Consumer-Friendly Checking Account Practices Vary Wildly From Bank To Bank

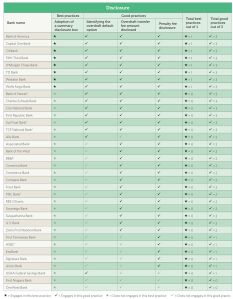

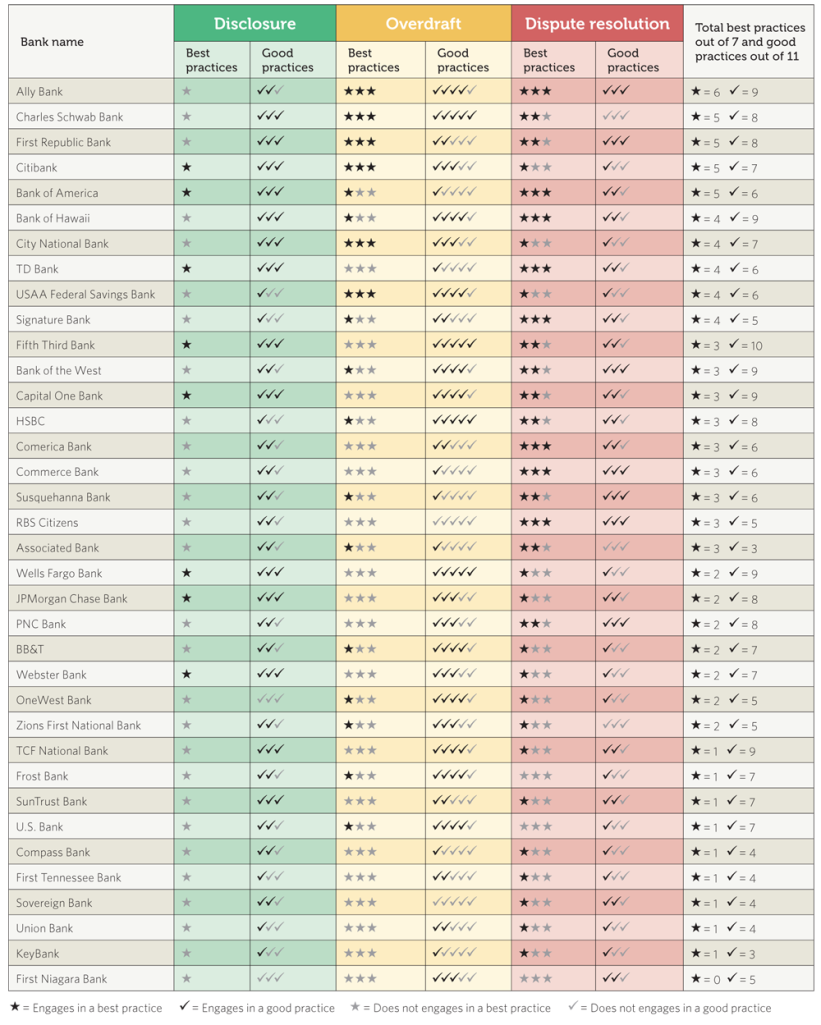

This chart (click to read at full size) shows the overall best/good practices scores for the surveyed banks. As you can see, no one is even close to perfect.

In the latest Safe Checking report [PDF] from the folks at the Pew Charitable Trust, researchers looked at disclosure, overdraft, and dispute resolution policies for the nation’s largest banks to determine if these institutions are being upfront, fair, and honest (or as upfront, fair, and honest as banks can be expected to be) with their customers about the ins and outs of their checking accounts.

Surprisingly, some of the most publicly reviled names in banking, including Bank of America and Citi, were among the institutions with the highest number of best and good practices. But let’s not go patting anyone on the back yet.

DISCLOSURES

For example, in 2011, Pew developed a model summary disclosure box that shows banks how they can concisely list the key fees and terms of a checking account in an easy-to-understand format. While 18 banks have since adopted a form based on the Pew model, only eight of the 50 largest banks — JPMorgan Chase, Bank of America, Citibank, Wells Fargo, TD Bank, Capital One, Fifth Third Bank, Webster Bank — have instituted this level of transparency on disclosures.

The rest of the banks are hit and miss in this category. For example, PNC is transparent about its overdraft transfer and penalty fees, but does not clearly disclose the opt-in policy for overdrafts. Meanwhile, Pew says that First Niagara Bank is not transparent in any of these categories.

Given the lack of standardization in the industry, Pew is asking the Consumer Financial Protection Bureau to require that banks provide information about checking account terms, conditions, and fees in a “uniform, concise, easy-to-read format that would be available online and in financial institutions’ branches.”

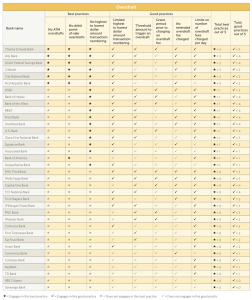

OVERDRAFTS

First, there are the banks that do not allow checking account customers to overdraft (or don’t charge a fee for overdrafting) at the ATM. Only six banks — Citibank, Charles Schwab, USAA, Ally, First Republic, and City National Bank — get a star here.

These same six banks plus Bank of America also have policies that keep basic checking account holders from overdrafting when they use debit cards to make purchases at the point-of-sale.

An even bigger concern — and one that is the subject of pending legislation — is the order in which banks process customers’ transactions. Many banks will process transactions in order from largest dollar amount to smallest.

For example: Say I have $125 in my checking account and the bank has three transactions — for $90, $15, and $50 — to process. If the bank processes these transactions in descending order, I will have overdrafted after the second transaction, incurring a $35 twice (for the $50 purchase and the $15 purchase) in addition to the $30 in actual overdrafts I will have incurred. So I’m now $100 in the hole to the bank.

If those transactions are processed in ascending order, I won’t overdraft until the third transaction. I’ll still have overdrafted $30, but will only incur one overdraft fee for $35, and thus only be $65 in debt to the bank.

According to Pew, the following banks do not engage in the practice of processing transactions from highest to lowest: Citibank, U.S. Bank, HSBC, BB&T, Charles Schwab, USAA, Bank of the West, Ally, First Republic, City National Bank, Frost Bank, OneWest Bank, Associated Bank, Zions First National, Signature Bank, Susquehanna Bank, and Bank of Hawaii.

Some banks — JPMorgan Chase, Wells Fargo, First Niagara, Fifth Third, TCF National, Comerica, Union Bank — only engage in limited reordering of transactions, a practice the Pew folks admit is better than nothing, but still not as consumer-friendly as it could be.

Other not-bad practices at some banks include set a threshold before charging the full overdraft penalty. Thus, overdrafting your account by a dollar or two at the following banks may not result in a whopping $35 fee: JPMorgan Chase, Wells Fargo, U.S. Bank, PNC, HSBC, BB&T, SunTrust, Capital One, Fifth Third, Charles Schwab, USAA, Bank of the West, Ally, City National Bank, Frost Bank, First Tennessee, OneWest, Zions First National, Webster Bank, TCF National, and Bank of Hawaii.

And the following few banks give customers a grace period to cover overdrafts, so that the customer might not get dinged for a fee if a transaction is processed the day before his paycheck is deposited: Wells Fargo, U.S. Bank, PNC, HSBC, Capital One, Fifth Third, Charles Schwab, Bank of the West, Webster Bank, and Bank of Hawaii.

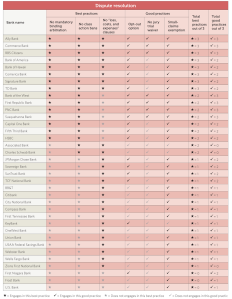

DISPUTE RESOLUTION

Click on the image to see how each of the surveyed banks fared in the Dispute Resolution categories.

And it’s only gotten more complicated in recent years with the rush by all big companies to slap mandatory binding arbitration clauses in their contracts, stripping consumers of their right to challenge a dispute in the courtroom.

So it’s not surprising that only a handful of banks — Bank of America, PNC, TD Bank, HSBC, Capital One, Fifth Third Bank, RBS Citizens, Comerica, Bank of the West, Ally, First Republic, Commerce Bank, Signature Bank, Susquehanna Bank, and Bank of Hawaii — don’t currently have forced-arbitration clauses in their terms for checking account customers.

There are two additional banks — Charles Schwab and Associated Bank — that have arbitration clauses but don’t use these clauses to ban class-action lawsuits. However, it’s worth noting that Schwab’s decision to not ban class-action suits may be temporary, as the bank appeals its right to do so.

Of the banks that do have forced-arbitration clauses, there are six that do allow customers to opt out by notifying the institution in writing — JPMorgan Chase, SunTrust, KeyBank, Sovereign, First Niagara, and TCF National.

Additionally, 26 of the surveyed banks (see above chart for names) do not include a clause in their account agreements requiring consumers to pay the bank’s loss, costs, and expenses no matter the outcome of a dispute. And 34 of the banks have an arbitration exception that allows for certain disputes to be handled in small claims court.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.