The baddies behind the recent Target payment data breach are selling off card data at fire-sale prices and cranking out cards that can be used in the real world, some of the people whose card numbers were breached have a long wait to get their new cards issued. [More]

banks

Big Banks Don’t Want To Be Transparent About Checking Fees If Little Banks Don’t Have To Be

If we were to play a word-association game with the nation’s largest banks, we’re sure that terms like “fair” and “equitable” would be right on the tip of peoples’ tongues. And because big banks always play fair with everyone else, they are asking that their checking-account fees not be put under the regulatory microscope if smaller banks’ fees aren’t going be subject to the same scrutiny. [More]

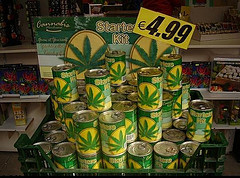

Federal Government Releases Guidelines For Banks To Deal With Marijuana Businesses

One of the biggest worries marijuana businesses have in states like Colorado and Washington, where recreational use is now legal, was that they’d be shut out of financial institutions and be stuck with cash-only transactions. That worry is now likely allayed today as the federal government has given the go ahead for banks to offer services to the legal marijuana industry, as it said it would earlier this year. [More]

These Smug Citizens Bank Ads Show Exactly What’s Screwed Up About Banking

If a bank wants to offer a checking account that isn’t as terrible as most of what’s out there, that’s fine. But that bank shouldn’t pat itself on the back and act like it’s doing consumers a favor just because it gives them a slightly easier way to avoid being nickel-and-dimed. [More]

Free Checking Accounts Are Vanishing And Consumers Are Letting It Happen

U.S. consumers and businesses currently have $1.4 trillion stashed away in checking accounts and banks and credit unions around the country. That’s more than ever before, and most of that cash is being held in accounts that earn absolutely no interest. At the same time, financial institutions are continuing to cut down on the availability of unconditional free checking. [More]

Millionaire UBS CEO Wants Everyone To Stop Picking On Banks For Being Unethical

Listen, you guys. We know it makes you feel better to pick on banks for all those ethically dicey financial things like manipulating interest rates and making other questionable decisions. But the CEO of UBS wants you to cut it out, because while sticks and stones may break his bones, words will never hurt him. Sniff. Sniff. [More]

Federal Government To Issue New Guidelines For Banks Dealing With Legal Marijuana Businesses

Now that marijuana for recreational use is doing booming business in Colorado where it’s legal (with Washington State to join it eventually) the federal government is getting around to answering some weighty questions. Namely, how will it deal with the revenue coming in from pot sales? [More]

Banks Are Cashing In With Brand-Name Prepaid Debit Cards

Who needs an actual debit card when there are hordes of prepaid debit cards on the market? That’s a question you might have to ask yourself with more retailers (and at least one wireless provider) launching their own cards. But while the branding on the front of the card might be for a store, it’s the bank behind that card that is cashing in. [More]

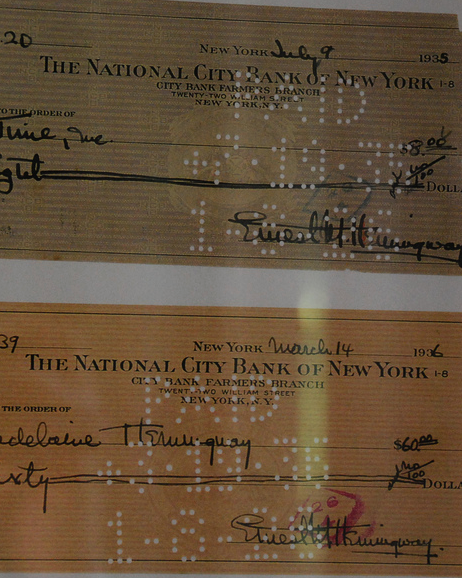

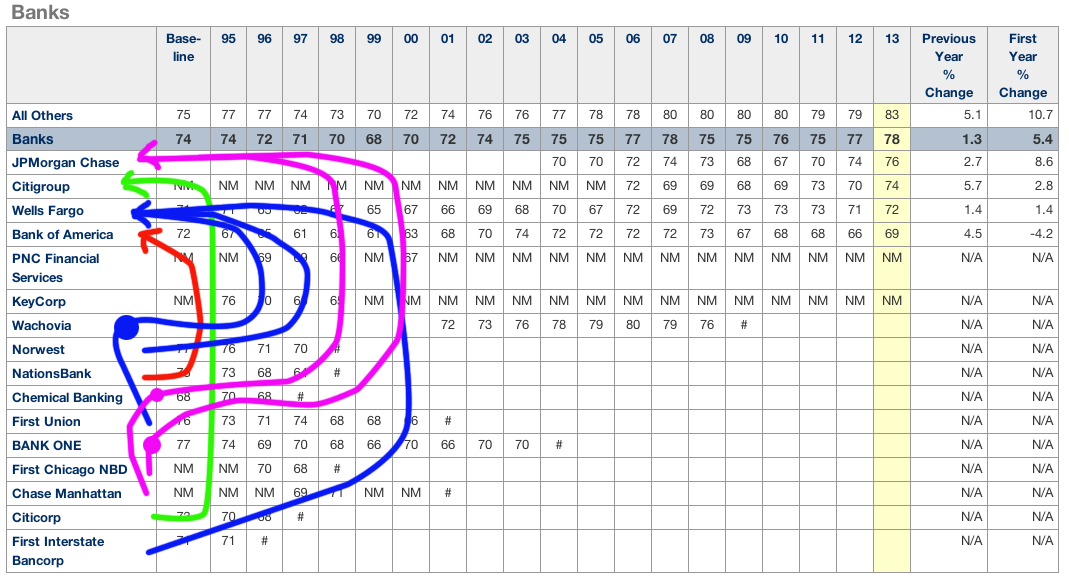

This Bank Customer Satisfaction Chart Is A Sad Reminder Of Rampant Consolidation

Maybe last week’s news that there are now fewer banks in the U.S. than ever before didn’t bother you. But here’s a chart of historic customer satisfaction scores that stands as a reminder of how so many banks have been absorbed into larger banking Voltrons in just the last two decades. [More]

USAA No Longer Offering Bank Accounts To Everyone

Sad news, Consumerists. There was a brief, shining period beginning in 2009 when anyone, not just people affiliated with the military, could get checking and savings accounts from the almost-universally-beloved USAA. Now that dream is over. [More]

How A 1¢ Interest Payment Zombified My Bank Of America Account

A few days ago, we shared the hilarious and pitiful one-cent check that a reader received after closing out his Bank of America money-market account and taking the funds elsewhere. This was a silly and annoying waste of paper and postage, but better than the alternative…having the account go zombie and run up a negative balance when it should have been long since dead. [More]

Robbing The Bank Isn’t The Best Way To Turn A Negative Account Balance Into A Positive

Many banks are a one-stop shop for financial services — you need to withdraw money? Cool, do that there. Get a loan? Sure, you can ask about that. But if you’re inquiring about a negative account balance, the best way to turn that red account into a black one is not robbing the bank itself. That’s one deposit that’ll be tough to make. [More]

More Than A Million People Can’t Get Bank Accounts, Many Because Of Minor Past Errors

Many of us have had that sinking feeling that comes with realizing there’s just not enough money in your bank account to cover a purchase, or received a notification saying as much. It’s no fun, but it happens to plenty of people. Now imagine that even just one of those overdrafts could prevent you from getting a bank account in the future. [More]

Sen. Elizabeth Warren Introduces ’21st Century Glass-Steagall Act’ To Rein In Too-Big-To-Fail Banks

In response to the stock market crash of 1929, the Banking Act of 1933, also known as the Glass-Steagall Act, put up a wall between commercial banking and investment firms. That wall stood for more than 60 years until it was torn down by the 1999 Gramm-Leach-Bilely Act, which allowed commercial banks to reap huge profits, but also resulted in financial institutions that were so large that, had they failed, they would bring down the entire economy with them. So when those banks began to crumble following the collapse of the housing bubble, we taxpayers were left with little option but to bail them out while our federally insured deposits were put at risk. Thus, Senator Elizabeth Warren from Massachusetts has introduced legislation that would reenact the regulations that were stripped away 14 years ago. [More]

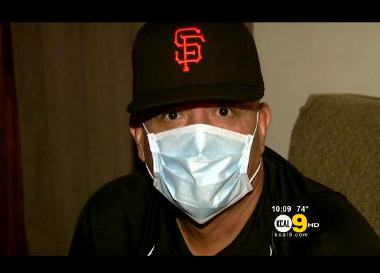

Wear A Surgical Mask Into A Wells Fargo Branch, You Might Be Mistaken For A Bank Robber

Whether it’s Patrick Swayze in a Ronald Reagan mask or a woman holding up a McDonald’s with a girdle stretched over her face, robbers will wear just about anything to hide their identity from those being robbed. But sometimes a person walks into a bank wearing a mask not because he’s a criminal, but because he just underwent chemotherapy. [More]

Coming Soon: Withdraw Prepaid Debit Cards From The Nearest ATM

The automated teller machine is now ubiquitous and can perform most of the functions you would visit a bank branch for: withdrawing cash, transferring money, making deposits. One thing that has really never changed about ATMs is what they dispense. Cash is cash: untraceable, lightweight, and nobody charges you any fees to use it. How boring and unprofitable. [More]

SunTrust Denies Taking Automatic HELOC Payments, Then Stops Taking Them

Steven opened a free checking account with SunTrust, the bank that holds his mortgage, because it was free and convenient. But something strange started to happen: payments to his home equity line of credit began to magically disappear. His local bank staff denied that this was happening or that it was even possible, but it kept happening. It was convenient, so he didn’t look too far into it. Until the auto-payments that never existed stopped. [More]