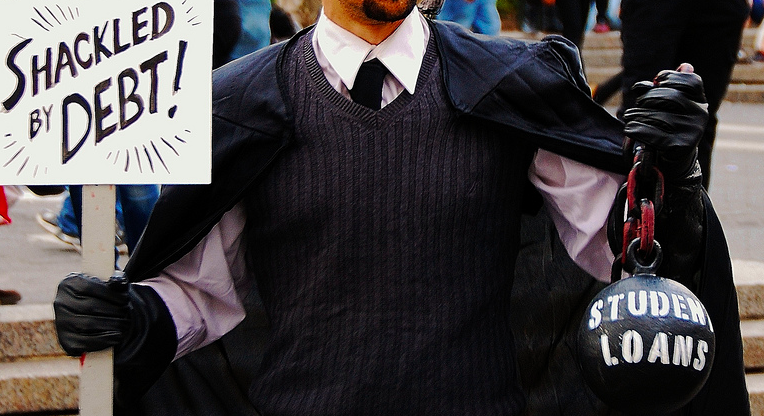

Outstanding student loan debt now totals more than $1.2 trillion in the U.S., and it’s only going to grow as college tuitions continue to outpace inflation. Meanwhile, student loan servicers aren’t exactly making it easy for borrowers to pay down that debt with confusing and inconsistent policies and an apparent reluctance to work with troubled borrowers. In an effort to see if the repayment process can be made less byzantine, the Consumer Financial Protection Bureau is asking for you to share your thoughts on the state of student loan servicing. [More]

student loans

Attorneys General Coalition Urges Dept. Of Education To Clarify Corinthian Students’ Options

A week after nine senators urged the Department of Education to provide support to the thousands of students affected by the closure of now-bankrupt Corinthian Colleges schools — Everest University, Heald College, and WyoTech — the top prosecutors in 11 states are adding their voices to the chorus encouraging the Dept. to protect students and clarity their options following the company’s final downfall. [More]

SEC Charges Current, Former Executives Of For-Profit Chain ITT Educational Services With Fraud

Back in September ITT Educational Services – the operator of for-profit college chain ITT Technical Institute – revealed it was facing increased scrutiny by several government agencies. That scrutiny turned to action this week as the Securities and Exchange Commission filed fraud charges against current and former executives with the company for their part in concealing problems with company-run student loan programs. [More]

Senators Urge Dept. Of Education To Provide Support To Students Affected By Corinthian Colleges Closure

Ever since now-bankrupt Corinthian Colleges Inc. began its downward spiral, consumer advocates, students and legislators have urged the powers that be to provide relief for students of Everest University, Heald College and WyoTech. Today, that plea continued as nine senators called on the Department of Education to provide support to the 16,000 students affected by the company’s final closure. [More]

More Banks Are Offering Student Loan Refinancing, But Is It Really Safe & Beneficial?

For the last several years legislators have repeatedly introduced a bill that would allow student loan borrowers to refinance their private and federal student loans to the lower interest rates at which new loans are currently being issued. Although the legislation hasn’t managed to make it into law, that hasn’t stopped banks and credit unions from creating their own refinancing programs to help alleviate the debt burden for student loan borrowers. [More]

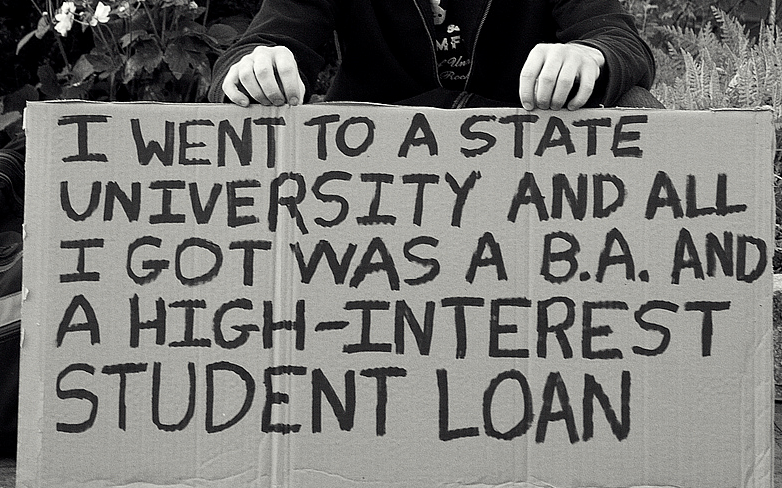

Billions In College Aid Will Go Unclaimed Again Because Students Won’t Fill Out A Stupid Form

Don’t say we didn’t warn you. Way back in December, we advised high school seniors who planned on attending college to not be stupid and go fill out a Free Application for Federal Student Aid [FAFSA] form right away. Every year, billions of dollars in grant and loan money goes unclaimed because students and their parents never get around to filling out this paperwork, and it looks like the upcoming school year will be no different. [More]

Petition Calls For Loan Relief For Corinthian College Students

Ever since for-profit education chain Corinthian Colleges began its downward spiral last summer, consumer groups, students and legislators have urged the Department of Education to provide current and former students relief from student loans they took out to finance an education based on deceptive recruitment practices. Now that CCI has closed its remaining Everest University, Heald College and WyoTech campuses, consumer advocates say discharging federal student loans held by these students – and protecting students of other for-profit institutions – should be of immediate concern for the Department. [More]

Corinthian Colleges Completes Collapse, Closes Remaining Campuses Effective Immediately

Although it was nearly a year in the making, the largest collapse in U.S. higher education finally occurred Sunday, as embattled for-profit education chain Corinthian Colleges Inc. – the operator of Everest University, Heald College and WyoTech – announced it would close the remainder of its campuses effective Monday. [More]

Can’t Pay Your Student Loans? In Some States It Might Cost You Your License To Drive Or Work

In addition to causing irreparable damage to their credit scores, student loan borrowers who default on their debts face a much more devastating and counter-intuitive danger: the lost of their driver’s or occupation licenses, including those used by nurses, doctors, teachers and emergency personnel [More]

Student Loan Borrower’s Bill Of Rights Would Reform Disclosure And Servicing Standards

In recent weeks, legislators have introduced a range of bills aimed at addressing student loans and revamping the laws governing those debts. Today, that push continued with the reintroduction of a bill that would ensure student borrowers are treated fairly and understand the range of options at their disposal. [More]

Legislators Once Again Introduce Bill That Would Allow Student Loan Refinancing

If at first you don’t succeed try again… and again, and again. That appears to be the approach members of Congress are taking when it comes to a bill that would allow student loan borrowers to refinance their private and federal student loans. [More]

You Can’t Discharge Your Student Loans In Bankruptcy Because Of Panicked 1970s Legislation

Although bankruptcy should only be viewed as the last option for consumers drowning in a sea of debt, even this final-straw course of action won’t help Americans with getting out from under hefty student loans — but it wasn’t always this way. [More]

Legislation Would Require Private Student Loans Be Forgiven If Borrower Dies

Shortly after the death of their daughter, a New York couple’s grief was interrupted by a battle with an entity they never imagined: her private student loan lender. Inheriting a dead child’s student loan debt is a problem too many parents have had to face, and one that a new piece of legislation aims to eliminate. [More]

Senators Introduce Legislation To Make Private Student Loans Dischargeable In Bankruptcy

Since 2005, student borrowers have been unable to discharge their private student loans through the process of bankruptcy. But that could soon change after a group of 12 senators introduced a bill aimed at addressing the current student debt crisis by restoring the bankruptcy code to hold private student loans in the same regard as other private unsecured debts. [More]

Student Aid Bill Of Rights Aims To Overhaul Federal Student Loan Repayment, Servicing Process

The way in which borrowers pay back their federal student loans – from checking the balance to filing complaints against servicers – is set to change with the signing of a presidential memorandum Tuesday. [More]

Banks & Credit Card Companies Saving Millions By Taking Away Your Right To Sue

Tens of millions of American consumers have clauses in their credit card, checking account, student loan, and wireless phone contracts that take away their rights to sue those companies in a court of law, and more than 93% of these people have no idea they’ve had this right taken away from them. The companies involved are presumably quite happy about this lack of awareness, as it results in millions of dollars in savings that aren’t being passed on to you. [More]

U.S. Department Of Education Cuts Ties With Five Debt Collection Agencies To Protect Borrowers

Consumer advocates applauded the Department of Education’s announcement last week to end contracts with five private collection agencies that provided inaccurate information to borrowers. [More]

Senators Chastise Govt. For Making Money Off Struggling Student Loan Borrowers, Not Offering Enough Relief

For several years now the government has offered federal student loan forgiveness programs aimed at helping borrowers to avoid defaulting on their debts. While recent reports have shown that the popularity of the programs has exceeded expectations, a group of six senators say the Department of Education could do more given the billions of dollars in payments it receives from federal loans each year. [More]