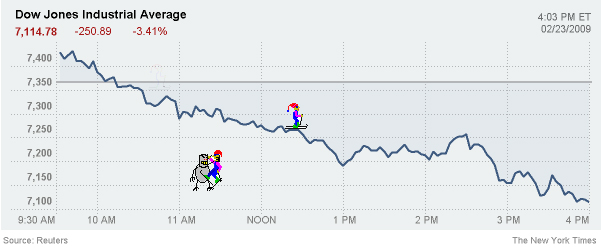

Bad day on Wall Street today, folks. The S&P 500 closed at the lowest level since April 1997.

wells-fargo

Meet The Savings & Loan That Destroyed Wachovia

60 Minutes recently took a look at World Savings Bank, the acquisition that ultimately wounded Wachovia so badly that it had to be acquired by Wells Fargo. What was wrong with an institution for which Wachovia was willing to pay $25 billion? Well, one whistleblower claims that World Savings was engaged in fraud and predatory lending — tricking its customers into signing up for dangerous “option-arm” or (as they cheerfully called them) “pick-a-payment” loans.

Secret Phone Numbers And Email Addresses To Reach Executives At 101+ Companies

Inside, email addresses, phone numbers, and addresses for over 100 different companies to inject your customer service complaints into their corporate executive offices, and get it well on the way to success.

../../../..//2008/10/22/wachovia-announced-their-237-billion/

Wachovia announced their $23.7 billion third quarter loss with an all-too-easy-to-mock pre-taped conference call. “Let’s just close our eyes and imagine what the combination of Wells Fargo and Wachovia will create,” said CEO Bob Steel. We suppose that does make it easier not to rudely stare at the number “23,700,000,000.” [WSJ Deal Journal]

Wells Fargo Wins, Will Buy Wachovia

Wells Fargo is the winner in the battle for Wachovia, says the New York Times. Apparently, Citibank became nervous about splitting the bank when they saw the size of the “bad assets” it would have to take on, and quietly walked away. The bank will continue to seek $60 billion in damages, however.

Citibank, Wells Fargo May Carve Up Wachovia, Feast On Its Bones

Bloomberg is reporting that Wells Fargo and Citibank may split Wachovia. Neither bank would get assistance from the government and taxpayers under the deal being discussed now.

Not So Fast: Judge Blocks Wachovia Sale To Wells Fargo, Citibank Rejoices

Tsk tsk, Wells Fargo. You should’ve known that stealing Citibank’s unspoiled bride at the alter was going to draw a bitter legal challenge. Late last night, Citibank’s team of repo-lawyers claimed a partial victory, announcing that a New York judge has agreed to block Wachovia’s sale. Citibank is also demanding $60 billion from Wells Fargo for interfering with the deal.

Giddyup! Wells Fargo Rides In And Steals Wachovia From Citibank!

Attention Wachovia customers: Wells Fargo just rode on on that stagecoach thing of theirs and stole your bank from Citibank, says the NYT. Rather than pick apart the pieces of Wachovia, Wells Fargo is going to buy the whole darn thing.

../../../..//2008/10/03/surprise-wells-fargo-is-buying/

Surprise! Wells Fargo is buying Wachovia, even though Citibank said at the beginning of the week that it was going to. (Check out the full post here.) Unlike Citibank, Wells Fargo will absorb all parts of Wachovia, including its securities and retail brokerage biz, in a “$15.1 billion all-stock merger.” [DealBook] (Thanks to Stephen!)

Contact Info For Wells Fargo CEO John Stumpf And Friends

Here’s some info we dug up that can help you contact some higher ups at Wells Fargo if you’ve tried regular customer service and escalating to supervisors and it’s not working out.First read this post about how to contact and conduct yourself when using executive customer service. [More]

Home Mortgage Collector Confessor Responds To Your Comments

In response to some of the comments posted on 12 Confessions Of A Home Mortgage Collector, the confessor has sent in a followup letter to answer your questions, and clarify some of his statements.

12 Confessions Of A Home Mortgage Collector

A former Wells Fargo Home Mortgage home collector has stepped forth from the shadows to tell you what’s really going on. Here’s his confession:

Amex Tops JD Power Credit Card 2008 Customer Satisfaction Survey

JD Power and Associates ranked American Express at the top of their 2008 Credit Card Satisfaction Study. Customers gave the company high marks in interaction, billing and payment processes, reward programs, fees and rates, and benefits and services, with the first three factors standing out in particular. Capital One and HSBC, which target revolvers with lower credit scores, received the worst marks. Oddly, Discover got second place. People must really like their two-cycle billing (see “Two-Cycle Billing And Why It’s Evil“). Full rankings inside…

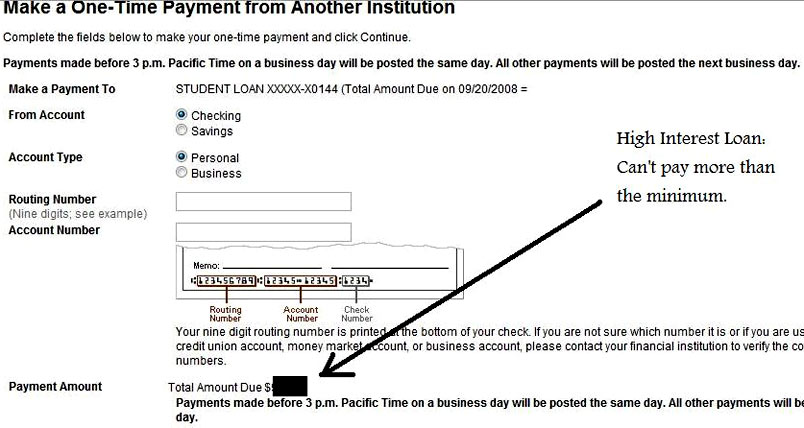

Wells Fargo Forces You To Pay Off Loans Costliest Way Possible

According to reader Caleb, Wells Fargo seems to have recently crippled their loan repayment system in a way that makes it impossible for borrowers to pay off loans the way they want to. That is, unless you prefer to let your highest-interest loans ride for as long as possible while you pay off your lower-interest loans…

96 Numbers For Wells Fargo Card Service Senior Management And Their Direct Reports

If you have a problem with your Wells Fargo-issued credit card and regular customer service isn’t helping you, you might want to try one of the 96 people whose phone numbers we have posted inside. Just like with tier 1 customer service, you want to be polite, professional, and able to calmly tell them exactly what you want in a sentence or two. This primer on using executive customer service should help too. Time to put that stagecoach on turbo!

Banks Put 8-Week Hold On IndyMac Checks

People who got their money from IndyMac are facing new challenges as other banks put extended holds on releasing the funds when the checks are deposited. WaMu is putting 8-week holds on the checks. Wells Fargo is putting holds on amounts over $5,000. If you deposit more than that, Wells Fargo will only let you have access to the first $5,000. The Office of Thrift Supervision is looking into whether this is ok or not. Good, we needed something like this, that panic wasn’t looking frothy enough.

If Wells Fargo Calls To Offer You An Equity Loan On Your Car… Say No.

Over on the Credit Slips blog, Elizabeth Warren posted an email from a bankruptcy lawyer who was stunned at the horrible deal one of her clients got from Wells Fargo on an equity loan on a car.

Wells Fargo Allows Your Data To Be Breached – Twice

Reader Bryan’s Wells Fargo credit/debit card stopped working unexpectedly one day while he was trying to gas up his car. He was confused because he had used the card the night before with no problems. He spoke to a Wells Fargo CSR at a local branch and discovered that the data for 125,000 cards, including his, was “compromised” thus deactivating his card. This had already happened to him once before within the last year and he was not pleased. His letter, inside…