Consumers who took out federal student loans through private lenders are more likely to default on their debts than their counterparts who received federal loans through the Department of Education, in part because these borrowers have difficulty obtaining adequate information on repayment options. [More]

student loans

Borrowers With Federal Student Loans Made By Private Lenders At Greater Risk For Default

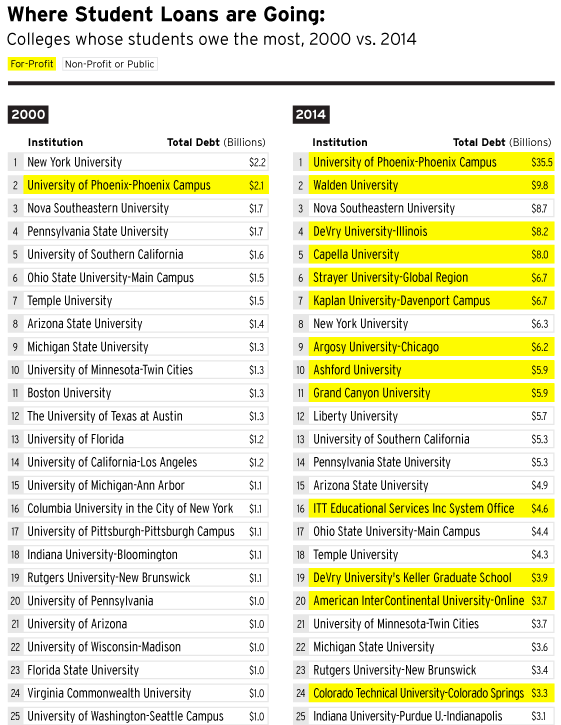

Under-Investigation Educators Still Received $8.1B In Federal Funds Last Year

The federal government has ramped up its efforts to protect consumers from unfair and deceptive for-profit colleges in recent years: implementing so-called gainful employment rules this summer, discharging millions of dollars in student loans for students who were defrauded by Corinthian Colleges and restricting the University of Phoenix’s ability to participate in tuition-assistance programs for active-duty servicemembers. Still, these steps appear to have done little to keep questionable for-profit colleges from getting their hands on billions of dollars in funding straight from the government. [More]

Wells Fargo Reportedly Under Federal Investigation Related To Student Loan Servicing

According to a new report, Wells Fargo is the latest big-name bank to be scrutinized as part of the Consumer Financial Protection Bureau’s ongoing investigation into student loan servicing practices.

[More]

Colleges Paying Sketchy Agents To Recruit Rich Foreign Students

With schools looking for ways to bolster their bottom lines without having to rely on federal funding, a growing number of colleges are paying recruiters to bring in well-heeled students from overseas — even though some of these agents have been caught trying to fake applicants’ transcripts. [More]

Federal Perkins Student Loan Program Set To Expire At Midnight

After 57 years of assisting nearly 20 million low-income students to finance their dreams of obtaining a higher education, the Federal Perkins Loan program could soon be grinding to a halt. [More]

Feds Recommend Overhaul Of Student Loan Servicing

Earlier this year, the Consumer Financial Protection Bureau launched a public probe into potentially anti-consumer practices of the student loan servicing industry. More than 30,000 people responded, leading the Bureau, along with the Departments of Education and Treasury, to release a framework they hope will curb these questionable practices, promote borrower success, and minimize defaults. [More]

Legislation Once Again Takes Stab At Allowing Borrowers To Refinance Student Loans

Lawmakers have renewed their support for students buried under piles of educational debt by — yet again – introducing a bill that would allow borrowers to refinance their student loans. [More]

White House Unveils New “College Score Card” To Help Students Select Schools

With student loan debt now well past the $1.2 trillion mark — due in no small part to students that paid top-shelf tuition prices but ended up with bottom-shelf educations and job prospects — there’s a need to provide American students and their families with all the relevant information they need when it comes to picking the right school for their goals and their wallets. [More]

For-Profit Colleges Lead The Way On Loan Defaults: Report

During the Great Recession, the growing industry of for-profit colleges promised millions of Americans a path to a higher education. But the high tuitions charged by many schools sent U.S. student loan debt soaring to more than $1.2 trillion. A new report claims that while for-profit schools charged top-dollar, many students were getting a cut-rate education, making it difficult to obtain jobs that will allow them to pay down this debt.

[More]

Corinthian Students Continue To Wait For Debt Relief As Department Of Ed. Reviews More Than 7,800 Claims

The tens of thousands of students seeking debt relief from the federal government after for-profit education chain Corinthian Colleges Inc. closed its Everest University, WyoTech and Heald College campuses, will have to wait a little longer, the Department of Education said Thursday as it provided an update on the number of federal student loans it has discharged and that are currently under consideration. [More]

Mass. AG, Lawmakers Call For More Assistance For Former Corinthian College Students

Ever since for-profit education chain Corinthian Colleges Inc. closed its Everest University, WyoTech and Heald College campuses, leaving tens of thousands of students with millions of dollars in loans, consumers advocates, legislators and others have urged the Department of Education to relieve former students of their debt burdens. Those calls for help continued on Tuesday with renewed pressure from Massachusetts Attorney General Marua Healey and Sen. Elizabeth Warren calling on the Dept. to rid victims of the defunct for-profit college of unsustainable loan payments. [More]

Sallie Mae Spinoff Navient Could Face CFPB Lawsuit Over Student Loans

In the short time since Navient – the nation’s largest student loan servicing company – spun off from Sallie Mae, the company has come under scrutiny for it allegedly unfair practices of overcharging and imposing excessive fees on consumers’ loans. While those practices resulted in a $97 million settlement with the Depts. of Education and Justice, and the Federal Deposit Insurance Corp, they could soon lead to a lawsuit from the Consumer Financial Protection Bureau. [More]

Dept. Of Education Plans To Overhaul Loan Forgiveness Program For Students Defrauded By Schools

As thousands of former Corinthian College students continue to wait to learn whether or not they’re on the hook to repay billions of dollars in student loans they took out to attend the now defunct for-profit college, the Department of Education announced plans to overhaul the loan forgiveness process for students who believe they have been defrauded by their colleges. [More]

Are Student Loan Forgiveness Programs Just A Free Pass For Grad Students With More Than $100K In Debt?

Just two years ago, the Consumer Financial Protection Bureau estimated that nearly 33 million American workers eligible for student loan forgiveness weren’t taking advantage of the programs. Times have certainly changed, as the federal government earlier this year revealed that these program were now so popular they cost nearly $22 billion more than they anticipated. But it doesn’t appear the increase in use for such plans is by those who might benefit the most. [More]

Auto Loan Debt Tops $1 Trillion For First Time; All Consumer Debt Nearing $12 Trillion

Now that the Great Recession has gone from “is it really over?” to “remember when?” more Americans are buying cars, pushing auto loan debt beyond the $1 trillion mark for the first time in U.S. history. [More]

Groups Say Proposed Student Loan Plan Doesn’t Provide Enough Assistance

The Dept. of Education recently proposed regulations intended to make the student loan repayment process less burdensome and drawn-out. Nearly two dozen consumer advocacy groups say that while these rules should help borrowers, more could be done to ensure that all students benefit. [More]