The day is finally here. No, not the day before Thanksgiving. Something far more important than spending time with your family, National Opt-Out Day. People who are doing it plan to, when asked to step through the body imaging machine, opt-out and get the enhanced pat-down instead. Are you gonna do it, or do you think it’s stupid – or worse? Take our poll! [More]

your rights

Your Credit Report Isn't The Only Report You Should Monitor

When an insurer decides whether to offer you a new policy, or whether to raise rates on a current one, he most likely pulls a CLUE report that lists any homeowner or automobile insurance loss claims (or sometimes even just inquiries) that you’ve made over the past 3-7 years. Hopefully you monitor your consumer credit report for errors, but as you can see, that’s not the only one you should keep an eye on.

Never Follow A Security Guard Into The Back Of The Store

Here’s some advice for you, the regular customer who doesn’t shoplift: never go into the back of a store with a security guard, store manager, rent-a-cop, etc. Never. Someone posted the following story in the Janesville, Wisconsin CraigsList over the weekend. Because the poster cooperated in good faith with the security personnel at her local Menards home store, she had to pay $150 to avoid having the police called on her.

Home Depot Needs To Check Your Receipt "In Case You Stole Something"

Rather than make up some line about needing to make sure customers receive everything they paid for, Home Depot is now openly treating its customers like shoplifters.

Senate Protects Employee Rights With Forced Arbitration Ban

Yesterday, the Senate adopted an amendment that will prevent federal funding from going to any contractor that requires its employees to use mandatory binding arbitration, instead of court, for sexual assault and civil rights claims against the company.

Squash Minimum Purchase Fees With Wallet-Sized Merchant Agreement

Fed up with stores not knowing the rules for credit card purchases, Andy at NonToxicReviews created this handy credit-card-sized PDF of the relevant portions of Visa’s and MasterCard’s merchant agreements.

Wave Of Fake Debt Collectors Hints At Possible Data Breach

The Better Business Bureau has released a warning to be aware of scammers calling to threaten people with arrest “within the hour” for defaulting on payday loans. What makes them stand out from normal debt collecting scammers is these callers have huge amounts of personal info on their victims, including Social Security and drivers license numbers; old bank account numbers; names of employers, relatives, and friends; and home addresses.

REI Says ATM Photographer Is Welcome In Their Store Any Time

REI’s Director of Corporate Communications contacted us with an official statement about the recent showdown between two Loomis security guards and a customer with an iPhone at one of their Seattle stores. She says despite the document Shane says he was forced to sign at the police station, he is not banned from their stores. Below is REI’s official statement.

Loomis Rent-A-Cops Have Shopper Cuffed, Hauled Away Over ATM Photo

While Shane was standing in the customer service line at a Seattle REI, he watched two Loomis employees open and change out the cash in an ATM machine. Shane took a photo of them with his iPhone. This apparently freaked out the Loomis guards, the REI security staff, and then the Seattle police, who put handcuffs on Shane, drove him to the police station, and then made him sign a statement that he wouldn’t return to a REI store for a year. You might have noticed in that summary that they didn’t actually bring any charges against him, which should make it clear to anyone who wants to side with the faux Po-Po that what Shane did wasn’t illegal, that the rent-a-cops should be fired, and that REI and Loomis owe Shane a big apology.

What Do The Notes On Your Account Really Say?

Pretty much every problematic customer service story these days includes some reference to the Notes—that unseen record of what you’ve been told, and by inference what you’ve agreed to, on previous calls. The funny thing is, you never get to see them.

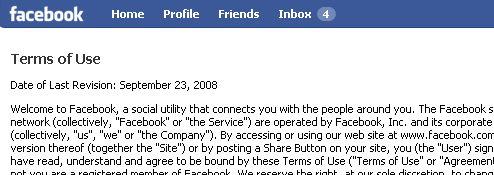

Facebook Will Let Users Help Draft New Terms Of Service

We are open to putting the documents up to a vote. The rules people must do when on the site and what we must do, a two way thing. There will be Comment periods, a council that will help on future revisions.

What Facebook's Users Want In The Next Terms Of Service

Now that Facebook has said they’re drafting a new Terms of Service based on community input, that community has eagerly put forth their proposals in the Facebook Bill of Rights and Responsibilities Facebook group. Forum admin Julius Harper went through the 27 pages of feedback and pulled out the three major areas the community seemed most concerned about. Here’s what the people are demanding:

Facebook Reverts Back To Old Terms Of Service

It appears in the wake of global attention and outcry, Facebook has, as of at least 12:27 am, reverted back to the previous Terms of Service. Phew, now we can all go back to sending each other digital cupcakes without Big Brother watching us. This is a temporary move until Facebook can draft a new Terms of Service that addresses the users’ concerns. CEO Zuckerberg wrote a new blog post, and Facebook spokesperson Barry Schnitt released this statement:

Facebook Privacy Fallout Goes Nuclear

Online, in print and on TV, Consumerist’s Facebook terms of service change story, and the ensuing global uproar, has spread like Ebola in a monkey house…

Facebook's New Terms Of Service: "We Can Do Anything We Want With Your Content. Forever."

This post has generated a lot of responses, including from Facebook. Check them out here.

Mandatory Binding Arbitration: The Worst Choose Your Own Adventure Ever

Mandatory binding arbitration agreements are bad for consumers for so many reasons that, unless you’re the victim of one, it’s hard to keep track of the various ways you can be screwed. So we’ve come up with this helpful illustration: a choose-your-own-adventure-styled trip through the arbitration process.

More On Minimum Purchases, Surcharges, And Other Credit Card Merchant Agreement Violations, From The Companies Themselves

We’ve posted a lot of stories of businesses requiring customers who pay with a credit card to make minimum purchases, or pay a surcharge, or show ID. And as we’ve repeatedly said, the businesses’ merchant agreements with the credit card companies forbids these practices. A reader wrote in to argue that this might not be true, as many businesses contract with third-party credit card processors, and are not bound by the merchant agreement. So we did some investigating.

This McDonald's Charges 25¢ To Use A Credit Or Debit Card, Violates Merchant Agreement

Reader Brandon sent us this picture of a McDonald’s violating its merchant agreement by charging a fee for using a credit or debit card. The text reads, “FEE ASSOCIATED WITH CREDIT/DEBIT CARD OF 25¢ WILL BE APPLIED TO CARD TOTAL.”