In the wake of the the massive Equifax customer data breach, many consumers are wondering: Why, exactly, should we be paying the credit bureaus for credit freezes or monitoring when it was one of them that just lost all our personal data? Two U.S. Senators are wondering that, too, and have now introduced a bill to fix it. [More]

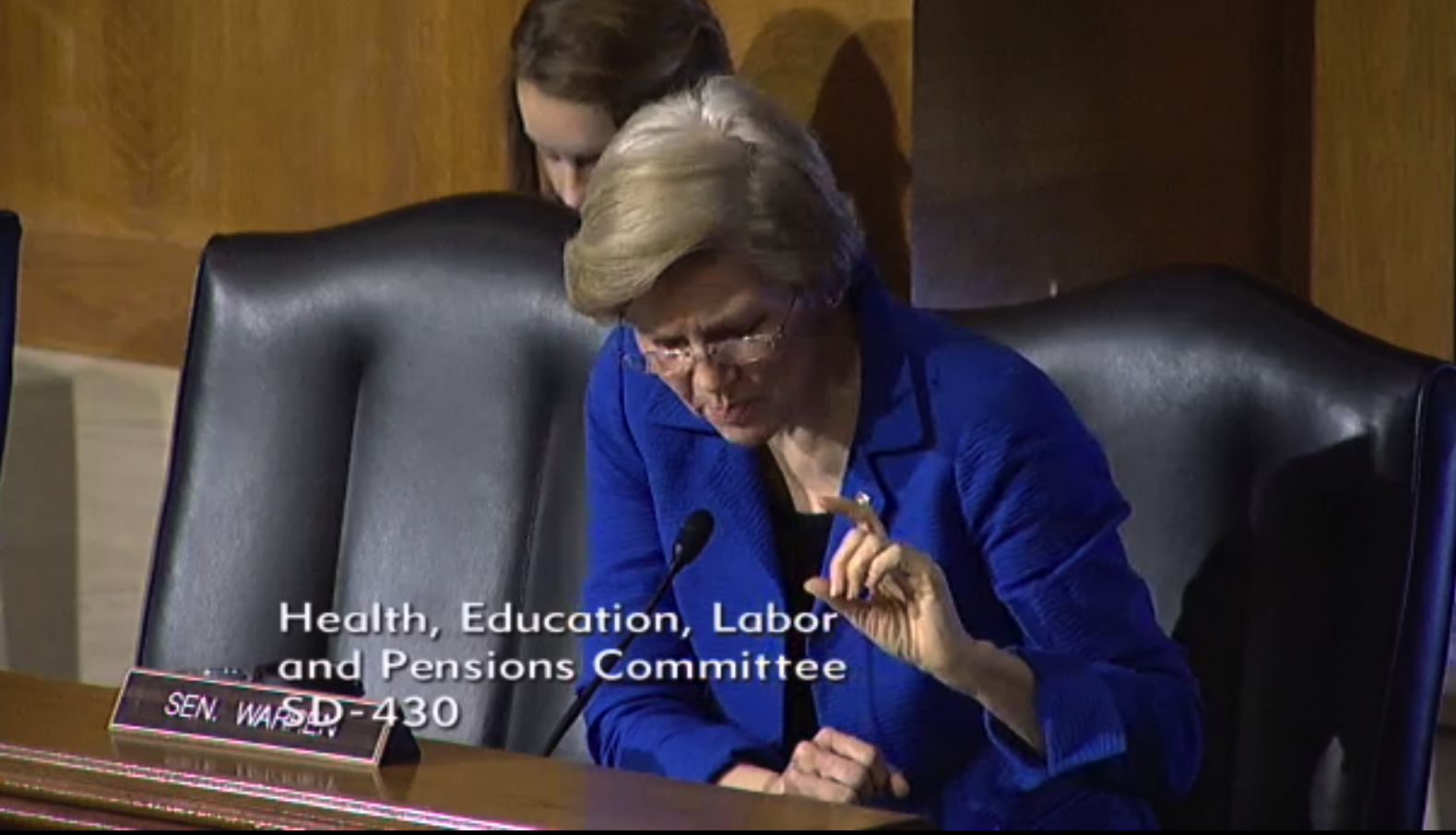

elizabeth warren

Will The Federal Reserve Fire Wells Fargo Board For Fake Account Fiasco?

Last month, Massachusetts Senator Elizabeth Warren urged the Federal Reserve to oust the 12 Wells Fargo board members who served during the bank’s fake account fiasco. Today, she received a response, sort of. [More]

Lawmaker Calls For Ouster Of 12 Wells Fargo Board Members

Since Wells Fargo’s fake account fiasco came to light in Sept. 2016, the top executive at the bank has “retired,” other executives have departed, and many have lost bonuses. Despite this, there are many holdovers from the years when employees opened millions of unauthorized accounts. To this end, Massachusetts Senator Elizabeth Warren is calling for the ouster of 12 Wells Fargo board members. [More]

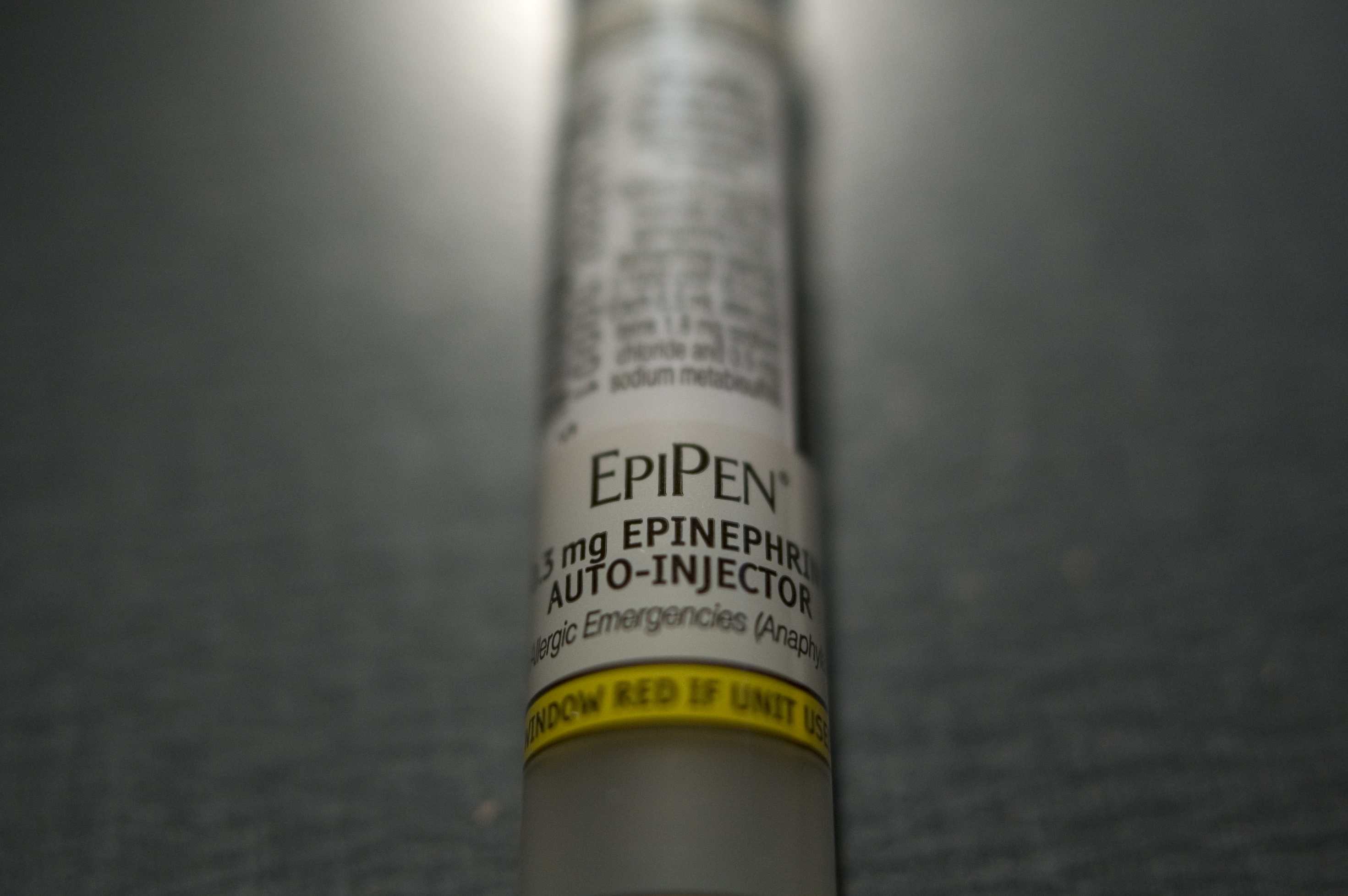

Sen. Elizabeth Warren: $465M Mylan EpiPen Settlement Is “Shamefully Weak… Shockingly Soft”

Earlier this month, drugmaker Mylan disclosed a $465 million settlement with the U.S. Department of Justice over allegations that the company had defrauded the Medicaid system by mis-categorizing its high-priced EpiPen allergy treatment. The DOJ has still yet to confirm this settlement or provide any details, and critics of the deal say it looks like Mylan is getting off easy. [More]

More Than A Year After Corinthian Collapse, Students Still Waiting For Financial Aid Help

Eighteen months after Corinthian Colleges Inc. completed its collapse – closing the remaining Heald College, Wyotech, and Everest University – tens of thousands of former students are still waiting to received some form of relief from the mountains of student loan debt they incurred to attend the defunct college. [More]

Senators Call For Inquiry Into Impact Of Airbnb & Other Short-Term Rentals On Affordable Housing

Short-term rental platforms like Airbnb, VRBO, and HomeAway are intended as a way to give travelers varied and interesting lodging options, while letting homeowners make a bit of money when they aren’t at home. However, a group of three senators are concerned that the affordable housing market is being squeezed by the increasing number of property owners cashing in on short-term rentals.

[More]

Elizabeth Warren Says Accreditor Of For-Profit Colleges Has “Dismal Record Of Failure”

Only days after a report found that an organization responsible for accrediting a number of for-profit colleges had engaged in a “pattern” of providing approval to schools with bad track records, resulting in these colleges receiving nearly $6 billion in federal funds, Sen. Elizabeth Warren is joining the chorus of voices calling on the Department of Education to take action. [More]

Lawmakers Continue Crusade To Rein In For-Profit Colleges Targeting Servicemembers

In recent months federal regulators and government agencies have increased scrutiny of for-profit colleges and their interactions with servicemembers, veterans and their families. Today, lawmakers furthered that mission by introducing legislation that would restore previous limits on how much money these educational institutions can receive from the federal government via military benefits and other programs. [More]

Legislation Would Hold For-Profit College Leaders Accountable For Misrepresentations

Lawmakers on Tuesday continued their mission to protect consumers from unscrupulous players in the for-profit college industry by introducing legislation that would impose stiffer penalties and restrictions on the leaders of such institutions. [More]

Mass. AG, Lawmakers Call For More Assistance For Former Corinthian College Students

Ever since for-profit education chain Corinthian Colleges Inc. closed its Everest University, WyoTech and Heald College campuses, leaving tens of thousands of students with millions of dollars in loans, consumers advocates, legislators and others have urged the Department of Education to relieve former students of their debt burdens. Those calls for help continued on Tuesday with renewed pressure from Massachusetts Attorney General Marua Healey and Sen. Elizabeth Warren calling on the Dept. to rid victims of the defunct for-profit college of unsustainable loan payments. [More]

Why Didn’t Dept. Of Education Find Problems With Loan Servicer Fined $100M?

Last May, investigations by the Department of Justice and the Federal Deposit Insurance Corporation into student loans servicing resulted in a $100 million fine against government-contracted servicer Navient for allegedly violating federal laws limiting the amount of interest that can be charged on servicemember student loans. Following those investigations, the Department of Education undertook a review that found its four servicers – including Navient – weren’t cheating military personnel. With such conflicting reports, members of Congress are now getting involved, calling for an investigation into the Dept. of Education’s review process. [More]

Sen. Elizabeth Warren Has Some Choice Words For Chase CEO Jamie Dimon

Earlier this week, JPMorgan Chase CEO Jamie “It sounds like Diamond” Dimon, was quoted as saying that Sen. Elizabeth Warren, an outspoken advocate of financial reform who helped create the Consumer Financial Protection Bureau before becoming a lawmaker, was clueless about how banks actually work. The Massachusetts senator says that Mr. Dimon doth protest too much. [More]

Senators Urge Regulators To Block Comcast Acquisition of Time Warner Cable

As we head into the final stretch of regulatory review for the pending $45 billion of Comcast and Time Warner Cable — and with the Dept. of Justice possibly prepping to block the deal — a group of U.S. Senators has written to U.S. Attorney General Eric Holder and FCC Chair Tom Wheeler urging them to prevent these two companies from getting hitched. [More]

Student Loan Borrower’s Bill Of Rights Would Reform Disclosure And Servicing Standards

In recent weeks, legislators have introduced a range of bills aimed at addressing student loans and revamping the laws governing those debts. Today, that push continued with the reintroduction of a bill that would ensure student borrowers are treated fairly and understand the range of options at their disposal. [More]

Senators Chastise Govt. For Making Money Off Struggling Student Loan Borrowers, Not Offering Enough Relief

For several years now the government has offered federal student loan forgiveness programs aimed at helping borrowers to avoid defaulting on their debts. While recent reports have shown that the popularity of the programs has exceeded expectations, a group of six senators say the Department of Education could do more given the billions of dollars in payments it receives from federal loans each year. [More]

Senate Set To Vote On Bill To Refinance Private & Federal Student Loan Interest Rates

A bill left for dead in the Senate back in June has been resurrected. The Bank On Students Emergency Loan Refinancing Act that would allow consumers to refinance their student loans to the rate currently being issues on new federal and private student loans is slated for a vote Tuesday morning. [More]