Sorry about that headline, I’ve just been really tired and not sleeping well and anyway — where was my bank account when a snoozing clerk accidentally transferred about $300 million accidentally? Oh, right. It wasn’t in Germany, which is where our dozing dude made his rather large mistake. It only took a second for him to fall asleep and leave his finger on the keyboard, turning a 2 into well, 222222222…

banks

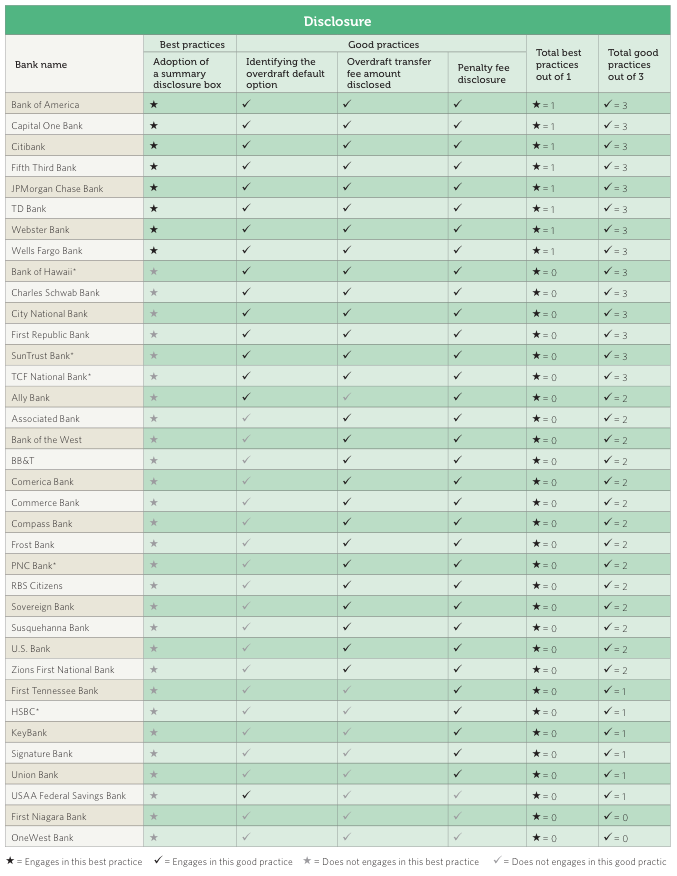

Consumer-Friendly Checking Account Practices Vary Wildly From Bank To Bank

Unless you’ve been hiding under a bed for the last six years, you probably know that the banking industry isn’t exactly beloved by many American consumers. As a reaction to public sentiment (and threats of regulation), a number of banks have begun phasing in some more consumer-friendly practices, but a new study shows these changes are not industry-wide and that several banks are still years behind. [More]

Protect Your Credit And Debit Accounts When You Travel

The summer travel season is here, which means driving and flying to new locales and using exciting and unfamiliar ATMs. That increases your risk of both having awesome fun times and of being the victim of credit or debit card fraud, so it’s good to keep that in mind and take a few precautions. [More]

Makers And Stars Of Porn Being Turned Away By Some Banks

With so many people choosing to watch porn for free online rather than pay for it, the adult industry claims to be nowhere near as lucrative as it was at the height of the VHS and DVD era. Making matters worse, some in the industry say their banks don’t want to be associated with this particular form of entertainment. [More]

Mortgages Slightly Easier To Get For Prime Borrowers, Still Tough For Subprime Applicants

Ten years ago, a potential home buyer could walk into a Countrywide office and get pre-approved for a half-million dollar home loan based on a bank statement written in crayon on a restaurant place mat and a pinky swear that the loan could be paid back. We all know too well the results of those lax standards, which is why regulators and banks ramped up restrictions on lending to the point where applying for a home loan is like auditioning for American Idol, without the washed-up celebrity appearances. But a new survey says that lenders are easing up… a bit. [More]

Banks Raking In Billions In Profits From Overdraft Fees

The notion behind an overdraft fee — in which a bank customer is charged a penalty for overdrafting his account — is twofold: To incentivize consumers to pay attention to how much money is in their accounts, and to allow the bank to recoup any money it lost by covering the overage. But a new report claims that these fees have become such a profit center for banks that it’s now in their interest to push account-holders with low-balance bank accounts toward overdrafting. [More]

Many Victims Of Shady Foreclosure Practices Will Only Get $300-$500 Under Government Plan

There’s no doubt that millions of homeowners were the victims of shady foreclosure practices at the country’s biggest banks when the recession hit. So many of those people were likely hoping for a positive resolution to their woes when the government said it was going to figure out how to compensate homeowners with its Independent Foreclosure Review, an investigation into banks’ mistakes in servicing mortgages. But after waiting years for an answer, about three million eligible borrowers will only be seeing checks for between $300 and $500. [More]

Brooklyn Grandma Finds $100K In Safety Deposit Box, But Can’t Keep It

Let’s say you have some valuable things you don’t want to keep in your home, so you take out a safety-deposit box at your neighborhood bank. The bank manager leaves you alone in a transaction room to deposit your items, and you discover that your brand-new box isn’t empty. There’s money in it. $100,000 in cash. [More]

Sen. Warren Asks Bank Regulators If “Too Big To Fail” Has Become “Too Big For Trial”

In her first hearing as a member of the Senate Banking Committee, Massachusetts Senator and longtime Consumerist favorite Elizabeth Warren grilled a panel of regulators on their tendency to settle with law-breaking banks rather than go to trial. [More]

Feds Now Letting Big Banks Review Their Own Foreclosures For Errors

Pre-recession banks turned a blind eye to problems with the mortgages they handed out, bundled, sold and securitized. When that bubble burst, these same banks put the foreclosure process on auto-pilot, allowing anyone with a pulse to sign legal documents. So who better to review all those foreclosures for errors than the institutions that didn’t care in the first place? [More]

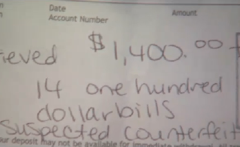

Man Claims Bank Gave Him $1,400 In Counterfeit Bills Which Don’t Work When Paying A Mortgage

Believe us when we say using Monopoly money in the real world is a sure way to fail. And even if your money isn’t hued funny, if it’s fake, it won’t fly. One man is blaming a local bank for his counterfeit woes, claiming he was given $1,400 in fake $100 bills. He can’t pay his mortgage with that stuff, putting him in a tight spot.

Suntrust Checking Account Wasn’t Really Closed, Goes Zombie

Stephen had an account at Suntrust, and decided to leave that bank behind and start a shiny new credit union account with his wife. He left the Suntrust account open instead of withdrawing all of his money and transferring it to the new account, spending it until it was empty, then going in to close it. This plan would have worked beautifully if Suntrust had actually closed the account when he asked them to. [More]

Bank Employee Explains Why It Takes So Dang Long To Process Debit Card Fraud Claims & Disputes… And Other Fun Stuff

We hear a lot from readers who say their debit cards were charged for services they didn’t receive — whether by fraud or by ineptitude on the part of a merchant — and who are now waiting for their bank to please put back the money that was wrongfully taken from them. [More]

Bank Teller: If You Have No Patience And Don’t Listen, Why Should I Feel Sorry For You?

Reader A. works as a teller at a regional bank. She write in with some advice for readers who use banks (and everyone uses banks) that will make your visits to the bank smoother and happier, and make your dealing with the tellers at your own bank more pleasant. Though we hope that none of our readers are as unreasonable and impatient as the customers A. describes. [More]

Bank Of America Dead Last In Customer Satisfaction Study

The folks at the American Customer Satisfaction Index have released their latest report on the banking industry and for the sixth year in a row, credit unions and small banks have outscored all the large financial institutions. And for the second consecutive year, Bank of America is bringing up the rear. [More]

Survey: When It Comes To Free Checking, Small Banks & Credit Unions Do The Best

There’s somewhat of a stark difference between big banks and their smaller counterparts and credit unions in the realm of free checking. Not having to pay for such an account is a big draw for consumers, and according to a new survey from the U.S. Public Interest Research Group, you’ll have much better luck finding gratis checking services at those small banks and credit unions. [More]

When Choosing A Bank To Rob, Avoid The One Where Everyone Is Packing

There’s a sign on the door of the Peoples Bank & Trust that says you’re allowed to bring your concealed firearm in with you if you’re so inclined. That’s very American, but that doesn’t mean you’d expect the bank president to chase a robber from the bank lobby to his getaway vehicle while pointing a Colt .380 at him. Experts generally don’t support this hands-on approach to bank security, but it was effective: the robber (who was unarmed) surrendered, and the bank president is now a local hero. [More]