NYT reports that the three major credit bureaus each keep a special VIP list of important people who are given preferential treatment when fixing their credit reports. The list has the names of celebrities, politicians, judges and others on it. When they have errors on their reports, they are fixed by employees who work in America, and fixed swiftly. The rest of us get our requests shunted overseas to be dealt with in a cursory manner. [More]

credit reports

Free Sample Letters For Dealing With Credit Bureaus

Cleaning up a dirty credit report usually involves a lot of letters. Because just mustering the strength to sit down and face this task may have already drained you of your creative juice, via Frugal For Life here are a few sample letters you can use when dealing with the credit bureaus, debt collectors and creditors. Use them as Madlibs or as inspiration to kick your own cleanup spree into high gear. [More]

Trying To Ruin Your Ex's Credit Score Is Not A Good Way Of Getting Revenge

When a romance goes south, it’s not unheard of for at least one of the parties involved to begin dreaming up clever ways to continue making the other person’s life hell. And one thing you definitely don’t want to do is try to screw with your ex’s credit score. [More]

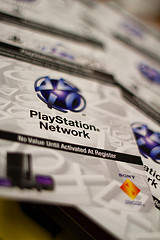

Sony: PlayStation Network Users' Credit Card Info May Have Been Leaked

Sony’s early bid for a high seed in next year’s Worst Company tournament continues, as does the mass outage of its PlayStation Network. Yesterday, the company admitted that it wasn’t sure if users’ credit card info was compromised by whatever evil forces hacked the system, but now Sony has slightly upgraded that uncertainty by saying that credit card info may have been leaked. [More]

Someone Explain To Experian How American Express Cards Work

How does American Express work? Michael writes that Experian doesn’t seem to understand how the company’s credit limits work. His card technically has no limit, and this confuses Experian. They coped with the confusion by showing that instead of having theoretically infinite available credit, he had $0, making his pristine record look pretty bad to potential lenders. [More]

Being 30 Days Late On House Payment Can Knock 100 Points Off Credit Score

Usually very closed-mouth about how it calculates scores, FICO released a whole bunch of data about how being late on your mortgage payments affects your credit score. For instance, being 30 days later on a mortgage payment can chop your 780 credit score down to 670. And a short sale or deed-in-lieu of foreclosure will hurt your score just as bad as a foreclosure if the service reports it as having a deficiency amount or an unpaid balance. Yikes! Here’s some sexy tables with more details: [More]

Get A Bad Deal On Your Loan? Now You'll Know Why

If you applied for a loan and got denied or received a higher interest rate than other borrowers with better credit scores, starting July 21st, the lender has to send you a free copy of your credit score. [More]

Want Just A Credit Report From TransUnion? Too Bad

Michael wanted to pay a copy of his Transunion credit report. In theory, this shouldn’t be a problem: he gives Transunion money, they give him a credit report. If only it worked that way. It turns out that just buying a single copy of your report from Transunion is like trying to buy a mobile phone in America from a retail store: you can get it for “free” with a subscription to monitoring service, or as part of a package deal with other services, but you can’t just hand over cash for a credit report. [More]

Capital One Burrows Into Your Wallet, Makes Your Life Hell

Gerard, now 26, has spent his entire adult life fighting with Capital One. No, we are not exaggerating: he got his first credit card with the company at age 18, and they have been causing him payment and credit-report headaches ever since. [More]

Mike Fights The Identity Thieves

Someone stole Mike’s identity and has been using it to pay for gas service and buy cellphones in his name. He’s even got a $163 default judgment against him for something he never paid. Here’s how he unraveled the threads of his identity thieves, and how he may never truly be free from their grasp. [More]

Experian Adds Rent Payments To Credit Reports

In what could be a boon to renters looking to build a credit history (or bad news if you have a roommate who always delays your rent), credit reporting agency Experian has begun incorporating data on rental payments into its reports. [More]

Wells Fargo Has A Dispute Representative Named "Dispute Representative"

It seems Wells Fargo has an employee whose actual name is “Dispute Representative.” Or at least so it would appear by the letter he received in his response to his request to have an erroneous item removed from his credit report. Guess the guy found his perfect job. [More]

Man Wants Verizon FiOS, Keeps Getting Credit Score Dinged Instead

Todd’s subject line to us was, “Verizon FiOS hates me,” and maybe he’s right. Each time he tries to sign up for their package deal, they check his credit score, proceed with the sign-up process, then cancel everything at the last minute due to a “technical glitch.” They say he can try a third time if he wants. [More]

Convincing The Credit Bureaus I Wasn't Dead

A writer for Slate shares the tell of her trying to convince Experian and Transunion that she is not deceased, as being dead is a bit of a problem when you’re trying to buy an apartment. Transunion only took one phone call and one fax to Lazarus her, but Experian was an abyss of despair, until, out of the darkness, a ray of hope emerged… [More]

Pay Your Early Termination Fee Or Get A Black Mark On Your Credit Report

A cell phone provider’s early termination fees isn’t a polite suggestion — it’s a contractual payment you’ve agreed to give to the company for failing to stick with its unsatisfying service. Whether or not the agreements are ethically valid, you’ll have to pay them or face collections and a likely scar on your credit report. [More]

Job Search Credit Check Scammers Still Roaming The Internet

Molly writes that her brother has been looking for employment for a long time, and finally received a tentative job offer for a job in a warehouse. It’s underemployment, but it’s employment, right? The problem is that the agency doing the hiring seems kind of shady to Molly. They want to verify that her brother is a U.S. citizen by having him use a “free” credit score service, and e-mailing them the score. Molly’s right: it’s a scam. [More]