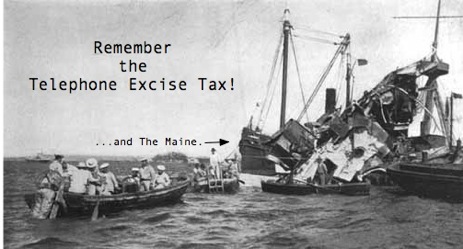

Free money! Free money! We shouted, begged, implored you to take the free money that was rightfully yours, but no, you would have none of it. The free money was too good for you. Too much effort, you said, to fill out a simple line on your tax return to celebrate phone ownership and our victory in the Spanish-American War. And now, $8 billion beautiful bucks lie cluttering our treasury, taking up valuable space needed for Social Security IOUs.

telephone excise tax

40 Million Taxpayers Forget To Collect The Telephone Excise Tax

Remember the telephone excise tax? For 40 million taxpayers, the answer is “no.” From Kiplingers:

Although nearly everyone who had a phone at any time between March 1, 2003, and July 31, 2006, deserved the credit, the IRS says that 30% of taxpayers failed to claim it. That means 40 million taxpayers missed the boat … and a chance to boost their refund (or cut their tax due) by $30, $40, $50 or $60.

You can still pry your money from the government by spending fifteen minutes with Form 1040X. X as in, remember the X-cise tax. Kiplinger’s has a step-by-step guide to claim the credit that is rightfully yours. — CAREY GREENBERG-BERGER

Tax Tip: Cell Phones Qualify For Telephone Excise Tax Refund

You may be one of the nearly 160 million phone customers who can request a refund of the 3% federal excise tax paid on long-distance and bundled phone service billed after Feb. 28, 2003 and before Aug. 1, 2006. Federal long-distance excise taxes paid on cell phone, land line, fax, Internet phone service and bundled service all qualify for the refund.

For more information about the telephone excise tax refund, click here.