This year’s deadline for filing federal taxes is April 17th, giving slackers two extra days to finish their returns. State taxes may still be due on April 16th.

taxes

Get Missing W-2s By Siccing IRS On Your Employer

We finally wrested our W-2 from our previous employer’s hands and all it took was the threat of an IRS fine.

Beware The Vanishing Hybrid Tax Credit

Consumer Reports cautions that buyers of popular hybrid vehicles may soon be ineligible to claim the Alternative Motor Vehicle tax credit. The credit sunsets when a manufacturer sells more than 60,000 qualifying vehicles, a figure Toyota has already reached.

The credit has already begun to phase out for Toyota and Lexus hybrids purchased after September 30, 2006, and others will follow suit as they reach the sales volume target. The 2006 Prius’ tax break, for instance, dropped in half to $1,575 if it was purchased after that date, and it will split again to $788 between April and the end of September, 2007. After that, the Prius rebate disappears altogether.

The IRS provides a list of models certified for credit. Available only to those not subject to the alternative minimum tax, the credit can be worth up to $3,150 for vehicles purchased after 2005. — CAREY GREENBERG-BERGER

Tax Tip: Cell Phones Qualify For Telephone Excise Tax Refund

You may be one of the nearly 160 million phone customers who can request a refund of the 3% federal excise tax paid on long-distance and bundled phone service billed after Feb. 28, 2003 and before Aug. 1, 2006. Federal long-distance excise taxes paid on cell phone, land line, fax, Internet phone service and bundled service all qualify for the refund.

For more information about the telephone excise tax refund, click here.

Download Tax Cut For Free

Still haven’t done the old taxes? Here’s your chance to download TaxCut Premium Federal from HRBlock for free.

CPA Answers Your Tax Questions For Free

The I Will Teach You To Be Rich blog has a certified public accountant (CPA) guest posting for the next month who will answer reader tax questions for free.

Smart Taxpayer Roundup

“…here’s the step by step process for notifying the IRS when nicely phoning the office manager hasn’t worked.”

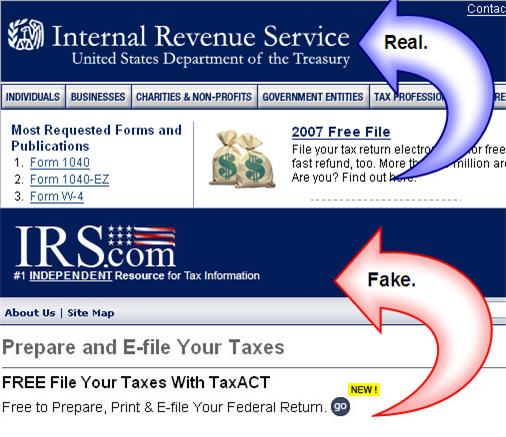

Tax Tip: Watch Out For Fake IRS Sites

The IRS issued an official warning to consumers to watch out for fake IRS sites. The only official IRS website is IRS.gov. Any sites ending with .com, .net, or any other common extension are not official IRS sites.

Why We Procrastinate On Our Taxes

•Delusion No. 1: If I put off filing until the last minute, I’ll have less chance of getting flagged for an audit amid the flood of deadline filers. “I don’t think so,” says Adams. “I’ve never heard that on either this side of the desk or the other.”

Still Missing A W-2? Call The IRS

Still missing last year’s W-2? We mentioned this tip a month ago, but here’s the step by step process for notifying the IRS when nicely phoning the office manager hasn’t worked.

Move Your Cell Phone To Nevada For Tax Purposes

Apparently, Verizon ties 3 addresses to your account which can all be different. There’s your BILLING address, YOUR address and your CELLPHONE’S address. The tax rate is tied to where your CELLPHONE resides which can be completely arbitrary for all they care.

IRS Has $2.2 Billion For People Who Haven't Filed a 2003 Tax Return

If you’re one of the 1.8 million people who haven’t bothered to file your 2003 tax return… it’s not too late! No, really. It’s not. You have until April 17, 2007 to file. And why wouldn’t you? The IRS has 2.2 billion dollars waiting for you to collect. If you thought you were in trouble, don’t worry. There’s no penalty for filing a late return if you qualify for a refund.

How To File A Federal Tax Extension

My Money Blog tells us how to submit for a federal tax filing extension if you’re still waiting for some forms or you just don’t think you can get it together in time.

Tattle On Tax Cheats, Get Big Bucks

Know someone who is cheating on their taxes? Under a IRS program enacted in December, you could fink on them and receive a sizable reward.

How To: Attract An IRS Audit

Sometimes the best way to avoid something is to know what attracts it. Thankfully, J.D. at Get Rich Slowly has put together a list of suspicious items that will set off an audit flag on your return. Here are a few:

Hunt Down Your Missing W-2s and 1099s

The deadline for mailing W-2s and 1099s was Jan. 31, so if you don’t have yours yet…they’re probably lost in the mail. Don’t panic, Blueprint for Financial Prosperity has some tips to help track them down.

Avoid The "Dirty Dozen" Tax Scams

It’s nice to save money at tax time, but watch out your preparer isn’t leading you into a scam, like these on the IRS top twelve to watch out for this year:

10 Phat Tax Breaks

CNN Money has got ten “secret” deductions to use this year. Yeah, that phone tax rebate that everyone won’t shut up about is there, but there’s also…