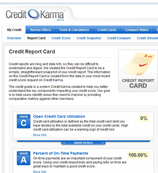

Take Your Score From 650 To 800 With The Credit Karma Report Card

Credit Karma recently launched the free Credit Report Card service that assigns letter grades to each component of your credit score. If you want to improve your credit score, try to bring up your performance in areas where you have low or failing grades. Not every component has the same bearing on your score, so underneath each section Credit Karma tells you how much weight it has. For those who look at their reports and scratch their head, the Credit Karma report card, which is drawn from your TransUnion report, makes understanding why your credit score is the way it is a snap. Full screen shot inside.

AmEx Denies Existence Of A Store Blacklist, Will Slash Your Credit Whenever They Want

Despite sending customers letter saying otherwise, American Express now insists that it never blacklisted cardholders based on where they shopped. Those notes explaining that “other customers who have used their card at establishments where you recently shopped have a poor repayment history with American Express?” Whoops! Just a big misunderstanding! Not unlike the comment they gave to ABC explaining that “shopping patterns” were used as a “contributing factor” in slashing credit lines, a statement AmEx later retracted. So what’s really going on? Let’s explore…

Ex-Countrywide Employee Sells Your Data, They Offer Credit Monitoring Service, Hang Up When You Ask For It

Re: Countrywide Sends Fraud Alert Letters: ‘Your Info May Have Been Sold,” Reader Esqdork writes, “Yesterday, I phoned Countrywide to get them to extend the credit monitoring service [that they offered in their apology letter] to my co-borrower and was promptly hung up on.” The only surprise here is that they even picked up in the first place.

Countrywide Sends Fraud Alert Letters: 'Your Info May Have Been Sold'

I received a letter from Countrywide today that says:

Citigroup May Reinstate Universal Default

Last year Citigroup pledged to abandon the customer-screwing policy of universal default, where an unrelated late payment or credit score change can trigger an interest rate increase on your Citibank card. They even used a marketing phrase to promote their promise: “a deal is a deal.” According to the New York Times, Citigroup is “quietly reconsidering its pledge” and may decide to reinstate universal default as early as this week.

Third-Party Debt Collectors Misusing Courts To Increase Profits

The Chicago Tribune writes that “More than 119,000 civil lawsuits against alleged debtors are clogging [Chicago] courtrooms,” but since collection agencies make money off of volume business, the suits filed are based on too little information. The result: cases based on mistaken identities, or for debts already settled, or against debtors who have made good-faith efforts to work out repayment plans. “The system is out of control,” one attorney tells the paper.