Last year I filed through fileyourtaxes.com, a participating company, and everything worked fine. This year, I went straight to fileyourtaxes.com to file again. I entered all my information (taking probably 1 to 2 hours total) and then at the end, after entering everything, I was told I’d be charged $32.75 for my federal taxes and $32.75 for my state taxes. After traveling around the website for a while I finally found a page that said that to use the freefile service, I had to land on their website by clicking a link on the IRS freefile site.

taxes

Tax Season: IRS Owes You $60 If You Own A Phone

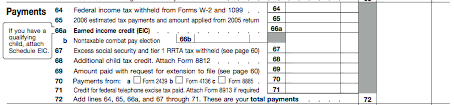

The New York Times reports how our victory in the Spanish American War will save you $60 on this year’s taxes. Last year Congress realized that Cuba was no longer occupied by the Spanish Empire. The war, funded by a 3% tax on all long distance calls, is over. No more measly one or two dollar “Federal Excise Tax” on your monthly phone bill. With the empire unlikely to strike back, Congress decided to drop the tax and refund the excise taxes collected over the last three years.

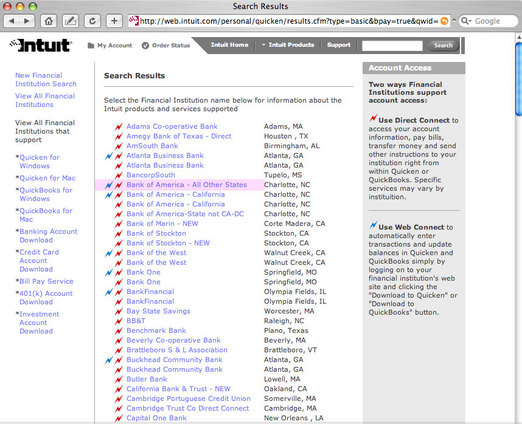

Quicken Claims To Sync With Bank Of America. It Does, Unless You Have Quicken For Mac.

Despite holdings of almost $1.5 trillion, Bank of America, the largest bank in America, won’t sync with users of Quicken for Mac. Reader Philip, who spent $65 on Quicken, writes to tell us how Intuit’s website advertises such compatibility.

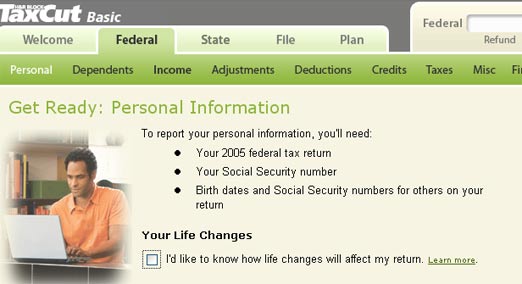

Free No-Frills Tax Prep Software From H&R Block

H&R Block is offering Tax Cut Basic federal tax preparation software to directly compete with TurboTax. It’s free, for a price.

Claim The Home Office Deduction

If you work from home and/or are self-employed, you’ll likely want to claim the home office deduction on your taxes this year.

The 13 Most Overlooked Tax Deductions

Thirteen often overlooked deductions that can blunt the dent to your wallet come April 15th.

How To File Taxes If You're Self-Employed

This moderately difficult tutorial walks the self-employed through the steps of filing taxes.

Tax Tip: New State Sales Tax Calculator

The Sales Tax Calculator is another interactive tool on the IRS.gov web site designed to help make it easier for taxpayers to figure their taxes,” said IRS Commissioner Mark W. Everson.

Taxes: Breaking Changes To How You Claim College Deductions

December tax law changes mean 1040 filers claiming college deductions will have to take special steps.

Tax Tip: Do Not Put A Refund Anticipation Loan On A Prepaid Credit Card

As we’ve mentioned before, refund anticipation loans are a bad idea. They’re made doubly bad when they are deposited to a prepaid credit card, but that’s just what HR Block suggests that you do. Why is this a bad idea?

Avoid Tax Refund Anticipation Loans

- Some of America’s most cash-strapped taxpayers – those from low- and moderate-income families – spent nearly $1 billion in the latest year recorded for what is almost always an unnecessary product: the so-called “refund anticipation loan” at income tax time. With another tax season gearing up, consumer advocates at the National Consumer Law Center (NCLC) and Consumer Federation of America (CFA) are warning taxpayers to steer clear of refund anticipation loans (RALs), one of the most avoidable tax-time expenses. New figures reveal that RALs drained about $960 million in loan fees, plus over $100 million in other fees, from the wallets of nearly 9.6 million American taxpayers in 2005. “Taxpayers can save themselves over a billion dollars by just saying ‘no’ to quick tax refund loans,” says NCLC staff attorney Chi Chi Wu. “These loans take a chunk out of your hard earned tax refund, and they expose you to the risk of unmanageable debt if your refund doesn’t arrive as expected.”

TRA’s are bad! Just say no.—MEGHANN MARCO

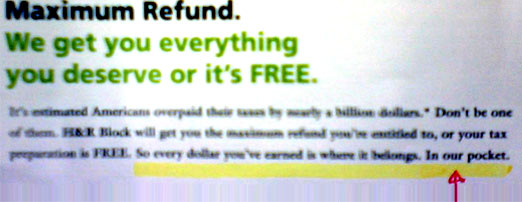

H&R Block’s Freudian Slip

The Consumerist has its fair share of typos, but at least we don’t make them in a fixed medium.

2007 Nissan Altima Hybrid Qualifies for Tax Credit

Need a car? The 2007 Nissan Altima Hybrid vehicle meets the requirements of the Alternative Motor Vehicle Credit as a qualified hybrid motor vehicle. If you want to get in on this tax credit, it’s best to buy early. From IRS.gov:

Consumerist Tax Poll: When Do You Start?

Gawker Media polls require Javascript; if you’re viewing this in an RSS reader, click through to view in your Javascript-enabled web browser.