Last May, investigations by the Department of Justice and the Federal Deposit Insurance Corporation into student loans servicing resulted in a $100 million fine against government-contracted servicer Navient for allegedly violating federal laws limiting the amount of interest that can be charged on servicemember student loans. Following those investigations, the Department of Education undertook a review that found its four servicers – including Navient – weren’t cheating military personnel. With such conflicting reports, members of Congress are now getting involved, calling for an investigation into the Dept. of Education’s review process. [More]

student loans

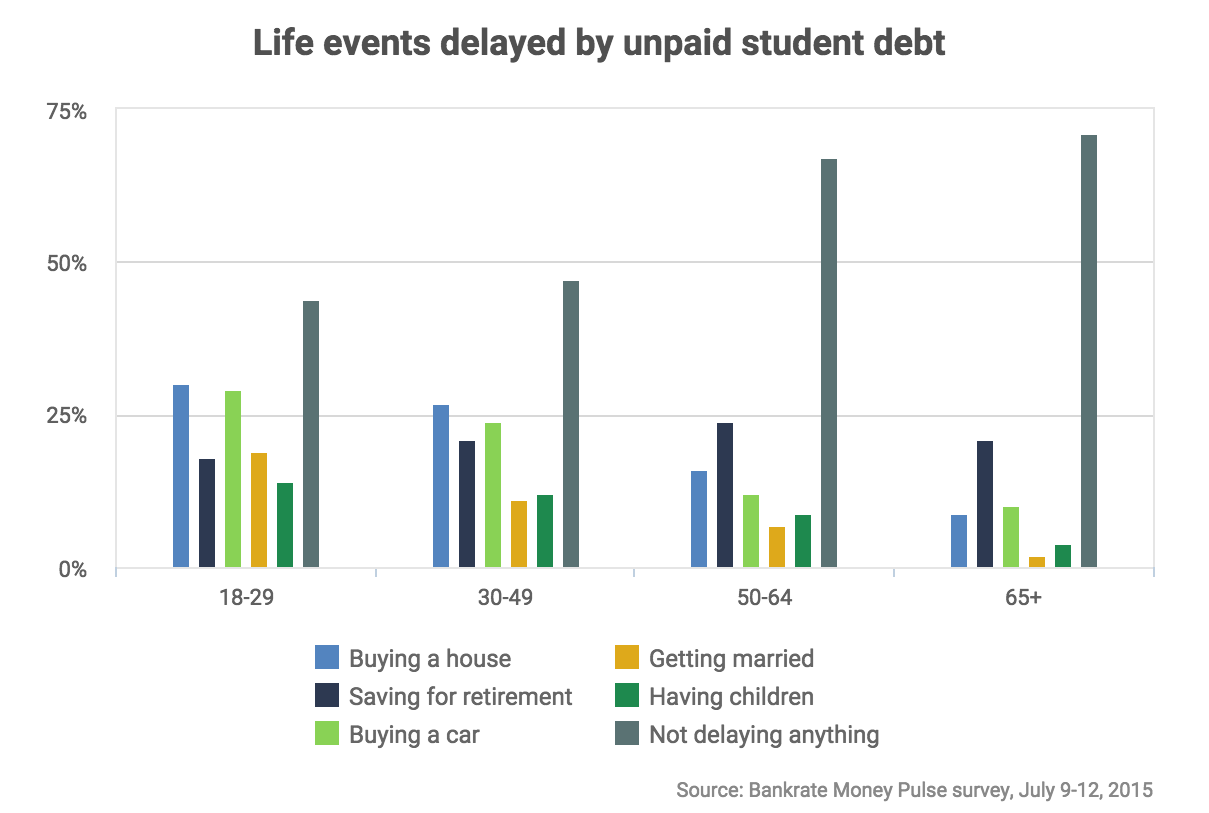

Student Loan Debt Causing Millennials To Delay Marriage, Kids, Home-Buying

We’ve written before about the idea of a “debt backpack,” this notion that young adults are graduating from college already burdened by debt. The more burdensome that backpack, the less able and likely they may be to not only make major financial investments — like a home, or a new car — but also might be putting off important personal milestones, including marriage and kids. The results of a new survey back up this theory and show the delaying effect that student loan debt has on Millennials. [More]

Citigroup Facing Federal Investigation Into Student Loan-Servicing Practices

Just last month federal regulators announced that an ongoing probe into potentially unscrupulous student loan-servicing practices resulted in nearly $18.5 million in refunds and fines from Discover Bank. Now, regulators appear to have Citigroup in their crosshairs, as the financial company announced it was party to an investigation. [More]

Former Corinthian College Students Seek To File $2.5B Claim Against Bankrupt For-Profit Operator

Former students of now-defunct for-profit education chain Corinthian Colleges continued their fight to recoup the money they spent on classes at the company’s Heald College, WyoTech or Everest University campuses, filing a $2.5 billion claim against the bankrupt educator.

[More]

Former Operator Of FAFSA.com Penalized $5.2M For Illegal Billing

Five years ago, we told readers looking to fill out the Free Application for Federal Student Aid (FAFSA) to steer clear of FAFSA.com, as it was not the official Dept. of Education site for the FAFSA. Today, federal regulators announced a $5.2 million settlement with the company behind the now-defunct website for illegal billing practices. [More]

Discover Bank Must Pay $18.5 Million Over Illegal Student Loan Servicing Practices

As federal regulators continue to probe potentially unscrupulous student loan servicing practices, the Consumer Financial Protection Bureau has ordered Discover Bank and its affiliates to pay nearly $18.5 million in refunds and fines for, among other things, overstating amounts due on student loans and failing to notify borrowers of their rights. [More]

![[Source: Sallie Mae]](../../../../consumermediallc.files.wordpress.com/2015/07/fig2.png?w=300&h=225&crop=1)

Families Going Deeper Into Their Own Pockets To Pay For College

College spending continues to rise, but not all American families are taking measures to bring down the amount of their own money they have to spend to educate their children. [More]

Agreement Could Temporarily Halt Legal Action On Loans For Some Former Corinthian College Students

Former Corinthian College students left with piles of debt after the company closed its Heald College, Everest University and WyoTech campuses earlier this year are getting a bit more relief, as the Department of Education announced it would temporarily suspend some legal actions related to borrower’s defaulted loans. [More]

Oregon Becomes Second State To Offer Free Tuition To All Graduating High School Students

Thousands of recent high school graduates in Oregon now have the chance to attend community college without the worry of accumulating loads of debt they may never be able to pay back, as lawmakers in the state recently approved a bill to establish the second program in the country to offer students help in paying for college. [More]

New Jersey Legislation Would Create Student Loan Lottery To Let You Gamble Away Your Debt

While lottery proceeds may do an awful lot of good for state coffers, the odds of winning are microscopically small, and anyone who has lived in a poverty-stricken neighborhood has likely seen people who can’t afford to lose any money throwing away what little they have on a nose hair’s chance that they might win something. So why not apply that same model to the $1 trillion student loan debt problem? [More]

Military Personnel Face Student Loan Issues Despite Required Protections

The Servicemembers Civil Relief Act (SCRA) provides a number of protections for military personnel and their families when it comes to private and federal student loans. While these benefits aim to alleviate the burden servicemembers face when paying back their educational debts, a new report from the Consumer Financial Protection Bureau shows that many student loan servicers continuously fail to uphold their end of the SCRA requirements. [More]

Court Case Illustrates Just How Difficult It Is For Borrowers To Discharge Student Loans In Bankruptcy

Students being crushed under the weight of mounting student loan debt have few options when it comes to receiving forgiveness for their debts, and bankruptcy is often the least obtainable – thanks in part to the nearly impossible to meet “undue hardship” standard. To see just how difficult and seemingly arbitrary this guideline is, all one needs to do is hear about a recent federal court case out of Maryland that determined a woman couldn’t escape her debt obligation because she had failed to make a good faith effort in repaying the loans despite the fact she’s unemployed, disabled and living below the poverty line. [More]

CFPB Asks Google, Bing & Yahoo To Help Stop Student Loan Debt Scams That Imply Affiliation With Feds

The Internet is teeming with scammers, fraudsters, and hustlers determined to part consumers from their money, and as a $1.2 trillion venture, student loans often present an attractive avenue for these ne’er-do-wells. In order to better protect individuals from such schemes, the Consumer Financial Protection Bureau is enlisting the help of the country’s major search engines. [More]

CFPB Report Finds 90% Of Student Loan Borrowers Who Seek Co-Signer Release Are Denied

Last year, the Consumer Financial Protection Bureau brought our attention to a relatively new phenomenon in which more and more private student loan borrowers found themselves placed in automatic default – even if they were up-to-date on payments – when their co-signer died or filed for bankruptcy. While the agency and consumer advocates urged these borrowers to seek co-signer release from their lenders, a new report finds that’s simply hasn’t been possible. [More]

Students At Closed Corinthian Colleges May Ask For Federal Student Loan Relief

Getting a student loan discharged is not easy. Even bankruptcy is not usually enough to shake off that debt. But recent students at schools under the Corinthian Colleges Inc. [CCI] umbrella (Everest, WyoTech, Heald) will get the chance to request that some of all their federal student loan obligation be lifted. [More]

Student Loans Are The New Robo-Signing Crisis

You may remember the term “robo-signing” from the recent financial crisis, where lenders would put homeowners in foreclosure without an actual person reviewing the documents, which is required in many states. The same thing is reportedly happening again with s different debt crisis: student loan lenders are robo-signing those, too. [More]

Legislator Demands Department Of Education Investigate For-Profit Chain ITT Technical Institute

Following the Securities and Exchange Commission’s decision earlier this week to file fraud charges against current and former executives with ITT Education Services – the operator of for-profit college chain ITT Technical Institute – for their part in concealing problems with company-run student loan programs, one legislator is calling on the Department of Education to further investigate the company. [More]

Consumer Groups Urge CFPB To Provide Better Oversight, Rules Over Student Loan Servicing

Two months ago, the Consumer Financial Protection Bureau took the first steps in tackling issues within the student loan servicing arena by asking consumers and organizations to share their thoughts on the state of an industry that is tasked with recouping the more than $1.2 trillion in outstanding student loan debt in the U.S. Now, as the deadline to submit comments has come and gone, we know a bit more about just how the industry is perceived by those tasked with sticking up for consumers. [More]