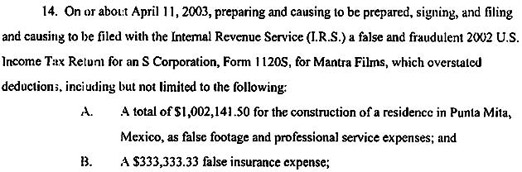

Joe Francis, the quivering chumbucket behind the “Girls Gone Wild” franchise, got indicted Wednesday for tax evasion, as noted by commenter LAGirl. His story holds a lesson for all taxpayers: when claiming deductions, don’t use funny-looking numbers.

taxes

Tax Tip Roundup

AHHHHHHH OH MY GOD TAXES. Don’t worry, you don’t have to mail them until Tuesday. For those finishing their taxes this weekend, here’s some tips to get you started.

CPA Answers Blog Readers' Tax Questions

I Will Teach You To Be Rich took over 100 reader tax questions and posted answers to the best ones from from David Bergstein, CPA.

Avoid Big Name Tax Places

We haven’t been getting many complaints about tax places this year but as far as we know, they still suck. They’re known for messing some people’s returns up pretty bad, or encouraging people to take questionable deductions. Like making up a child, for instance. Here’s a walk down memory lane, a lane that’s definitely shady…

April 30th Is "Tax Freedom" Day

April 30th is the day you stop working for the government and start working for yourself, according to the Tax Foundation’s annual estimate dubbed “Tax freedom day.” CNNMoney explains:

Avoid IRS Audits

WSJ says the IRS is ramping up its audits this year, especially for high-earners. Here’s some ways to duck the ax.

12 Common Tax-Filing Mistakes You Can Avoid

Bankrate has 12 common and avoidable mistakes people make when filing their taxes.

Taxes: Deductions For Non-Itemizers

Even if you’re just going to claim the standard deduction, Don’t Mess With Taxes says there’s above-the-line “deductions” you can take.

US Government Sues Jackson Hewitt Alleging "Pervasive Fraud"

The US Government has filed “civil injunction suits against five corporations that operate Jackson Hewitt tax preparation franchises, as well as 24 individuals who manage or work at the franchises.” The suits allege that employees at 5 Jackson Hewitt franchisees committed pervasive fraud.

Taxpayer's Advocate Service Gets Your IRS Issues Unstuck

If you’ve got a longstanding tax issue that you’ve tried to resolve with the IRS but were unable, get in touch with your local Taxpayer Advocate. It’s an independent office within the IRS whose job is to see that citizen’s tax issues are “promptly and fairly” handled.

Tax Deductions You Might Not Know About

Check out the Kiplinger’s guide to what items you can deduct from your tax return.

Consider Itemizing Your Telephone Tax Refund

I found out about the telephone tax refund available on this years tax returns via Consumerist. Would you please encourage your readers to itemize their excise tax charges instead of taking the standard refund amount?

Can't Afford Your Taxes? Apply For An Installment Plan

Can’t afford to pay your taxes in full? Sign up for an installment payment plan using form 9465. [PDF]

Tax Advance Loans On The Retreat

The number of refund anticipation loans declined 22.5% last year as consumers took advantage of cheaper and only slightly slower alternatives, NYT reports.