Student Loan Debt Causing Millennials To Delay Marriage, Kids, Home-Buying

We’ve written before about the idea of a “debt backpack,” this notion that young adults are graduating from college already burdened by debt. The more burdensome that backpack, the less able and likely they may be to not only make major financial investments — like a home, or a new car — but also might be putting off important personal milestones, including marriage and kids. The results of a new survey back up this theory and show the delaying effect that student loan debt has on Millennials.

We’ve written before about the idea of a “debt backpack,” this notion that young adults are graduating from college already burdened by debt. The more burdensome that backpack, the less able and likely they may be to not only make major financial investments — like a home, or a new car — but also might be putting off important personal milestones, including marriage and kids. The results of a new survey back up this theory and show the delaying effect that student loan debt has on Millennials.

According to a survey from Bankrate, nearly half (45%) of all adult Americans who took out student loans ended up delay some major financial or personal milestone. The effect is most notable among student loan borrowers in the 18-29 age range, where 56% say that this debt has put them off of investing or starting a family.

Home-buying is often the easiest can to kick down the road, since one can always rent. You can’t (or at least shouldn’t; please don’t) rent a spouse or child.

So it’s of little surprise that homeownership is the most frequently delayed milestone among Millennials with student loan debt. Buying a car was a close second in this age group, which makes some sense as it’s often cheaper to keep driving and fixing your old vehicle than it is to sink money into a new one. In both cases, around 30% of 18-29 year-olds put off these important purchases.

The next oldest age range (30-49) had similar results, though the overall impact of student debt was slightly less, with 53% saying they had delayed these milestones.

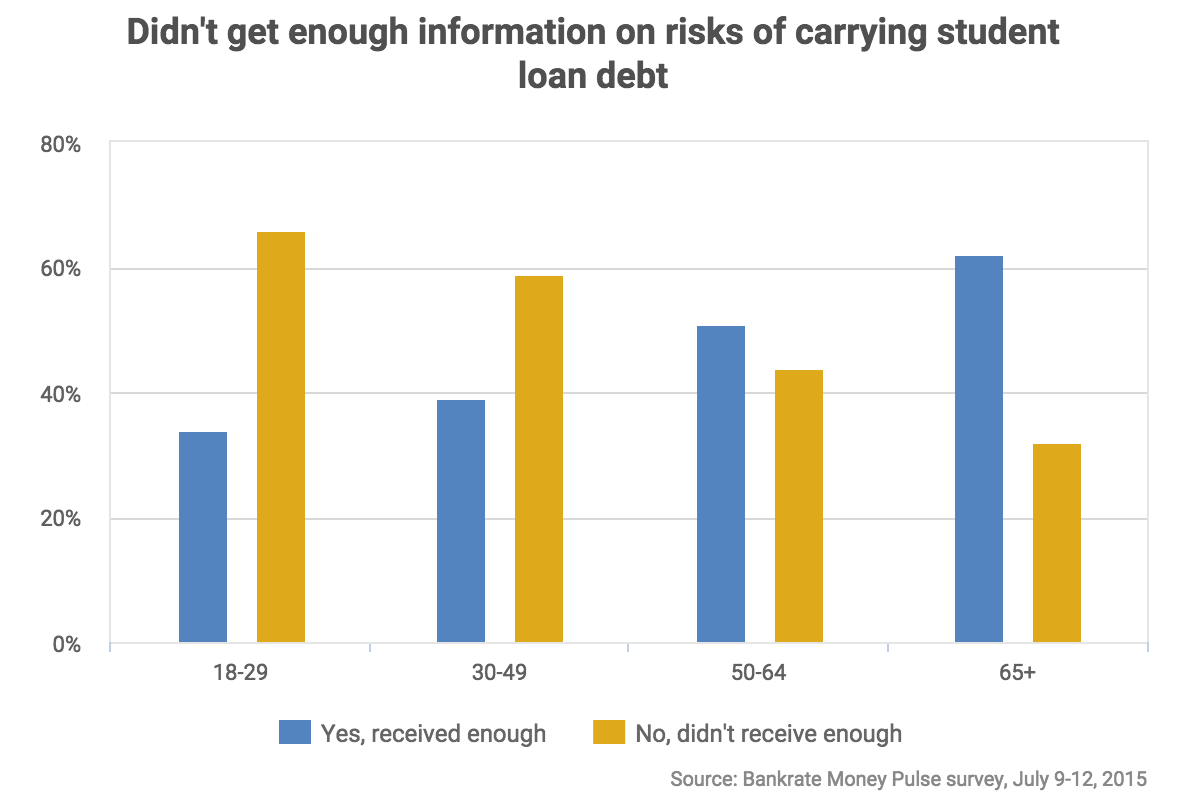

Millennial borrowers are more likely to say they were not provided sufficient information about the potential risks of taking out student loans. A full two-thirds of this age group believe they were not provided enough info. Compare that to 59% for those in the 30-49 group, and only 44% in the 50-64 bracket.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.