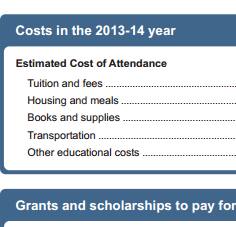

If you went to college, you’re probably familiar with the financial aid letters that detail — in not very much detail — the loans, grants and other assistance the school can offer. These letters vary from school to school, even though the Dept. of Education created a standard form, and it’s students and their families that pay the price. [More]

student loans

Students & Families Getting Screwed Because Schools Won’t Adopt Standard Financial Aid Letter

More Than 1-In-5 Students At For-Profit Colleges Default On Student Loans Within Three Years

For the first time, the Dept. of Education has provided stats for people three years into their student loan repayments, and the numbers don’t paint a pretty picture. The percentage of college students defaulting on their loans is on the rise, with 9.1% of recent students defaulting within two years of their first payment coming due, and a whopping 13.5% defaulting within three years. And at controversial for-profit colleges, that number is alarmingly higher. [More]

Study: Some State Universities Offer A Better Return On Investment Than Ivy Leagues

Sure, everyone has a hope that their kid can go to Harvard, Princeton — or even Brown, the Staten Island of the Ivy League — but a new study that compares how much graduates earn to what it cost for that framed piece of paper on the wall shows that there are many less expensive public universities that offer a better return on investment. [More]

Broke College Students Resorting To Sugar Daddies & Donating Baby-Making Cells To Cover Tuition

In case you hadn’t heard, college is like, really really expensive these days. Some students have their parents to help out, and many take out loans (even if they don’t know it). And then there are those willing to go to unconventional lengths to scrape up enough cash to cover the costs of their educations — things liked donating eggs and sperm, connecting with a sugar daddy or turning their bodies over to science. [More]

Apparently Not Many People Pay Off Their Student Loans In One Go

John had the money on hand to pay off the rest of his student loans all at once. Lenders don’t seem to get a lot of customers approaching them to do this, since student loan debt generally has lower interest rates than consumer debt. At least we’re guessing that they don’t get very many customers looking to rid themselves of all student loan debt, because they weren’t able to handle the request all that well. At least not without generating a teeny, tiny overpayment. [More]

Sallie Mae Can't Add, Thinks I Can't Pay My Bill

Reader Vanessa is paying her student loans on time. Really, she is. The problem is that she can’t manage the full amount herself right now, so the payment comes in two parts: one from her, and one from her mom. This is too difficult for our friend Sallie to understand, and they keep sending delinquency notices to Vanessa even though the monthly bill gets paid in full. No matter how many times she contcats the company about the problem, no one can figure out how to make it stop. [More]

We Cosigned Our Unemployed Son's Student Loans. Now We're Screwed

If you retain one piece of information from reading this site, let it be this one: never co-sign anyone’s student loans. Not your spouse’s student loans. Not your best friend’s student loans. Not your nephew’s student loans. Not even your own child’s student loans. It is the worst possible kind of debt to assume on behalf of someone else. The balances can be huge, the debt can’t be discharged in bankruptcy, and there’s nothing to repossess. That’s what anonymous parents M and D have learned, the very hard way. [More]

Student Loan Debt: It's Not Just For Poor People Anymore

While upper-income and upper-middle-income families have historically not needed to drink from the financial aid fountain to pay for their kids’ college educations, soaring tuition costs (and declining net worth) have forced even the well-off into taking out loans, adding to the already enormous $1 trillion ocean of student loan debt in the U.S. Surprisingly, this may end up being a good thing for the next generation. [More]

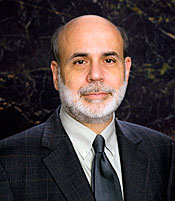

Fed Chair Bernanke: Smart Consumers Are Good For The Whole Economy

Too often when people talk about being a good consumer or being educated about financial matters, the big picture is ignored in favor of images of individual wealth and well-being. But Federal Reserve Chairman Ben “It rhymes with stanky” Bernanke says that it’s really in everyone’s best interest for us to be smart about what we do with our money. [More]

Shouldn't We Be Able To Negotiate On College Tuition?

If someone offers to sell you a life-changing product ranging in price anywhere from $10,000 to $250,000 — maybe more — chances are that most of you will at least attempt to negotiate that price down; only suckers pay sticker price. And yet, when it comes to a college education, it’s unheard of to call up competing institutes of higher learning to see if you can knock a few bucks off the MSRP. [More]

Why Do Student Loan Borrowers Default?

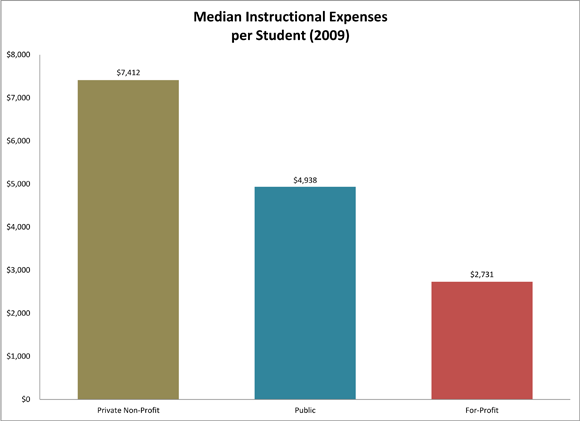

On Monday, we shared the results of a two-year Senate investigation into how much federal money is going to for-profit colleges, and what kind of return students and society as a whole are getting on that investment. (Answers: $32 billion, and a pretty terrible return on that investment.) A study that the National Consumer Law Center released yesterday shows the college bubble from a different perspective: that of student loan borrowers who have gone into default. It’s not pleasant. [More]

Report: $32 Billion In Federal Aid Going To Students At Underperforming For-Profit Colleges

Earlier today, the Senate Committee on Health, Education, Labor, and Pensions (HELP) announced the findings of its two-year investigation into exactly where the $32 billion annual investment in federal student aid is going — and whether students are getting a return on taxpayers’ investment. [More]

Citibank Doesn’t Understand The Word ‘Minimum,’ Cancels Deployed Soldier’s Student Loan Forbearance

Benjamin is in the military, and currently serving in Afghanistan. We’d thank him for his service, but Citibank says not to. They think that he’s not there anymore, and have ended the active-duty forbearance on his student loans. Calling up Citi and sending them documentation is tricky when you’re you know, in Afghanistan, but he’s doing his best. Nothing he sends is good enough for Citibank to actually believe him. [More]

Letter About 7-Cent Student Loan Bill Seems Like Efficient Use Of Government Resources

It was really thoughtful of the U.S. Department of Education’s Direct Loans program to let Puck know that his student loan payments, which he starts making in August, are too low to cover interest payments, and that some of that interest was about to be capitalized and become part of the loan’s total. It wasn’t all that thoughtful toward the environment or the program’s bottom line, though, because they printed and mailed a letter inviting him to use a forty-four cent stamp to pay off seven cents in accrued interest. [More]

Student Loan Bubble Eerily Similar To Subprime Mortgage Debacle

Billions in high-interest loans being handed out to people who probably shouldn’t qualify for them, who may not understand the full terms of the loans, and who will likely have trouble paying the money back. Sounds a lot like the stories we were writing five years ago as mountains of subprime, adjustable rate mortgages were coming due, but now it’s about the massive number of student loans written in recent years. [More]

Fortysomethings Are The Worst Age Group When It Comes To Paying Back Student Loans

The group most likely to get in trouble when it comes to paying back student loans could very well have kids ready to set off on college careers of their own right now: Fortysomethings have the worst delinquency rates of all the age groups currently paying back loans. [More]

Congress Doubles Up, Extends Student Loan Subsidies While Funding Transportation Programs

As we mentioned the other day, the clock was ticking on Congress to agree on an extension to subsidies that would keep interest rates from doubling on federal Stafford student loans, and that this agreement would likely be tied to a bill recertifying lawmakers’ authority to spend money on federal transport initiatives. Well, with a vote of 373-52 in Congress and 74-19 in the Senate, that bundle of legislation is now headed to the White House. [More]

Say Goodbye To The Student Loan Grace Period

Though it looks like federal lawmakers will finally come to an 11th-hour deal to keep interest rates on federal Stafford student loans from doubling, certain programs that student borrowers have benefited from will be going by the wayside come July 1. [More]