To some people, $7 per month isn’t a lot of money, but it is to Timothy. He was relieved when he learned that US Bank would be waiving the newly-imposed monthly maintenance fee on his checking account. That’s why he was surprised when his local branch called him up to discuss ways to avoid maintenance fees. The letter that said, “you’re a valued customer and we’ll be waiving your fees” apparently said no such thing. [More]

banks

Observant Bank Teller Recognizes Alleged Robber As Customer: “Hey, I Know You!”

As the old saying goes, “Don’t [dispose of your bodily waste] where you eat.” One Massachusetts woman learned that the hard way, when a teller at the bank she was allegedly attempting to rob had a bit of a “Eureka!” moment. The plot went all twisty when the teller recognized the person robbing the bank as a customer. Awkward. [More]

Turns Out Regulators Aren't Too Keen On Ice Cream Shops Going Into The Banking Business

Although federal regulators never caught onto my father’s First Bank of Dad, they’re totally paying attention to a Pittsburgh man who’s set up his own community bank right at his ice cream and coffee shop. He even doles out interest in the form of gift cards to his business, which might go over well with his customers, but there are rules against that sort of thing. [More]

Bank Of America Dispenses Phantom Cash, Uberbank Bureaucracy Doesn't Seem Too Worried

Sometimes, our mailbag reads like some kind of reality-based personal finance version of the Penthouse Forum. “I never understood why people are so angry with big banks,” our readers type, “until one of those horror stories happen to me.” That’s sort of what happened to Kestris. She and her husband are longtime Bank of America customers who never really had any problems with the bank. Until they did. It was a big one: when they withdrew their rent from an ATM, the machine made bill-counting whirring noises, but dispensed no cash. [More]

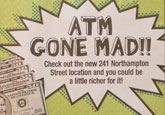

New Branch Promotion Turns ATMs Into No-Lose Slot Machines

How can you spice up a routine visit to the ATM? Easthampton Savings Bank in Massachusetts is promoting a new branch by turning its ATM into a sort of no-lose slot machine. They call it the “ATM Gone Mad,” because sometimes it will dispense $50 bills in place of the normal $20 bills. Cute promo. One local blogger finds it amusing that this is going on around the same time that the nearby city of Springfield is considering a downtown casino proposal from MGM Grand. All of the fun of gambling, none of the risk of financial ruin. But what’s the fun if there’s no chance of destroying your family’s future? [More]

U.S. Banks Are Doing Okay, Made $34.5 Billion Profit Last Quarter

While the big banks plead hardship and whine about having their profits eroded by regulatory reform, they fail to mention that the American banking industry appears to be doing okay, with 12 straight quarters of year-over-year growth and $34.5 billion in profit in the second quarter of 2012 alone. [More]

Plenty Of People Wanted To Move Checking Accounts This Year But Banks Made It Too Tough

Fed up with your bank but too frustrated by how tricky it is to take your money elsewhere? You’re not alone: Our benevolent benefactors over at Consumer Reports have been busy polling bank customers to see how they’re feeling about their financial institutions and found that while almost one-fifth of all consumers with checking accounts flirted with the idea of switching to a new financial institution in the last year, many didn’t just because it was simply too difficult to do so. [More]

Can I Survive The Wells Fargo Takeover Of Wachovia With My Account Terms Intact?

Keith has had the same bank account for eight years, but during that time “his” bank has been four different banks thanks to mergers. Ameribank became First Union, which became Wachovia, which in turn was gobbled by Wells Fargo. That’s just how the history of American banking has worked: what’s the big deal? For the first time in all of these mergers, additional fees will be imposed on Keith’s account. He wants to keep things the way they’ve been for the last eight years, and Wells Fargo wants to move on. Well, it wants to move on to taking more money out of Keith’s wallet. [More]

Zombie Bank Of America Account Makes Me A ‘Delinquent’

The last time that Jen had visited a Bank of America branch, her deposit of more than $3,000 had been credited to the wrong customer, and she was there to make sure that she got her money back. A branch manager denied her assertions, denied that there was a mistake, and told her that she must have deposited the money in another bank. There was no other reasonable explanation…or so it seemed until she pulled out the receipt from her deposit. Oh. She closed her account that day, and assumed that her relationship with Bank of America was now over. She was incorrect. [More]

Regions Bank: Offers Car Loans, Not Sure How They Work

Jennifer took out a car loan from Regions bank way back in 2005, and paid it off in 2009. She never received the title, but that wasn’t an urgent matter until she was ready to get a new car, and sell or trade in her old one. Then she kind of needed the title. Thanks to the stunning incompetence of everyone at the branch where she originally took out the loan, this process somehow took six months. [More]

Pew Says Checking Account Fees Are Still Too High & Complicated

Even though banks have had a whole year since the last time the Pew Charitable Trust looked into potentially harmful practices related to checking accounts, the latest news from Pew indicates those banks haven’t done a whole lot to improve things for consumers. [More]

Citizens Bank Manages To Make Debit Card Number Breach Even More Unpleasant

Mobile apps that can pay for things are pretty neat, but lead to a huge headache if your phone is lost or stolen. Especially if you don’t have a credit card, and use your debit card number instead. When Megan’s iPhone was stolen, she was ready to deal with the annoyance of getting a new debit card and changing her information on each app. She didn’t expect a cascade of incompetence and obnoxiousness from Citizens Bank. [More]

Report: Banks Make It Really Difficult To Take Your Business Elsewhere

Outrage over fees assessed by banks on checking accounts and other unfair practices has led to consumers attempting to leave their institutions in droves. But as a new report by Consumers Union points out, banks throw up a myriad of obstacles that can confuse consumers who are trying to switch banks. [More]

If The Bank Hands You A Counterfeit Bill, You're Probably Stuck With It

While financial institutions often go through various security checks to make sure that the $50 and $100 bills you hand to them are genuine, most consumers will accept these same bills from banks without giving a thought to whether or not they are bogus. Problem is, if you end up with counterfeit cash, you are most likely screwed. [More]

This HSBC Customer Is Left Out Of The Changeover

Last year, HSBC unloaded its credit card division on Capital One, and most of its retail bank branches in the Northeast to upstate New York’s First Niagara Bank. They’ve also been selling off their retail banking operations in other countries. Regular people just aren’t as profitable as we used to be. The thing is, while those branches and all of their customers have been sold, not all of their customers are making the change. George, who lives near a branch but had opened his HSBC accounts online for the sake of convenience, didn’t know this. He’s not associated with a branch, so his account stays with HSBC. He just won’t have a branch to go to. [More]

Are Bank Tellers Going The Way Of The Dinosaur?

Between ATMs, online banking and smartphone apps, the average person can now go months, possibly years, without ever having to go into a bank and interact with a teller. And a number of financial institutions are continuing to looking for ways to remove tellers from the equation — or at least move the tellers somewhere that they aren’t taking up expensive real estate. [More]

Police: Man Tried To Rob Banks While Brandishing Toilet Plunger

A toilet plunger isn’t a terrifying weapon to anyone but germaphobes, or maybe a child with nightmares of being chased by Daleks. Yet a man in Utica, NY thought that it made a terrifying enough weapon that he attempted to rob three different banks while threatening tellers with the plunger. None of the robberies were successful.

Key Finally Decides Not To Make Family Pay Dead Student's College Loans

When a person dies and their estate is settled, any remaining debt dies with them, including student loans. But there’s an exception: if a parent or other responsible grown-up co-signs a loan and the borrower dies a tragic young death, that co-signer is on the hook for the entire amount of the loan. That’s how co-signing works, after all. But after a Rutgers student died in 2006 after two years in a coma, most of his lenders (credit cards and student loans) deferred, then forgave his debts. Key Bank was the holdout, since the student’s father had co-signed his college loans at Key. Since 2006, the family has paid $20,000 of the $50,000 balance. It took an awful lot of negative publicity, but Key says that they will forgive the debt, and might not even put future families in the same terrible situation. [More]