As Halloween draws closer, here’s a reminder of what you should really be scared of: ATM skimmers, or devices that attach to cash machines to slurp up customers’ card numbers and PINs. You should also be afraid of adults in creepy baby doll masks. According to police in Minnesota, a recent crime there incorporates both of these terrifying prospects, with a mask-wearing suspect accused of placing skimmers on ATMs in two counties and stealing tens of thousands of dollars. [More]

credit unions

Arby’s Admits Malware Infection And Credit Card Breach At Hundreds Of Restaurants

The last time you satisfied your craving for seasoned curly fries at Arby’s, did you use a credit or debit card? It’s time to start watching your statements for fraudulent transactions and also to watch your mailbox for a new card: Arby’s announced a payment card breach at a few hundred of its restaurants. [More]

Pot-Centric Colorado Credit Union Sues Federal Reserve Bank For Denying Account

The state of Colorado no longer outlaws recreational marijuana use, but the U.S. government still considers it a Schedule I controlled substance, so many businesses making money from the locally legal sale of cannabis are having trouble finding banks to handle their cash. One credit union formed with the goal of providing financial services to those in the marijuana industry received a charter from Colorado, but has filed suit against a regional Federal Reserve bank for blocking its ability to work with other banks. [More]

Does Postdating A Check Prevent Anyone From Depositing It Early?

Thanks to automated payments and online banking, many of us rarely (if ever) write checks, but millions of Americans still pull out their checkbooks every day to pay their bills. Because they might not always have enough money in their accounts on the day they write those checks, some folks will postdate their checks so that they aren’t deposited or cashed until after that date. Unfortunately, the fact is that there’s generally no actual obligation to honor the date on a check. [More]

1-In-4 Americans Turn To Payday Loans & Other High-Cost Financial Products

When discussing the topic of payday loans — or other high-cost, short-term financial products like auto-title loans and check-cashing — there can be a tendency to treat them like something that only a small percentage of Americans use. But a new report from the FDIC confirms that 25% of us have turned to one of these potentially predatory services in the past year, and that this rate has not been going down. [More]

Service Members Deserve More Transparency From On-Base Banks, Credit Unions

The Military Lending Act attempts to shield military personnel and their families from some predatory lending practices, but a new report from the Pew Charitable Trusts claims that some traditional banks on military bases are nickel-and-diming members of the armed forces with excess overdraft fees, and a general lack of transparency.

After Target Breach, Banks Are Way Behind In Reissuing New Cards

The baddies behind the recent Target payment data breach are selling off card data at fire-sale prices and cranking out cards that can be used in the real world, some of the people whose card numbers were breached have a long wait to get their new cards issued. [More]

USAA No Longer Offering Bank Accounts To Everyone

Sad news, Consumerists. There was a brief, shining period beginning in 2009 when anyone, not just people affiliated with the military, could get checking and savings accounts from the almost-universally-beloved USAA. Now that dream is over. [More]

Report: Some Credit Unions Are Still Involved In Payday Lending

Loans from federal credit unions are currently capped at 18%, though some qualifying short-term loans can go as high as 28% (plus a $20 fee). These numbers are far below the standard three-digit APRs you see on payday loans, but a small number of credit unions are still figuring out ways to hook customers up with these questionable, high-interest loans. [More]

Bank Of America Dead Last In Customer Satisfaction Study

The folks at the American Customer Satisfaction Index have released their latest report on the banking industry and for the sixth year in a row, credit unions and small banks have outscored all the large financial institutions. And for the second consecutive year, Bank of America is bringing up the rear. [More]

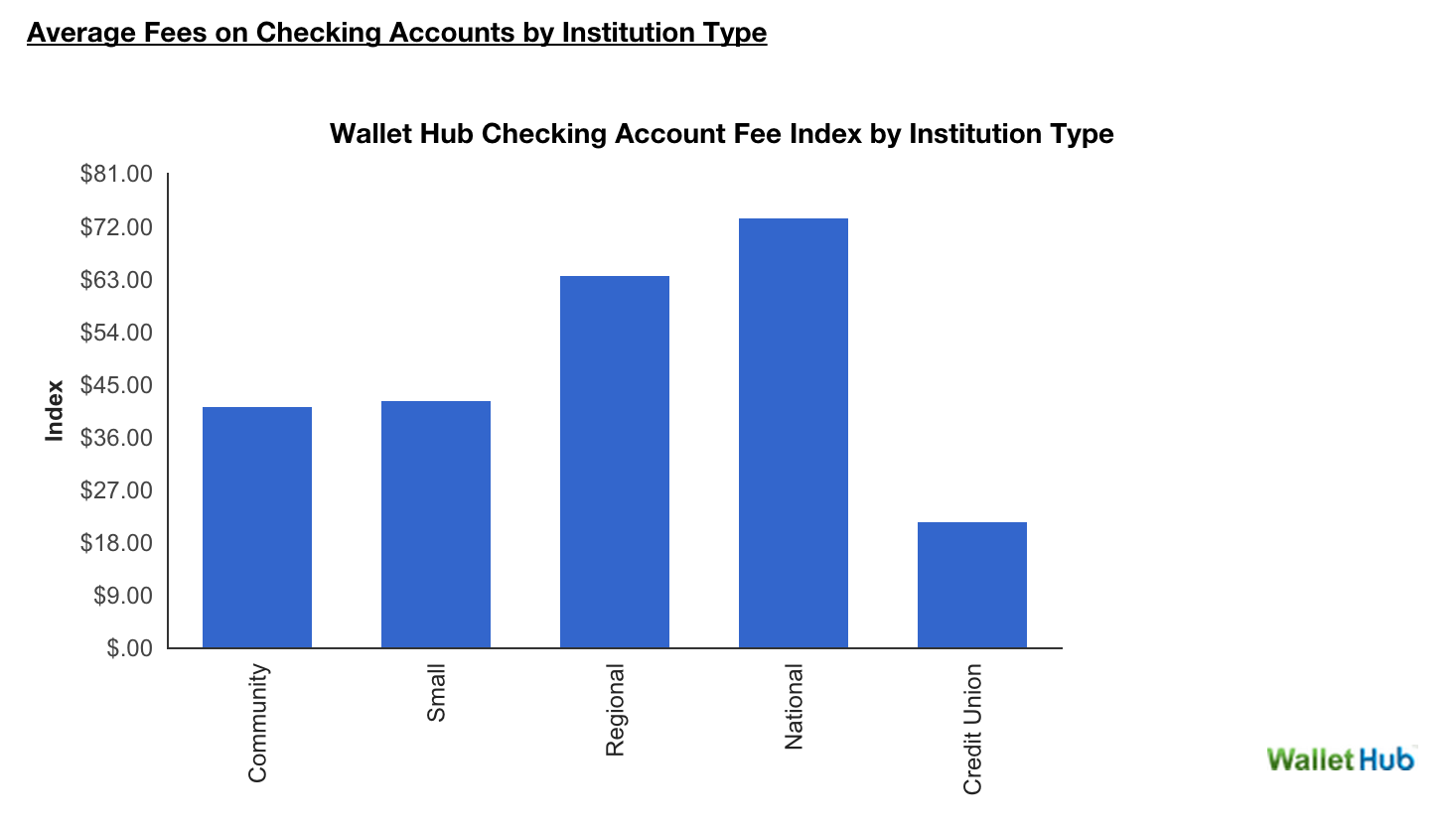

Survey: When It Comes To Free Checking, Small Banks & Credit Unions Do The Best

There’s somewhat of a stark difference between big banks and their smaller counterparts and credit unions in the realm of free checking. Not having to pay for such an account is a big draw for consumers, and according to a new survey from the U.S. Public Interest Research Group, you’ll have much better luck finding gratis checking services at those small banks and credit unions. [More]

Reforms Needed To Keep Consumers From Being Trapped In Their Old Bank Accounts

It’s been nearly a year since the first Bank Transfer Day, when people around the country ditched fee-laden accounts in favor of more consumer-friendly institutions, and yet many bank customers still find roadblocks that keep them from easily jumping ship from one bank to another. [More]

Closed BofA Bank Account Mysteriously Reopened With 1 Penny Balance

Chris was one of the many in October who closed their bank accounts with Bank of America, and other similar big retail banks, in protest over planned fees for using their debit card. But last week she found it had been reopened for no apparent reason, with a 1 penny balance out of nowhere. [More]

Video: Occupy Portlanders Open Credit Union Accounts On Bank Transfer Day

Saturday was the fifth of November, and many remembered to take a stand and shut down their big retail bank accounts, transferring their cash to a new credit union account. Here’s a video out of Occupy Portland covering what happened on Bank Transfer Day. Interviewees talk about why they’re switching to a credit union, and how this is just the beginning. [More]

Here's An Idea: Credit Union Pays Members For Using Their Debit Cards

Instead of charging customers a $5 monthly fee for using their debit cards, one credit union is actually paying its members to use their debit cards. In a direct jab against the big banks, First Community Federal Credit Union is running a promotion that lets members earn up to $5 a month for swiping their debit card. [More]

650,000 People Joined Credit Unions In Just The Last Month

In the month following the announcement of Bank of America’s (subsequently scrapped) plan to charge a $5 fee to some of its debit card users, at least 650,000 Americans consumers have opened accounts at a credit union. According to some reports, that’s 50,000 more than the number of new accounts opened in all of 2010. [More]

Video Of People Closing Down Their Accounts At Big Banks

Tomorrow is Bank Transfer Day. By this date, people all across America are shutting down their accounts at large, costly, name-brand banks and transferring their funds to new bank accounts at their local credit union or community bank. Here is an excellent video made in Portland that follows along with several different people as they close their bank accounts and give their reasons for doing so. One person wants to save money, another disagrees with the bank’s foreclosure practices, a third is mad about the bailouts, and the last is a union withdrawing its funds to show solidarity with holding Wall Street accountable. [More]